![]()

Markets remain snore-inducingly slow as we move into the latter portion of today’s US session. That said, traders may want to start looking ahead to some of the noteworthy data on tap in the coming Asian session.

First, shortly after this note goes to press, the RBNZ will release its semi-annual Financial Stability Report. Back at the last release in May, the New Zealand’s central bank keyed in on three major risks to the NZ economy: the housing market, dairy prices, and global financial conditions. Unfortunately, none of these factors have improved notably over the last 180 days, so we would expect a similar focus in today’s release.

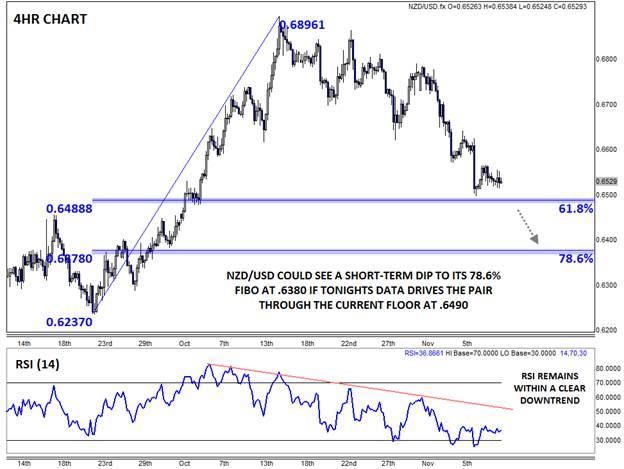

The RBNZ has also used this report, and Governor Wheeler’s accompanying press conference, to jawbone the kiwi lower in the past, so traders should be wary of any comments about the currency as well. Looking to the chart, the key areas of support to watch will be the Fibonacci retracements of the mid-September to mid-October rally at .6490 (61.8%) and .6380 (78.6%)

Across the Tasman, Australia’s Westpac bank will release the latest data on AU consumer sentiment. This report covers data from the current month, so it provides a timely view into the psyche of the Australian consumer. Unfortunately, the data tends to be extremely volatile on a month-by-month basis, so it’s impact on markets may be limited, even in the current data-starved environment.

Finally, traders will also get the latest update on the world’s second-largest economy, China. Specifically, China will release its latest industrial production and fixed asset investment data, which are critical reports for the manufacturing-led economy. Expectations are for the former report to tick up to a 5.8% y/y growth rate (from 5.7%) and the latter release to edge down to a 10.2% y/y gain (against 10.3% last month). If the data fails to live up to these still lofty expectations, more weakness is possible in both the Australian and New Zealand dollars, regardless of the domestic data.

This research is for informational purposes and should not be construed as personal advice. Trading any financial market involves risk. Trading on leverage involves risk of losses greater than deposits.

Recommended Content

Editors’ Picks

EUR/USD extends sideways grind below 1.0900

EUR/USD stays in a consolidation phase below 1.0900 following the previous week's rally. In the absence of high-tier data releases, the US Dollar stays resilient against its rivals as investors scrutinize comments from central bank officials.

Gold pulls away from record highs, holds above $2,400

Gold rose sharply at the beginning of the week on escalating geopolitical tensions and touched a new all-time high of $2,450. With market mood improving modestly, XAU/USD erases a majority of its daily gains but manages to hold above $2,400.

GBP/USD holds steady near 1.2700, Fedspeak in focus

GBP/USD fluctuates in a narrow channel near 1.2700 on the first trading day of the week. The cautious market stance helps the US Dollar hold its ground, while market participants assess remarks from central bank officials ahead of this week's key events.

Ripple stays above $0.50 on Monday as firm backs research on blockchain and quantum computing

XRP price holds steady above the $0.50 key support level and edges higher on Monday, trading at 0.5130 and rising 0.70% in the day at the time of writing.

Week ahead: Nvidia results and UK CPI falling back to target

What a week for investors. The Dow Jones reached a record high and closed last week above 40,000, for the first time ever. This is a major bullish signal even though gains for global stocks were fairly modest on Friday, and European stocks closed lower.