USD/CAD

The dollar traded higher against all of its G10 major peers during the European morning Thursday, after having corrected over the past few days.

The euro was lower during the European morning ahead of the preliminary German CPI for November. All of the regional CPIs were 0.1-0.3ppt lower on a yoy basis (except Bavaria), indicating that the national inflation rate is also likely to be lower. In the meantime, even though the unemployment rate remained unchanged at 6.6% in November, the unemployment change declined 14k from -23k previously, showing that the labor market in Germany remains strong. Although the labor market shows signs of improvement, the softer inflation data raise the likelihood that Friday’s Eurozone estimate CPI rate may show a decline as well. With just a week ahead of the ECB’s crucial December meeting, the low inflation confirms President Draghi’s concerns that a stronger recovery is unlikely in the coming months and reinforces my opinion that the euro has plenty of room to the downside.

The Canadian dollar moved lower ahead of the OPEC’s press conference later in the day, due to concerns that the organization may not reach to an agreement to cut its oil production. However, given the recent batch of positive data and the positive sentiment towards CAD since early November, the currency doesn’t seem to react much on the ongoing decline in oil prices. Nevertheless, OPEC’s decision today could have a strong downside impact on CAD, given that the members fail to reduce oil production.

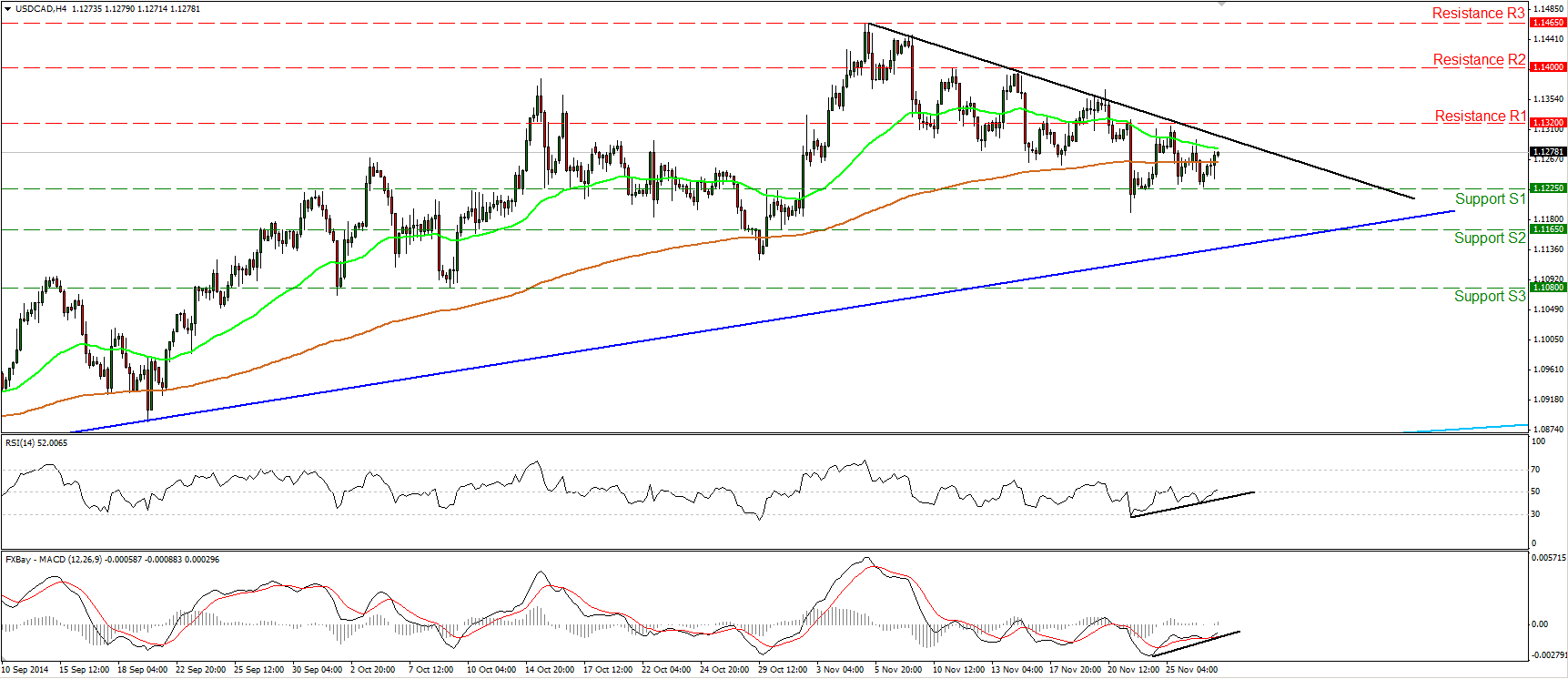

USD/CAD rebounded somewhat after finding support at 1.1225 (S1). Although the pair is still in a retracing mode, as marked by the short-term black downtrend line, I see signs that we may be experiencing the latest stages of the correction. A move above the black downtrend line and above the 1.1320 (R1) area is likely to reaffirm the case and perhaps trigger extensions towards our next resistance hurdle at 1.1400 (R2). The first reason why I believe the retracement could be ending is that, after printing a low below 1.1225 (S1) on the 21st of the month, the following lows where formed above that line. Second, our momentum studies have started printing higher lows as marked by their black upside support lines. Also, the RSI moved above its 50 line, while the MACD stands above its signal line and could enter its positive field in the near-future. As for the broader trend, on the daily chart, the dollar/loonie rate is still trading above both the 50- and the 200-day moving averages, and above the blue uptrend line drawn from back at the low of the 11th of July. Hence, I still see a longer-term uptrend.

Support: 1.1225 (S1), 1.1165 (S2), 1.1080 (S3).

Resistance: 1.1320 (R1), 1.1400 (R2), 1.1465 (R3).

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.