DXY futures

The dollar traded mixed against its G10 counterparts during the European morning Wednesday. It was higher against SEK, NOK and EUR, in that order, while it was lower against GBP and NZD. The greenback traded virtually unchanged against JPY, CHF, AUD and CAD.

GBP strengthened after the minutes of the Bank of England’s August policy meeting revealed the first dissenting votes since July 2011. According to the minutes, the committee voted 7-2 on the proposition that the Bank rate should be maintained at 0.5%. Two members noted that the continuing rapid fall in unemployment alongside survey evidence of tightening in the labour market created a prospect that wage growth would pick up and therefore they voted against the proposition to leave interest rates unchanged. Cable traded fractionally above our 1.6600 support level during the European morning ahead of the release. As soon as the minutes were out, GBP/USD jumped up by approximately 0.30%, but gave back most of its gains within the following minutes. That sterling could not reach and break our resistance of 1.6700 despite the split in votes suggests that the dissenting votes were somehow anticipated by the market after BoE Gov. Carney’s comments last Wednesday that the committee has a “wide range of views” on the level of slack in the economy. At the same time, the softening of inflation in July and the recent weak data coming from the country seem to have entrenched the negative sentiment towards the pound and prevented it from reversing its recent downtrend. We remain bearish about GBP as we move towards the September referendum on Scottish independence.

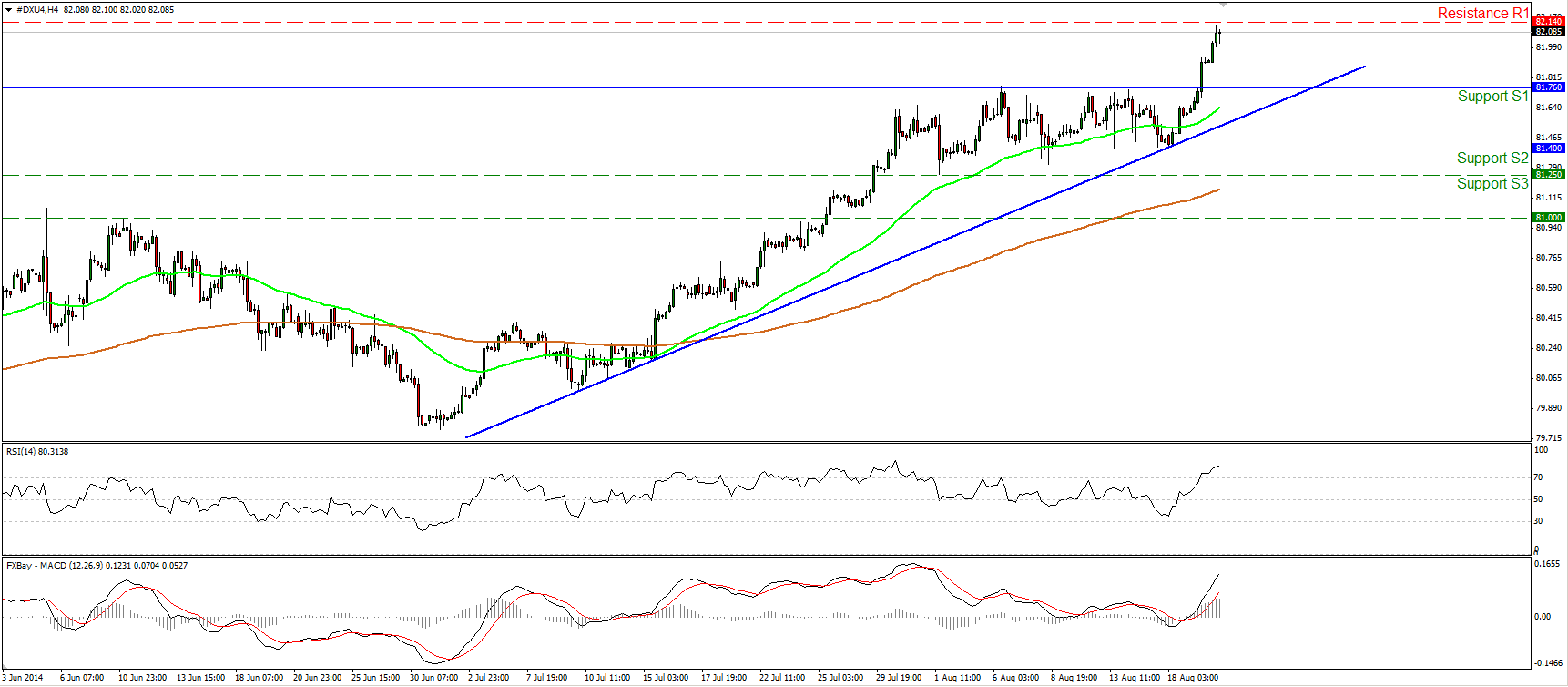

DXY futures rallied on Tuesday, breaking above 81.760 (resistance turned into support), the upper boundary of the sideways path it’s been trading in recently. In my view, the move above that hurdle signals the continuation of the uptrend, marked by the blue upside support line. Today, during the European morning, the price halted marginally below our resistance line of 82.140 (R1), the highs of the 11th of September. A decisive violation of that line could extend the rally and challenge the highs of the 5th of September at 82.700 (R2). Nevertheless, the RSI shows signs of topping and could exit its overbought territory in the near future. As a result, a pullback is likely before the longs pull the trigger again, perhaps to test the 81.760 (S1) level as a support this time. On the daily chart, an inverted head and shoulders formation was completed upon the violation of the 81.000 barrier, signaling a trend reversal and a first possible price objective is seen near 83.150 (R3).

Support: 81.760 (S1), 81.400 (S2), 81.250 (S3) .

Resistance: 82.140 (R1), 82.700 (R2), 83.150 (R3).

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.