AUD/USD

The dollar traded unchanged or lower against its major G10 peers during the European morning on Monday . It was lower against SEK, CAD, AUD and NZD, in that order, while it was higher only against JPY. The greenback was stable vs NOK, EUR, GBP and CHF.

The Swedish krona appreciated against the dollar after the country’s retail sales rose 1.9% mom in August, a rebound from -1.1% mom previously. The better-than-expected figure pushed USD/SEK down approximately 0.20%. This was the first major indicator to come strong from Sweden and beat market consensus so far this month. However, I believe that Sweden’s continued deflation risk and the positive sentiment towards the greenback could give USD/SEK back its losses in the near future.

The euro was resilient during the European morning ahead of the preliminary German CPI for September. All of the regional CPIs were unchanged or 0.1 ppt higher on a yoy basis, indicating that the national inflation rate is also likely to be unchanged or higher too. However, the outcome of the mixed US data due out later in the day are likely to give a better picture on the direction of EUR/USD, even though the overall sentiment lean towards a stronger dollar.

The New Zealand dollar tumbled during the Asian morning, after the country’s central bank revealed currency intervention during August. Despite Kiwi’s approximately 1 cent drop, it remains above its “Goldilocks” fair value, said the country’s Prime Minister. Having this in mind, we could see NZD/USD even lower.

Reserve Bank of Australia Governor Glenn Stevens said last week that regulators are considering imposing lending rules to limit mortgages in order to confront the overheating housing market. These specific measures may take some pressure off the RBA to raise interest rates in early 2016 as expected. Coming on top of falling commodity prices due to low Chinese demand, the change in interest rate view suggests AUD could weaken further.

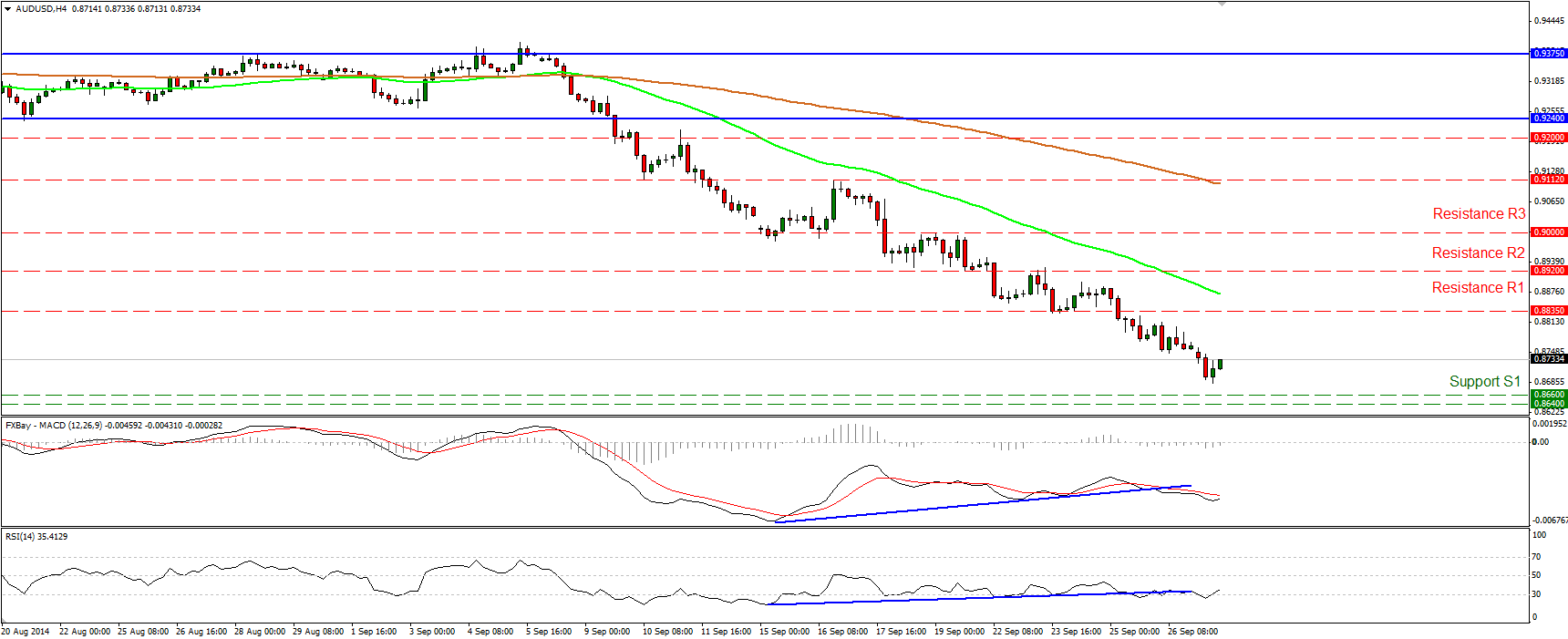

AUD/USD fell during the European morning Monday, breaking below the support barrier (turned into resistance) of 0.8730. That move confirms a forthcoming lower trough and I would expect the bears to pull the trigger for extensions towards our next support area of 0.8660 (S1), defined by the low of the 4th of February. As long as the price structure remains lower lows and lower highs below both the 50- and the 200-period exponential moving averages, I believe the overall picture is negative. My only concern is that I still see positive divergence between the price action and both of our momentum indicators, something that designates decelerating downside momentum.

Support: 0.8660 (S1), 0.8640 (S2) , 0.8600 (S3)

Resistance: 0.8730 (R1), 0.8835 (R2), 0.8920 (R3)

Recommended Content

Editors’ Picks

AUD/USD loses ground due to the absence of a hawkish RBA

The Australian Dollar has plunged following the Reserve Bank of Australia's decision to maintain its interest rate at 4.35% on Tuesday. Investors sentiment leaned toward a potentially more hawkish stance from the RBA, particularly after last week's inflation data surpassed expectations.

EUR/USD edges lower to near 1.0750 after hawkish remarks from a Fed official

EUR/USD extends its losses for the second successive session, trading around 1.0750 during the Asian session on Wednesday. The US Dollar gains ground due to the expectations of the Federal Reserve’s prolonging higher interest rates.

Gold price recovers its recent losses, despite a firmer US Dollar

Gold price attracts some buyers during the Asian trading hours on Wednesday. Safe-haven demand, fueled by geopolitical tensions and uncertainty, as well as ongoing central bank purchases, might contribute to a rally in gold.

FTX files consensus-based plan of reorganization, awaits bankruptcy court approval

FTX has filed a consensus-based plan for its reorganization, coming almost two years after the now defunct FTX filed for Chapter 11 Bankruptcy Protection in the District of Delaware.

No obvious macro catalysts to steer the bus

The US data calendar remains relatively light, with initial jobless claims and the University of Michigan survey being the key focus. However, these releases may not provide a significant catalyst for the next directional move in the US Dollar.