USD/NOK

The dollar was stable against most of its G10 peers during the European morning Wednesday, reflecting the restrained mood of investors ahead of the FOMC rate decision, and the widely expected completion of the QE3 program. The greenback was higher against NOK and GBP, in that order, while it was lower only against AUD.

The Norwegian krone was the main loser during the European morning after the country’s AKU unemployment rate rose to 3.7% in August from 3.4% previously. The figure was worse than the forecast of an increase to 3.5%. Despite the increase in the AKU unemployment rate, I would expect the reading of the official unemployment figure to be released this Friday, to give a better view on the country’s labor market. At the same time, retail sales excluding sales of motor vehicles dropped in September, a turnaround from the previous month. The worse-than-expected data together with the recent fall in oil prices could keep the NOK under selling pressure.

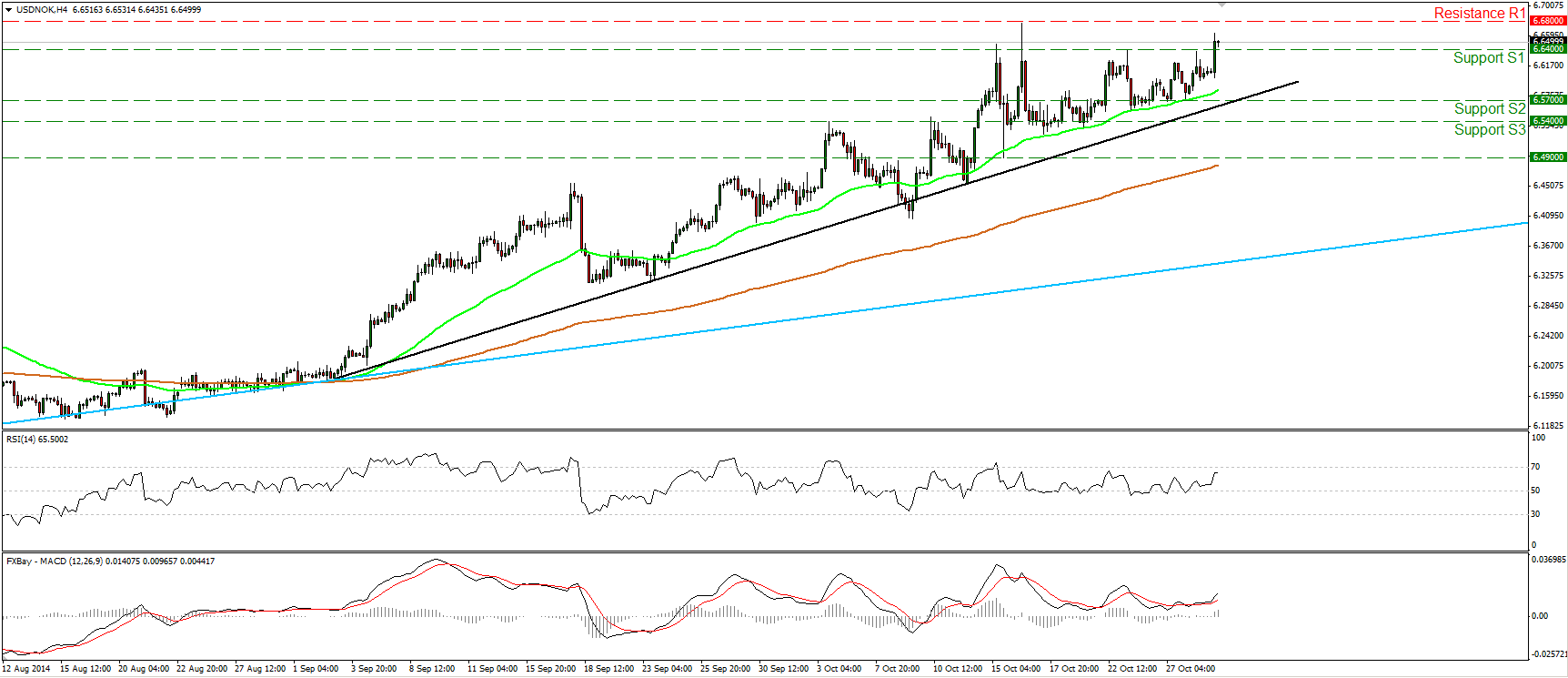

USD/NOK edged higher during the European morning Wednesday after the weak economic data coming out from Norway. The rate broke above the resistance (turned into support) area of 6.6400 (S1), but remained below 6.6800 (R1), the high of the 16th of October. As long as the price remains above the black uptrend line and above both the 50- and the 200-period moving averages, I would see a positive near-term picture. It is worth noting that the 50-period moving average supported the lows of the price action pretty well since the 15th of October. In my opinion, the bulls are likely to challenge the 6.6800 (R1) zone in the close future. A decisive move above that hurdle could set the stage for extensions towards our next resistance, at 6.7300 (R2), marked by the high of the 8th of June 2010. In the bigger picture, the rate is printing higher highs and higher lows above the light blue longer-term uptrend line (taken from back at the low of the 8th of May). Thus, I would consider the overall path of this pair to be to the upside.

Support: 6.6400 (S1), 6.5700 (S2), 6.5400 (S3) .

Resistance: 6.6800 (R1), 6.7300 (R2), 6.8100 (R3) .

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.