![]()

The NZD/USD could be heading significantly higher over the coming weeks. Not only have commodity prices rebounded across the board, but the RBNZ has also recently turned neutral while the US dollar is refusing to push higher despite improvement in economic data there. The RBNZ is meeting again on Wednesday and any hawkish comments will likely send the NZD further higher.

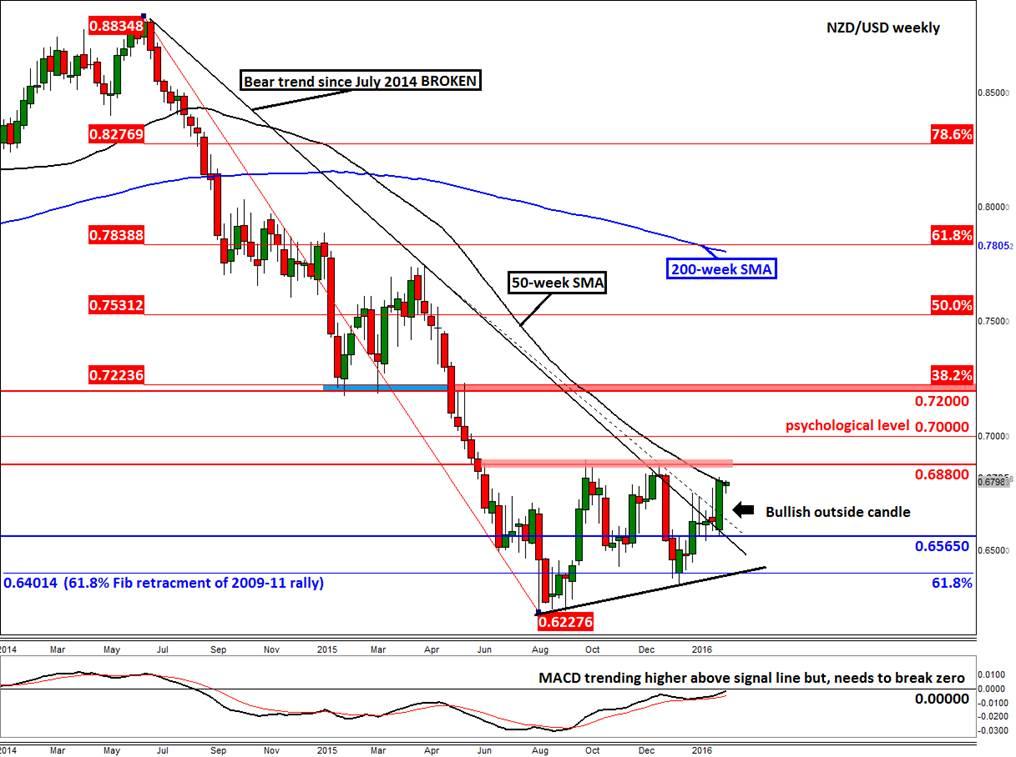

But today we are not focusing on the fundamentals much. Instead, we are looking at the technical outlook for this pair. Below we have a weekly chart of the kiwi. While still not out of the danger zone, recent price action strongly suggests that a bottom may be in place.

Over the past several weeks, the NZD/USD has formed several doji-looking candles around the bearish trend line that had been in place since July 2014. These indecisive-looking patterns would have normally led to selling pressure if this was still a downward-trending market. But the lack of any significant follow-through strongly suggested that the trend was turning bullish and that a breakout was forthcoming.

The NZD/USD has now well and truly broken above the bearish trend line, forming a large bullish outside candlestick on its weekly chart. For the reversal to be confirmed, it will still need to rise above previous resistance at 0.6880 and the momentum indicator MACD will need to move above zero.

Given the recent price action, a break out appears highly likely. At the time of this writing, the kiwi was testing its 50-week moving average at around 0.6800. But the key risk event this week is the RBNZ meeting, so anything can still happen. A break below the key 0.6565 support level would invalidate this bullish outlook.

If and when the 0.6880 level breaks then the bulls may aim for the psychological handle of 0.70 as their next target. Above this level, the next potential resistance area is between 0.7200 and 0.7225 where the previous support meets the 38.2% Fibonacci retracement level.

Trading leveraged products such as FX, CFDs and Spread Bets carry a high level of risk which means you could lose your capital and is therefore not suitable for all investors. All of this website’s contents and information provided by Fawad Razaqzada elsewhere, such as on telegram and other social channels, including news, opinions, market analyses, trade ideas, trade signals or other information are solely provided as general market commentary and do not constitute a recommendation or investment advice. Please ensure you fully understand the risks involved by reading our disclaimer, terms and policies.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.