Intraday market analysis: US Dollar Index cuts through resistance

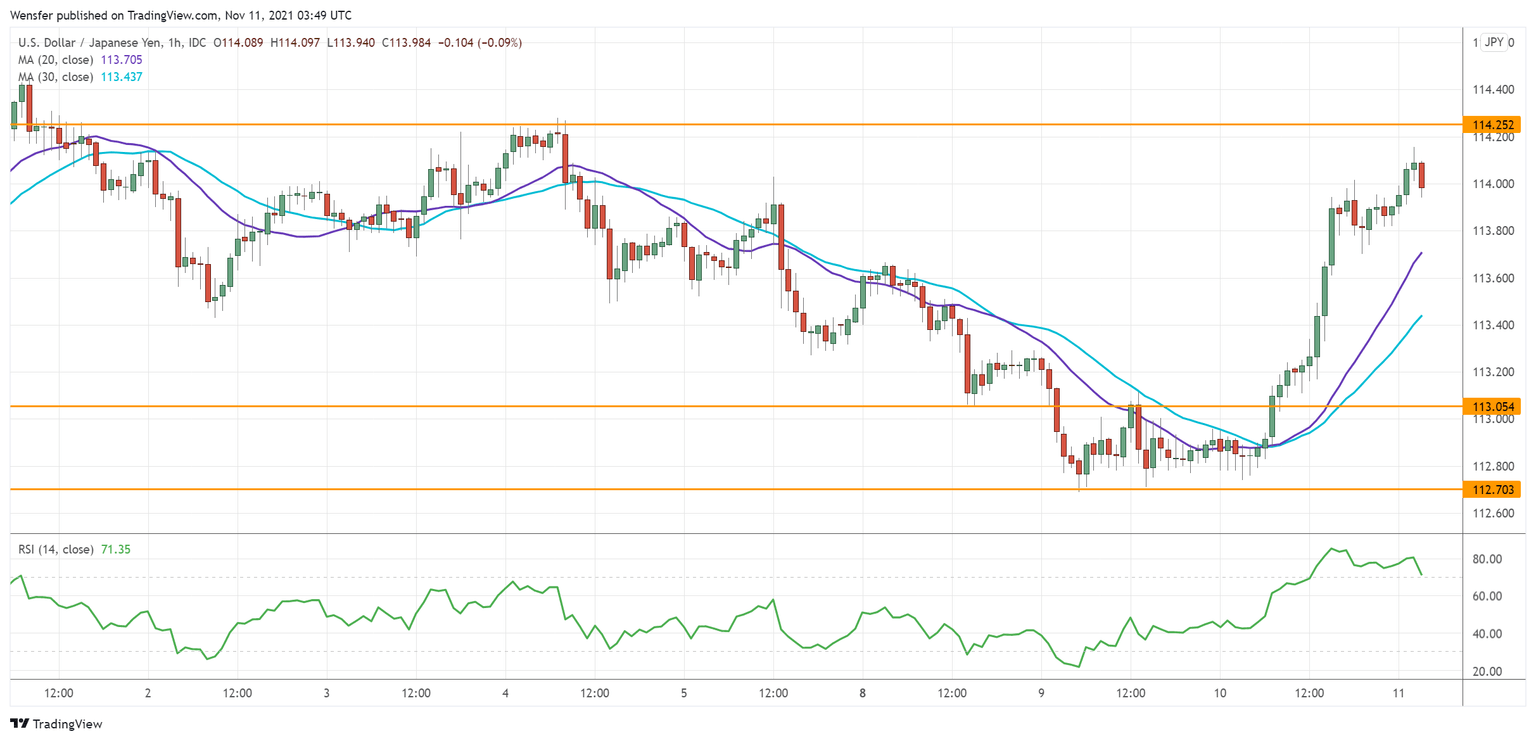

USD/JPY attempts a bullish reversal

The US dollar broke higher after October’s CPI exceeded expectations.

On the daily chart, the RSI has dropped back into the neutrality area. The greenback has secured bids around the 30-day moving average. An oversold RSI on the hourly chart attracted a ‘buying-the-dips’ crowd at 112.70.

The latest surge above the psychological level of 114.00 has prompted sellers to cover their bets, paving the way for a bullish reversal above 114.25. Before that, an overbought RSI may lead to a pullback towards 113.05.

XAU/USD breaks resistance

Rising US CPI boosts the demand for gold as an inflation hedge.

After being unable to clear the daily chart’s triple top at 1833 over the course of the summer, the precious metal has cut through the resistance like a hot knife through butter. High volatility suggests that sellers were quick to bail out.

As momentum traders jump in, the bullish breakout would lead to an extended rally towards 1900. An overbought RSI may cause a limited pullback. In that case, 1823 at the base of the rally may see strong buying interest.

USOIL retreats from resistance

WTI crude edged lower after the EIA reported a slight rise in US inventories. The price’s swift recovery above the sell-off point at 83.00 is an indication that sentiment remains overall optimistic.

However, the previous peak and psychological level of 85.00 seems like a tough hurdle to overcome for now. An overbought RSI has triggered a temporary pullback with a break below 81.90. In turn, this is deepening the correction towards 79.30.

Trend followers may see the limited retracement as an opportunity to stake in.

Author

Jing Ren

Orbex

Jing-Ren has extensive experience in currency and commodities trading. He began his career in metal sales and trading at Societe Generale in London.