USD/NOK

The dollar was mixed against its G10 counterparts during the European morning Friday. It was higher against AUD, NZD and CAD, in that order, while it was lower against NOK, JPY and SEK. The greenback was stable vs CHF, EUR and GBP.

The euro was stable despite the further fall of Eurozone’s CPI estimate into deflationary territory in January. Even though the figure was slightly below consensus expectations, the deep dive was probably already priced in following Germany’s fall into deflation on Thursday. In addition, the ECB has already introduced a massive QE program, therefore the market now waits to see whether this will help the Bank to reach its price stability target. In the meantime, the bloc’s unemployment rate fell to 11.4% in December from 11.5% previously.

Russia’s central bank lowered unexpectedly its key interest rate to 15% from 17%, as concerns over a forthcoming recession exceeded worries over stabilizing the ruble. USD/RUB simply extended its gains on the news and broke above the resistance line of 70.00. Given the worsening tensions in Ukraine, EU foreign ministers agreed to extend existing sanctions against Russia until September. Consequently, the threat of further new sanctions from the US and the EU are likely to keep the ruble under selling pressure.

Norway’s official unemployment rate increased to 3.1% in January, in line with expectations, and retail sales in December rose at the same pace as in November. Nevertheless, investors gave little attention to economic data and NOK gained the most after Norges bank announced it will sell foreign exchange equivalent to NOK 700mn per day in February, an increase from 500mn previously. Nevertheless, the low oil prices and the declining investments in that sector are likely to keep NOK under selling pressure and may prompt the Norges Bank to cut rates again at some point in the future. Hence, the recent USD/NOK decline could be seen as a renewed buying opportunity.

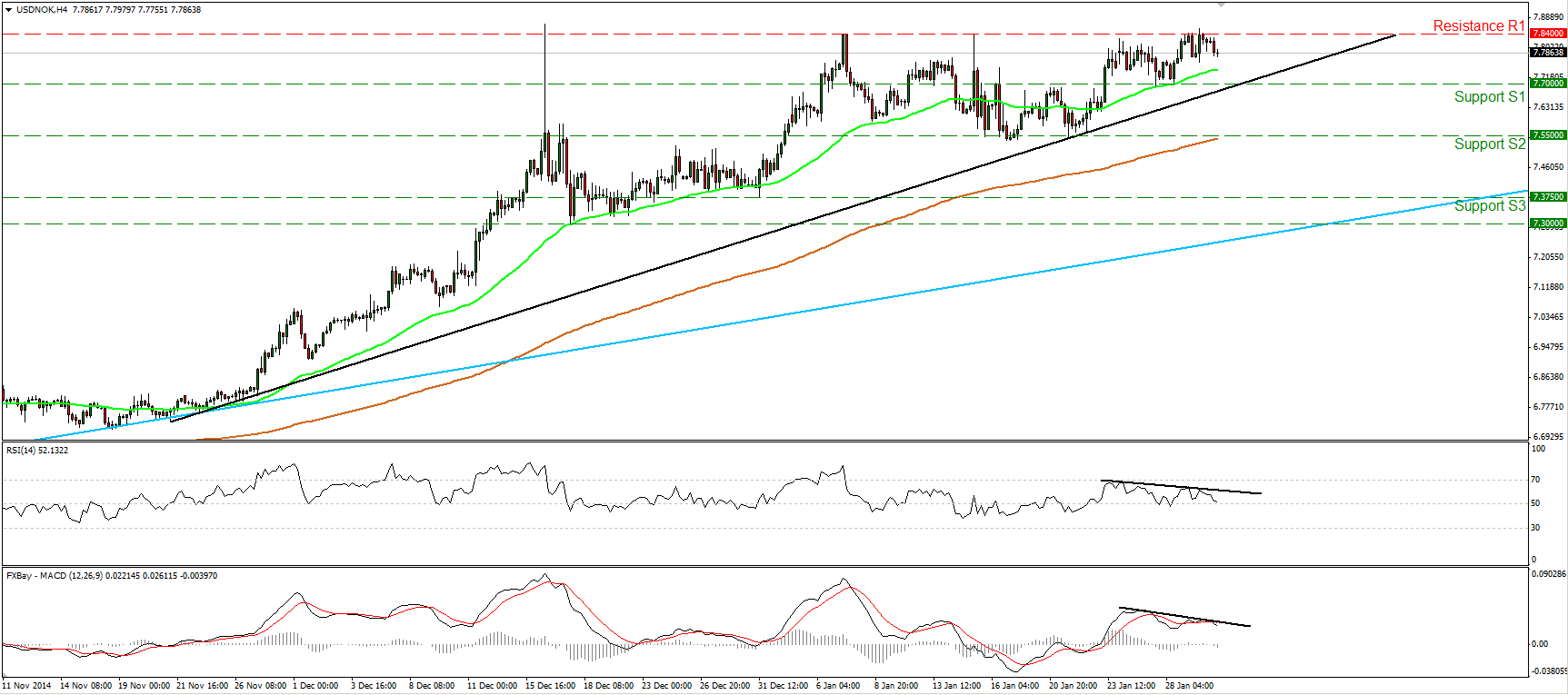

USD/NOK retreat somewhat during the European morning Friday after testing again the resistance zone of 7.8400 (R1). The inability of the bulls to overcome that area is also visible on our momentum studies, where I see negative divergence between them and the price action. Therefore, it is possible that we see the pullback to continue and perhaps challenge the 7.7000 (S1) support zone, defined by the lows of Tuesday and Wednesday. Nevertheless, the rate still lies above the near-term black uptrend line taken from the low of the 21st of November and well above the longer-term light blue uptrend line drawn from back at the low of the 3rd of September. This keeps the overall picture of USD/NOK positive and thus I would treat any possible near-term setbacks as renewed buying opportunities.

Support: 7.7000 (S1), 7.5500 (S2), 7.3750 (S3)

Resistance: 7.8400 (R1), 8.0000 (R2), 8.2200 (R3)

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.