If you remember my past article about EURUSD on 24.AUG I warned that 1.1255 is crucial for EURUSD upside. EURUSD dropped mainly because of Chinese equity markets, Shaghai index and EUROSTOXX50 futures especially at London open. Some hawkish comments about possible rate hike also gave boost to USDx which additionally lowered the pair. Yesterday we saw 2 rejections from 1.1260 each for 50+ pips and finally 1.1260 level was broken again. PMI rose to 53.3 from 51.8 and it better then preliminary estimate.

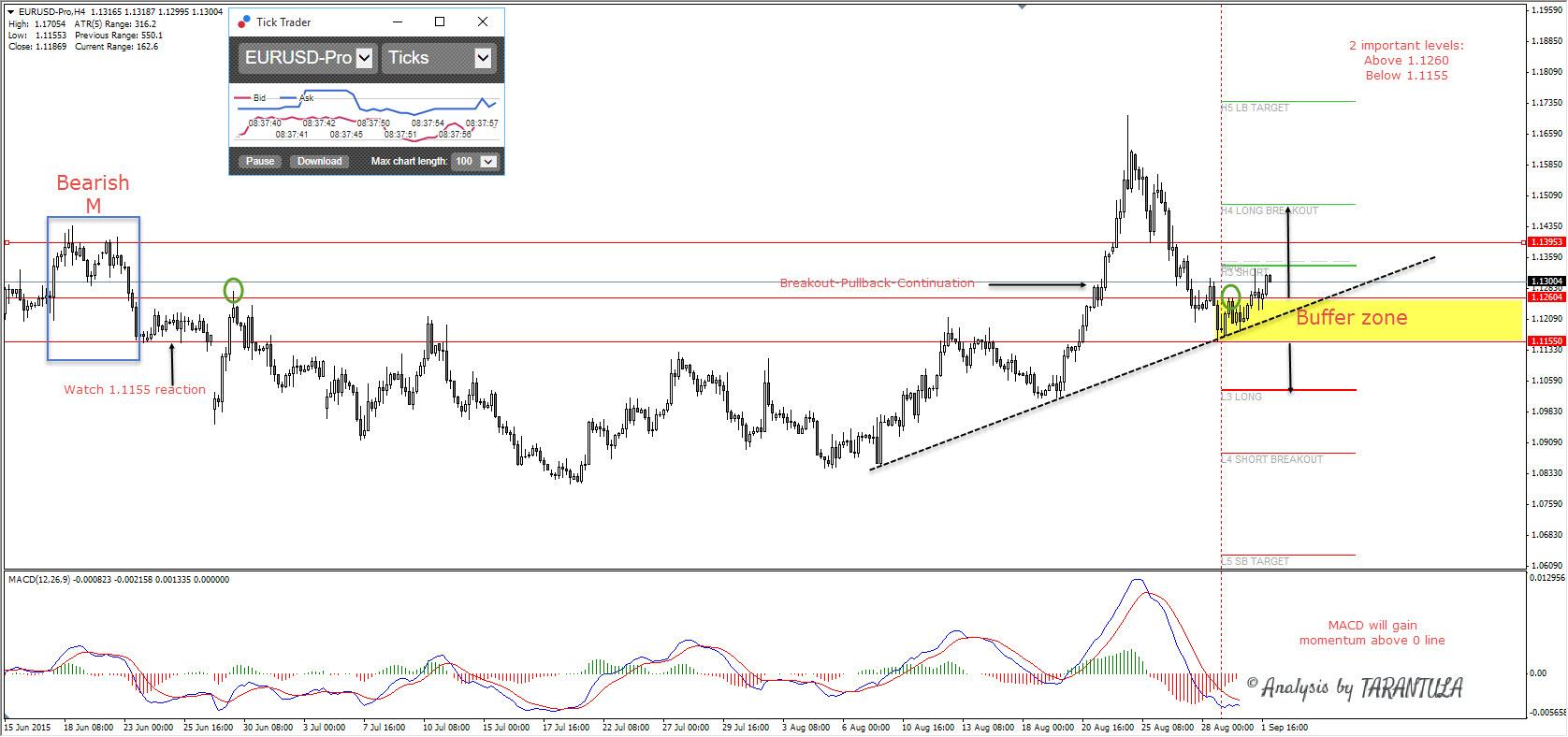

Technically we can spot HUGE Bearish M pattern which went below 1.1260 and it stopped at 1.1155 .EURUSD was sold subsequent spike to 1.1260 (green circles) and we can easily spot Historical vs Now moment sellers. Last drop from 1.1260 was good for intraday shorts but now the price is heavily bought from BUFFER ZONE. BUFFER zone shows clear levels which we should be focused on.

Historical PA shows BPC pattern at 1.1260 (1) so my conclusion is – as long as EURUSD is above 1.1260 it is bullish and below 1.1155 it is bearish. MACD is gaining a possible momentum (when above 0 line) so above 1.1260 we can expect 1.1360 and 1.1395. Only h4 close above 1.1395 will target 1.1500 again.

Below 1.1155 we can expect 1.1000 but so far this looks like a bullish price action with a possible scope for 1.17 retest.

The analysis and the article presents Nenad's opinion. Remember, financial trading is highly speculative & may lead to the loss of your funds. Proper risk management is the Holy Grail of trading.

Recommended Content

Editors’ Picks

AUD/USD appreciates amid hawkish RBA ahead of policy decision

The Australian Dollar continued its winning streak for the fifth consecutive session on Tuesday, driven by a hawkish sentiment surrounding the Reserve Bank of Australia. This positive outlook reinforces the strength of the Aussie Dollar, offering support to the AUD/USD pair.

USD/JPY extends recovery above 154.00, focus on Fedspeak

The USD/JPY pair trades on a stronger note around 154.10 on Tuesday during the Asian trading hours. The recovery of the pair is supported by the modest rebound of US Dollar to 105.10 after bouncing off three-week lows.

Gold price extends its upside as markets react to downbeat jobs data

Gold price extends its recovery on Tuesday. The uptick of the yellow metal is bolstered by the weaker US dollar after recent US Nonfarm Payrolls (NFP) data boosted bets that the Federal Reserve would cut interest rates later this year.

Bitcoin miner Marathon Digital stock gains ground after listing by S&P Global

Following Bitcoin miner Marathon Digital's inclusion as an upcoming member of the S&P SmallCap 600, the company's stock received an 18% boost, accompanied by an $800 million rise in market cap.

RBA expected to leave key interest rate on hold as inflation lingers

Interest rate in Australia will likely stay unchanged at 4.35%. Reserve Bank of Australia Governor Michele Bullock to keep her options open. Australian Dollar bullish case to be supported by a hawkish RBA.