EUR/GBP

The greenback traded mixed against its other G10 counterparts during the European morning Tuesday. It outperformed AUD, JPY, and CAD, while it traded lower versus SEK, NOK, CHF and EUR. The dollar stayed virtually unchanged against NZD and GBP.

The euro started strengthening well before the German ZEW survey for November was out and got another boost after the release. Specifically, the big surprise was the surge in the expectations index to +11.5 from -3.6. It is worth noting that this was the first rise of the index for this year. Back in January the index was at 61.7 and had been falling since then to dip into negative territory in October for the first time since December 2012. The forecast was for the index to improve to +0.5. The current situation index ticked up to +3.3 from +3.2. This could favor the continuation of the upside corrective phase of EUR/USD, which I actually expect to challenge again the resistance of 1.2575 in the very close future. However, in the bigger picture of this pair I still see a downtrend.

In the UK, the inflation rate rose to +1.3% yoy from +1.2% yoy, exceeding expectations of an unchanged pace of increase in consumer prices. Following the sharp decline in September from 1.5%, this is more than normal in my view. GBP/USD rose approximately 25 pips at the release but gave all the gains back within the following minutes to trade virtually stable. This shows that investors need much more to change their negative view on the pound. In my view the downtrend of GBP/USD is likely to continue and I believe that it won’t take us long before seeing the pair challenging the psychological zone of 1.5500.

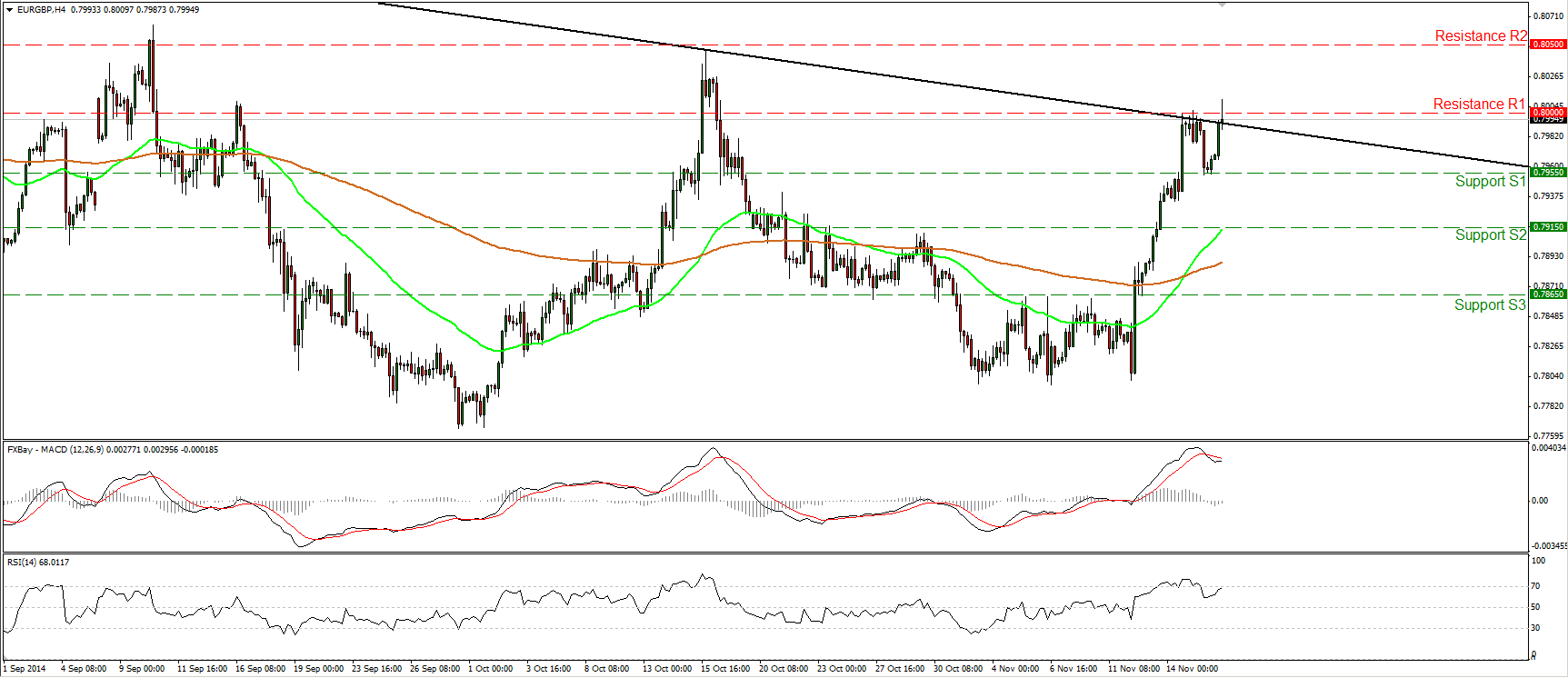

EUR/GBP firmed up during the European morning Tuesday, after finding support at 0.7955 (S1), but the advance was halted slightly above the psychological line of 0.8000 (R1). A clear close above that barrier is likely to confirm the break of the longer-term downtrend line (taken from back at the highs of August 2013) and perhaps trigger extensions towards our next resistance line at 0.8050 (R2). Our daily momentum studies support the notion. The 14-day RSI is pointing up and is heading towards its 70 line, while the daily MACD stands above both its zero and signal lines. However, in the bigger picture, I would like to see a decisive move above 0.8050 (R2) to bring a longer-term trend reversal or at least a medium term upside corrective phase.

Support: 0.7955 (S1), 0.7915 (S2), 0.7865 (S3)

Resistance: 0.8000 (R1), 0.8050 (R2), 0.8100 (R3)

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.