USD/CAD

In the absence of any material events to drive the markets, the dollar traded higher or unchanged against the other G10 currencies during the European morning Thursday. It traded virtually unchanged against AUD and NZD, while it gained the most against NOK, CHF and EUR.

One day after a not-so-exciting ECB meeting, sellers of the euro are back in the game. I believe that after the ECB meeting, the market attention has switched to Grexit possibilities again after the FT ran a front-page headline “Germany dashes hope of cash deal for Athens at high-stakes meeting.” German Finance Minister Wolfgang Shaeuble ruled out further grants and noted that it’s up to Greece to commit to the reforms needed to unlock the much desired aid. Furthermore, reports in Greek newspaper Ekathimerini say that New Democracy believes that a Greek exit is possible. These news follow yesterday’s move from Standard & Poor’s to downgrade Greece – I didn’t realize that was possible.

The loonie declined somewhat against the dollar, but this looks more like a pause in the CAD rally following the BoC policy meeting and the astonishing surge in oil prices. Tomorrow, we get Canada’s CPI data for March. Both the headline and the core rates are forecast to have remained unchanged. A positive surprise and a further rise in oil prices could add to the recent positive sentiment towards CAD.

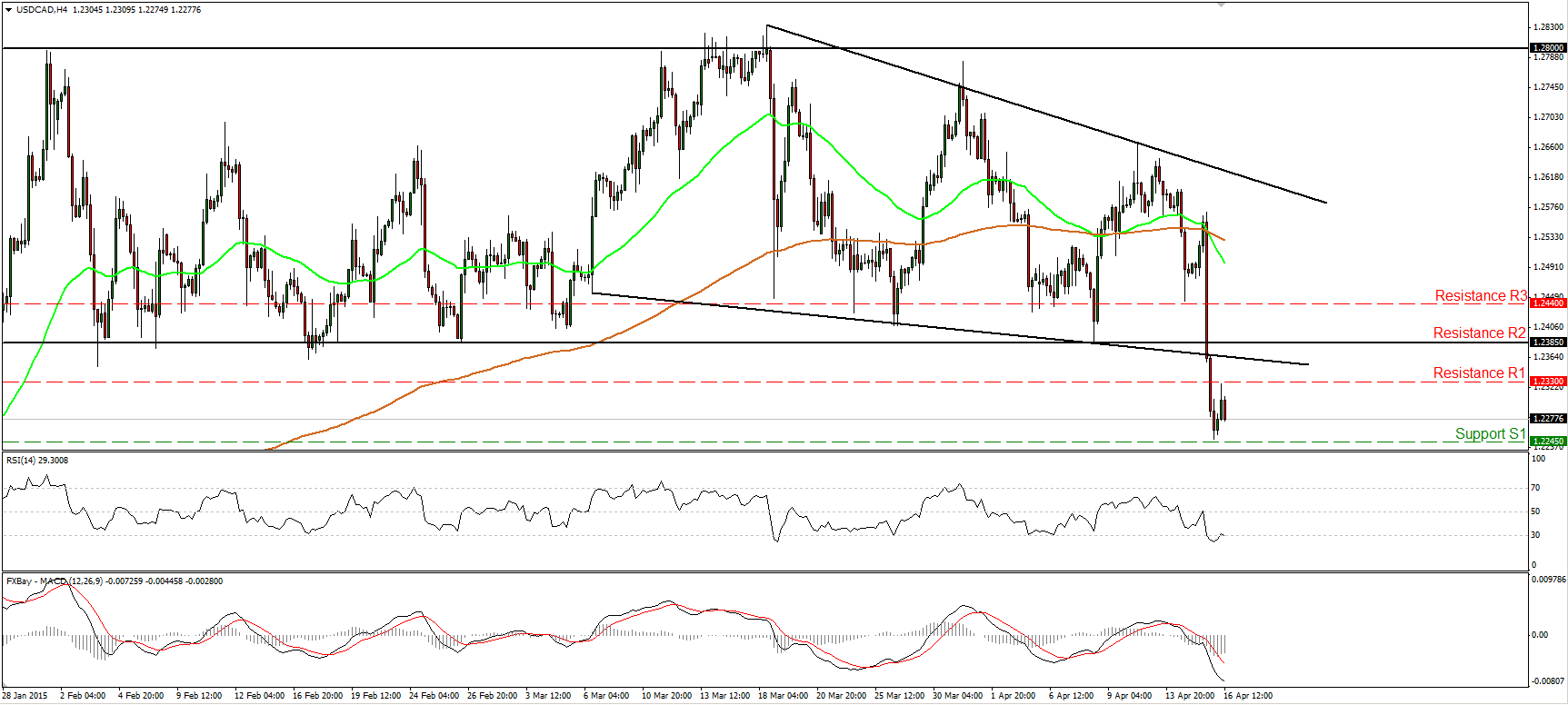

USD/CAD plunged yesterday but the decline was halted near 1.2245 (S1). Today during the European morning, the rate rebounded somewhat as USD/CAD (inversely) tracked WTI pretty closely, but the bounce remained limited to 1.2330 (R1). Yesterday’s free fall caused a break below the key support line now turned into resistance of 1.2385 (R2), which is the lower bound of the sideways range that had been containing the price action since the 26th of January. Therefore I would expect the rate to continue lower and if the bears are strong enough to drive it below 1.2245 (S1), I would expect extensions towards the psychological zone of 1.2000 (S2). The fall also confirmed the negative divergence between the daily oscillators and the price action, and brought into question the major uptrend of this pair. My view is that, at least the medium term picture has now turned negative for USD/CAD and that a test at 1.2000 (S2) looks very likely, assuming no major reversal in the new uptrend in oil prices.

Support: 1.2245 (S1), 1.2000 (S2), 1.1900 (S3).

Resistance: 1.2330 (R1), 1.2385 (R2), 1.2440 (R3).

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.