USD/TRY

The dollar traded unchanged or higher against most of its G10 counterparts during the European morning Friday. It was higher against GBP, NZD, CAD, NOK and AUD, in that order, while it was lower against SEK. The greenback was virtually unchanged against EUR, CHF and JPY.

The UK manufacturing PMI declined to 55.4 in July from 57.2 last month, lower than the market consensus of 57.2. The figure hit its lowest level in a year, adding to the recent weak data on the housing market and pushing cable down approximately 0.20%. The slowdown in the economy was partly anticipated by the BoE however and will most likely be a key concern at the Bank’s meeting next week.

SEK was the only winner against the dollar during the European morning. The nation’s manufacturing PMI rose to 55.2 in July from 54.8, above forecasts of a fractional increase to 54.9. The better-than-expected figure helped SEK to recover some of its losses from last Wednesday’s poor Q2 GDP reading and gave investors a reason to hope for a stronger currency and robust economy.

The Turkish lira was one of the main losers among the EM currencies, extending further its losses amid a rise in uncertainty about developing countries. Argentina’s second default in twelve years reminded investors over the high risk they take investing in EM countries, especially amidst the global economic instability that prevails. With this in mind, investors continued pushing EM currencies off the cliff for the second day in a row. Besides that, Turkey’s weak manufacturing PMI released earlier today exacerbated the deterioration of the lira.

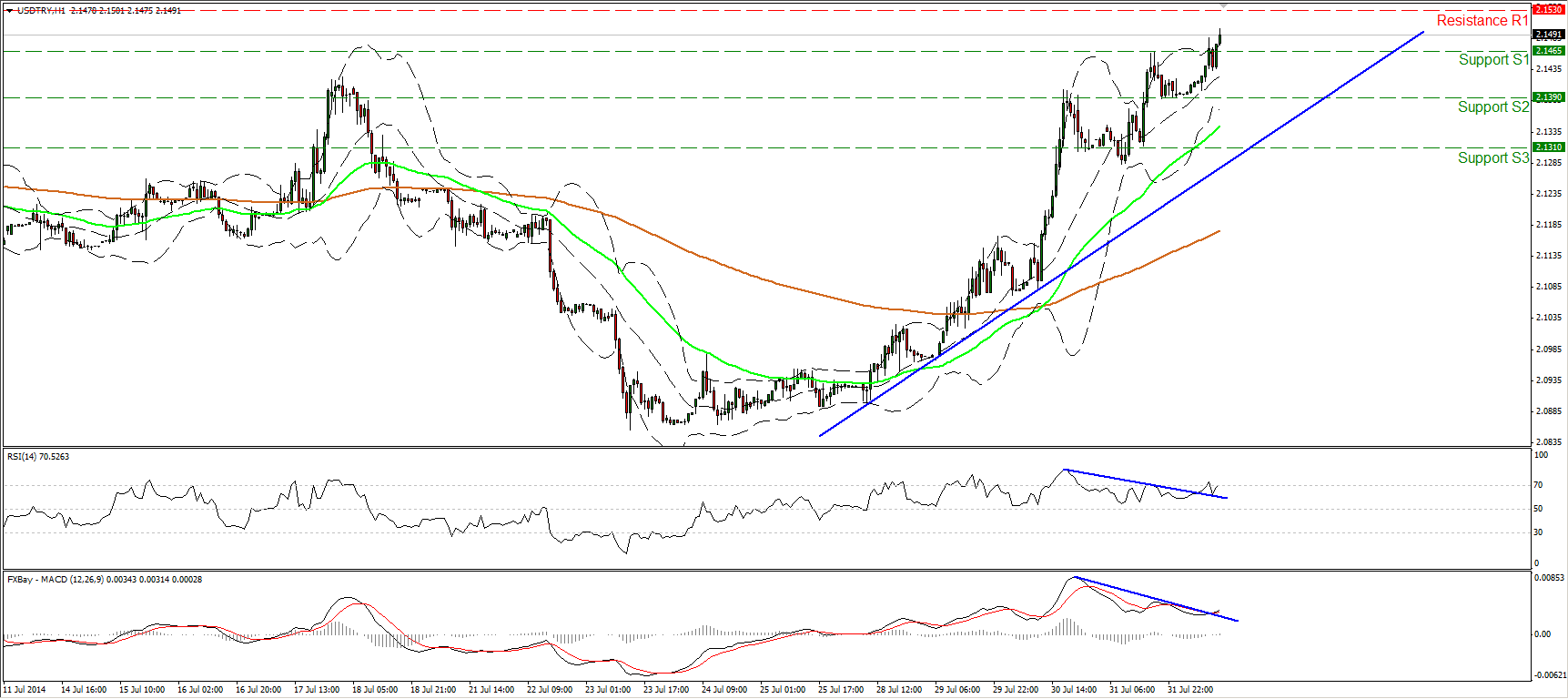

USD/TRY continued edging higher during the European morning Friday, overcoming yesterday’s highs of 2.1465. I believe that the longs will now go for the 2.1530 (R1) resistance barrier, where an upside violation may set the stage for further bullish extensions and target the next obstacle at 2.1600 (R2). The price structure is higher peaks and higher troughs above both the moving averages and above the blue short-term uptrend line. This keeps the bias to the upside. Additionally, both our momentum indicators eliminated prior negative divergence, moving above their downside resistance line. This supports my view that the bulls have shifted the gear up and they are willing to continue driving the battle higher.

Support: 2.1465 (S1), 2.1390 (S2), 2.1310 (S3)

Resistance: 2.1530 (R1), 2.1600 (R2), 2.1700 (R3)

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of US jobs report

EUR/USD stays in a consolidation phase above 1.0700 after closing the previous two days in positive territory. Investors eagerly await April jobs report from the US, which will include Nonfarm Payrolls and Unemployment Rate readings.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2550 amid the softer US Dollar on Friday. Market participants refrain from taking large positions as focus shifts to April Nonfarm Payrolls and ISM Services PMI data from the US.

Gold remains stuck near $2,300 ahead of US NFP

Gold price struggles to gain any meaningful traction and trades in a tight channel near $2,300. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support to XAU/USD ahead of the key US NFP data.

XRP edges up after week-long decline as Ripple files letter in reply to SEC’s motion

Ripple filed a letter to the court to support its April 22 motion to strike new expert materials. The legal clash concerns whether SEC accountant Andrea Fox's testimony should be treated as a summary or expert witness.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The NFP report is expected to show that the US economy added 243,000 jobs last month, sharply lower than the 303,000 job creation seen in March. The Unemployment Rate is set to stay unchanged at 3.8% in the same period.