With AUD/USD rising on Monday after rebounding from last week’s two-week lows, traders were preparing in eager anticipation for the Reserve Bank of Australia’s (RBA) rate statement to be released early on Tuesday.

Anticipation is especially keen since key Australian inflation data last week in the form of the Consumer Price Index (CPI) for Q1 came out significantly lower-than-expected, with the headline CPI falling 0.2% vs expectations of a 0.3% rise. The fall was due in part to a recovery of the Australian dollar in the past three months that has progressively decreased the cost of imports. This very unexpected deviation from prior inflation forecasts prompted a swift and substantial fall for AUD/USD below previous support at 0.7700 to approach the 0.7500 level, before rebounding.

The primary implication of this surprising deflationary reading is that it provides additional pressure and impetus on the RBA to cut benchmark interest rates from the record-low 2.00% during Tuesday’s policy meeting. Prior to release of the inflation data, the RBA was not widely expected to cut interest rates, but since the CPI numbers came out last week, speculation over a potential rate cut has increased markedly.

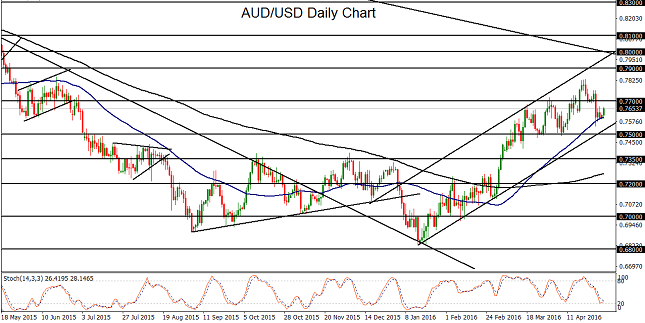

From a technical perspective, the past three months have seen AUD/USD stage a sharp recovery from January’s multi-year lows near 0.6800 as the dollar has generally weakened due to a dovish Federal Reserve and weak US economic data, and commodities have rebounded accordingly. Most recently, this has resulted in a new 10-month high above 0.7800 within the past two weeks, prior to the noted CPI-driven drop.

Despite the weakened US dollar in recent months, any actual rate cut or indication of a near-future rate cut on Tuesday’s RBA meeting could likely have the effect of pressuring AUD/USD to retreat significantly further. In this event, the immediate downside target is at the noted 0.7500 key support level. Any further breakdown below 0.7500 could then prompt a move towards 0.7350-area support. In contrast, if interest rates remain unchanged and the RBA statement’s language is not overtly dovish, a return back above the noted 0.7700 level could prompt a further continuation of the current three-month uptrend.

Investopedia does not provide individual or customized legal, tax, or investment services. Since each individual’s situation is unique, a qualified professional should be consulted before making financial decisions. Investopedia makes no guarantees as to the accuracy, thoroughness or quality of the information, which is provided on an “AS-IS” and “AS AVAILABLE” basis at User’s sole risk. The information and investment strategies provided by Investopedia are neither comprehensive nor appropriate for every individual. Some of the information is relevant only in Canada or the U.S., and may not be relevant to or compliant with the laws, regulations or other legal requirements of other countries. It is your responsibility to determine whether, how and to what extent your intended use of the information and services will be technically and legally possible in the areas of the world where you intend to use them. You are advised to verify any information before using it for any personal, financial or business purpose. In addition, the opinions and views expressed in any article on Investopedia are solely those of the author(s) of the article and do not reflect the opinions of Investopedia or its management. The website content and services may be modified at any time by us, without advance notice or reason, and Investopedia shall have no obligation to notify you of any corrections or changes to any website content. All content provided by Investopedia, including articles, charts, data, artwork, logos, graphics, photographs, animation, videos, website design and architecture, audio clips and environments (collectively the "Content"), is the property of Investopedia and is protected by national and international copyright laws. Apart from the licensed rights, website users may not reproduce, publish, translate, merge, sell, distribute, modify or create a derivative work of, the Content, or incorporate the Content in any database or other website, in whole or in part. Copyright © 2010 Investopedia US, a division of ValueClick, Inc. All Rights Reserved

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.