USD/NOK

The dollar traded lower against almost all of its G10 peers during the European morning Thursday. It remained stable only vs JPY and CAD.

EUR/USD moved higher as the bloc’s PMIs managed to remain above the neutral level. Even though the Eurozone’s preliminary composite PMI - covering both the manufacturing and service sectors - missed the forecast and fell to 52.8 from 53.8 in July, it remained above the neutral 50.0 level for the 14th consecutive month. Added to that, PMIs from Germany, the bloc’s strongest economy, beat market consensus, pushing EUR/USD up slightly. However, since the overall outlook remains negative in my view, I believe that any further rebound is likely to remain limited and I would expect the bears to prevail again soon.

The British pound weakened against USD after UK retail sales for July came out. Even though retail sales excluding gasoline rose by more than anticipated on a month-on-month basis, the year-on-year figure missed estimates. The news pushed Cable down by approximately 0.10%, however sterling managed to recover some of the losses. We believe GBP/USD could end the day lower again given the negative sentiment towards the British pound and the USD-supportive data expected later in the day.

The Swedish krona strengthened after the country’s unemployment rate declined to 7.1% from 9.2%, beating the market consensus of 7.2%. The strong improvement in the labor market offset the recent unchanged CPI reading and strengthened SEK. The positive data will most likely take off some pressure from Riksbank at their September meeting, and the chances to see a further rate cut lessen.

Norway’s economy grew 0.9% qoq in Q2, after expanding 0.2% qoq in Q1, beating the +0.5% qoq estimate. On top of the recent robust data coming from the country, NOK strengthened approximately 0.50% pushing USD/NOK further down.

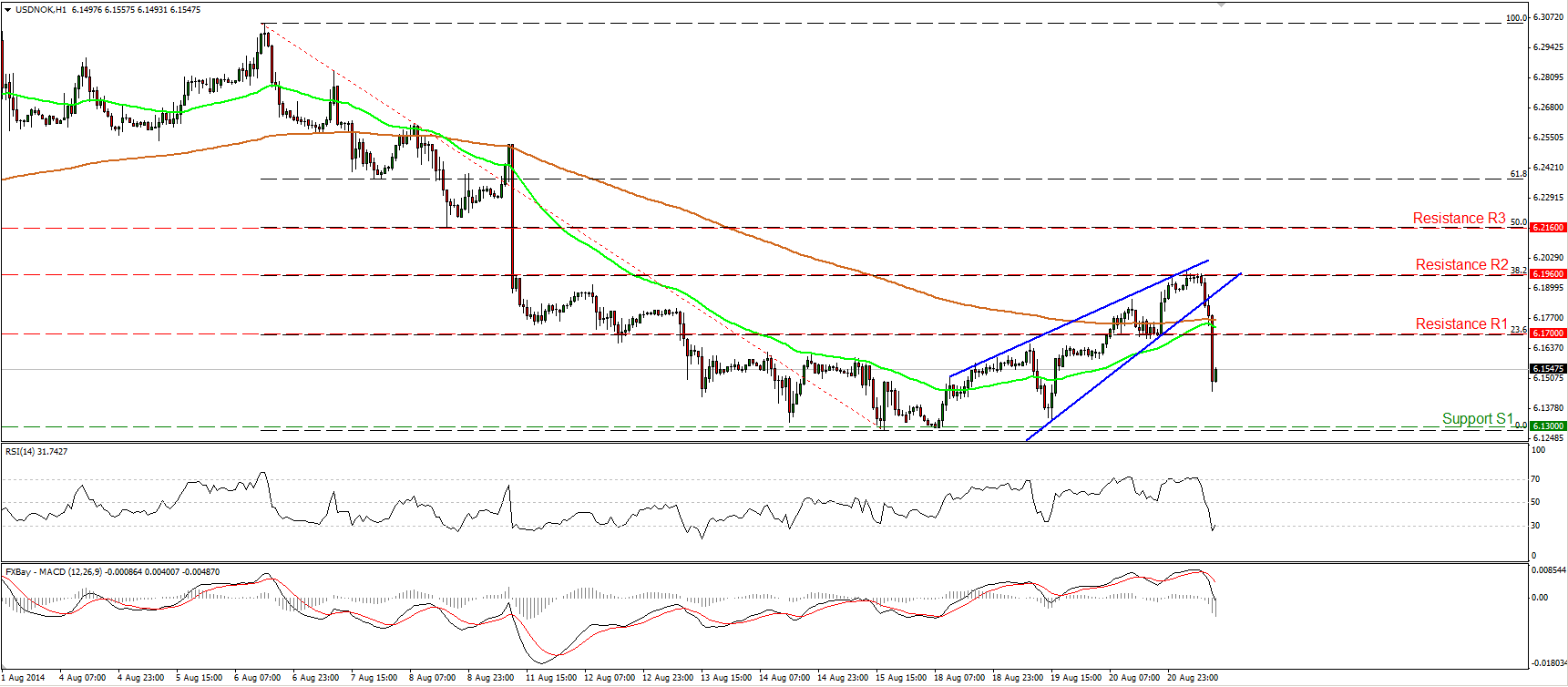

USD/NOK collapsed during the European morning Thursday, after finding resistance at 6.1960 (R2), the 38.2% retracement level of the 6th - 18th August down move. The rate fell below the 6.1700 (support turned into resistance) line, confirming the exit from a rising wedge formation. Having that in mind I would see a cautiously negative outlook and I would expect a test near the 6.1300 (S1) zone, which in turn is the 38.2% level of the 8th May- 6th August longer-term uptrend. As a result, only a clear dip below 6.1300 (S1) could clear the picture and trigger further extensions towards the key support of 6.1000 (S2). The hourly MACD, already below its signal line, crossed below its zero line, supporting my view for further declines, at least towards 6.1300 (S1). However, the 14-hour RSI exited its oversold field, thus I would expect a bounce to provide renewed selling opportunities.

Support: 6.1300 (S1), 6.1000 (S2), 6.0775 (S3) .

Resistance: 6.1700 (R1), 6.1960 (R2), 6.2160 (R3).

Recommended Content

Editors’ Picks

EUR/USD holds positive ground above 1.0750 ahead of Eurozone PMI, PPI data

EUR/USD trades in positive territory for the fourth consecutive day near 1.0765 during the early Monday. The softer US Dollar provides some support to the major pair. Traders await the HCOB Purchasing Managers’ Index (PMI) data from Germany and the Eurozone, along with the Eurozone PPI.

GBP/USD rises to near 1.2550 due to dovish sentiment surrounding Fed

GBP/USD continues its winning streak for the fourth consecutive day, trading around 1.2550 during the Asian trading hours on Monday. The appreciation of the pair could be attributed to the recalibrated expectations for the Fed's interest rate cuts in 2024 following the release of lower-than-expected US jobs data.

Gold price rebounds on downbeat NFP data, softer US Dollar

Gold price snaps the two-day losing streak during the Asian session on Monday. The weaker-than-expected US employment reports have boosted the odds of a September rate cut from the US Federal Reserve. This, in turn, has dragged the US Dollar lower and lifted the USD-denominated gold.

Bitcoin Cash could become a Cardano partnerchain as 66% of 11.3K voters say “Aye”

Bitcoin Cash is the current mania in the Cardano ecosystem following a proposal by the network’s executive inviting the public to vote on X, about a possible integration.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.