USD/CAD dropped to a new 9-month low below 1.2800 support on Tuesday as crude oil prices surged dramatically due to renewed speculation that a deal to cap oil production levels among OPEC nations and Russia could plausibly be reached.

With a meeting of major oil producers scheduled for this weekend on April 17, the run-up to that meeting has been rife with constantly shifting conjecture over what the results of those negotiations might possibly be.

On one side, pessimistic observers have pointed to the likelihood that Iran will not participate in any deal due to its newly-obtained, post-sanction freedom to export its long-idle oil production, as well as Saudi Arabia’s previous assertion that no deal would take place if Iran was not a participant. Retaining and gaining market share is the common goal of all oil-producers, and a deal to freeze output would run counter to that goal. Furthermore, even if a deal did take place, there would still be the looming question as to whether a coordinated production cap at the recent near-record output levels would do much to alleviate the oversupply situation. On the other side, optimists have pointed to the fact that major OPEC producers and Russia are under immense pressure to reach a deal of some kind in order to help relieve plunging oil prices, which have caused severe economic problems across the oil-exporting world.

It was reported on Tuesday that prior to next Sunday’s meeting, Russia and Saudi Arabia had already agreed on a production cap and that the decision to do so is not contingent upon Iran’s participation. Whether this news is completely accurate or not remains to be seen, but the report was enough to further fuel crude oil’s recent rally and recovery.

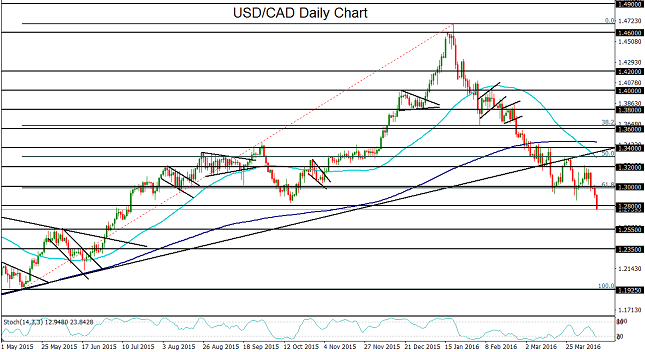

The surge in oil prices prompted a corresponding rise for the oil-correlated Canadian dollar. This was manifested as a sharp plunge for USD/CAD below the noted 1.2800 support level. Since late January, the currency pair has slid in a steep downtrend from its long-term highs near 1.4700. In the process of this slide, USD/CAD has broken down below several major support factors, including 1.4000, 1.3600. 1.3400, and most recently, the 1.3000 psychological level. Additionally, the 50-day moving average has recently crossed below the 200-day moving average, suggesting strong bearish momentum. As USD/CAD has just reached down to break below the 1.2800 level on an intraday basis, the currency pair could now be targeting the next major downside support level around 1.2550, on any continuing oil rebound.

Investopedia does not provide individual or customized legal, tax, or investment services. Since each individual’s situation is unique, a qualified professional should be consulted before making financial decisions. Investopedia makes no guarantees as to the accuracy, thoroughness or quality of the information, which is provided on an “AS-IS” and “AS AVAILABLE” basis at User’s sole risk. The information and investment strategies provided by Investopedia are neither comprehensive nor appropriate for every individual. Some of the information is relevant only in Canada or the U.S., and may not be relevant to or compliant with the laws, regulations or other legal requirements of other countries. It is your responsibility to determine whether, how and to what extent your intended use of the information and services will be technically and legally possible in the areas of the world where you intend to use them. You are advised to verify any information before using it for any personal, financial or business purpose. In addition, the opinions and views expressed in any article on Investopedia are solely those of the author(s) of the article and do not reflect the opinions of Investopedia or its management. The website content and services may be modified at any time by us, without advance notice or reason, and Investopedia shall have no obligation to notify you of any corrections or changes to any website content. All content provided by Investopedia, including articles, charts, data, artwork, logos, graphics, photographs, animation, videos, website design and architecture, audio clips and environments (collectively the "Content"), is the property of Investopedia and is protected by national and international copyright laws. Apart from the licensed rights, website users may not reproduce, publish, translate, merge, sell, distribute, modify or create a derivative work of, the Content, or incorporate the Content in any database or other website, in whole or in part. Copyright © 2010 Investopedia US, a division of ValueClick, Inc. All Rights Reserved

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.