![]()

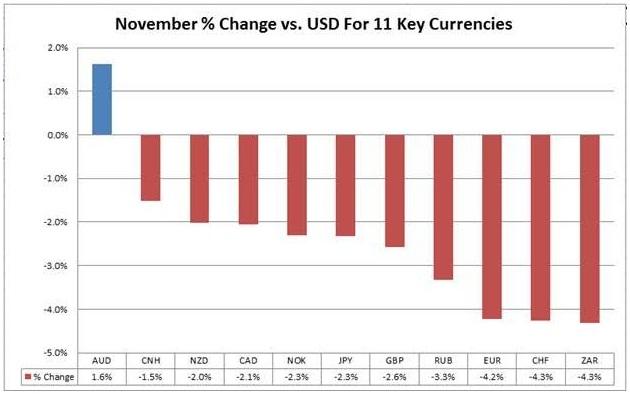

For anyone trading FX through the month of November, the most obvious theme was the resurgence of the US dollar bullish trend. This move was driven almost exclusively by increasing expectations that the Federal Reserve would raise interest rates at its upcoming December meeting, and throughout the month, economic data continually reinforced this view.

The dollar’s explosive November started out with the blowout October NFP report, which showed 271k new jobs created, carried through last week’s solid GDP reading, and was supported by hawkish Fedspeak throughout, to the point that Fed Funds futures traders are now pricing in a 78% probability that the FOMC hikes interest rates in two weeks. While we believe that the dollar’s rally could stretch further in the run-up to the Federal Reserve’s highly-anticipated meeting on December 16, the greenback may struggle in the latter half of the month with the most obvious bullish catalyst behind us and generally slow holiday trading conditions.

Meanwhile, one development that caught a lot of traders off guard last month was the surprise rally in the Australian dollar against all the other major currencies, including the dollar. Even before last night’s optimistic economic assessment by the RBA and solid PMI figures out of China, the Aussie was supported by decent data. The highlight of the month was no doubt the stellar mid-month labor market report, which drove unemployment rate from 6.2% to 5.9% Down Under.

Heading into the month, many analysts assumed that the RBA would be forced to cut interest rates before 2016, but after the raft of strong economic data, some are now suggesting that the RBA’s next move may be to hike interest rates, an inconceivable notion five weeks ago. The Australian dollar’s outperformance last month shows that it’s not the absolute position of central bank policy that drives currency values, rather how the expectations for monetary policy evolve relative to the market’s expectations.

With the Aussie peeking out above a 14-month bearish trend line off the September 2014 highs up at .9400, we could see more short-term strength in the Aussie moving forward, especially if China’s economy shows signs of accelerating once again and/or the price of industrial metals bounces.

This research is for informational purposes and should not be construed as personal advice. Trading any financial market involves risk. Trading on leverage involves risk of losses greater than deposits.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.