![]()

So, the minutes were considered dovish, which is no surprise since the meeting at the end of July allowed an element of doubt to be thrown in about the prospect of a rate rise next month. The build up to the first rate hike from the US is starting to get tortuous, the market wants clear direction from the Fed, but the Fed is resisting it. Our view is that the decision will come down to the wire, with the market lurching at key employment, wage and inflation data between now and then.

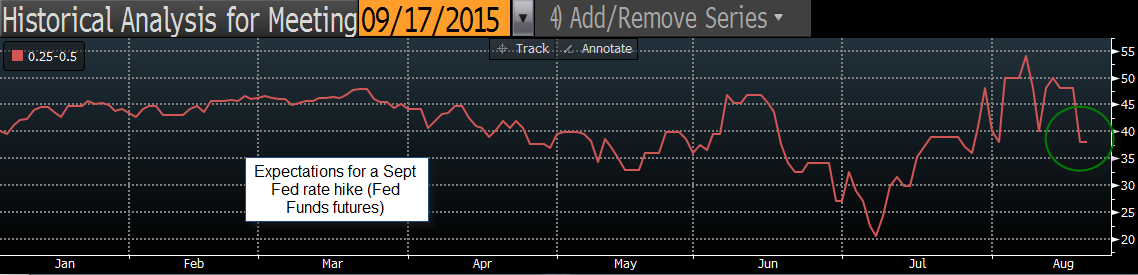

The actual damage done from these minutes is a shift in Fed Funds futures. The Fed Funds futures market is now pricing in a mere 38% chance of a rate hike next month, compared with more than 80% of economists polled by Bloomberg looking for a rate hike. The market is a bit more optimistic of a rate hike in December, with a 66% chance of a move. However, recent events including a sell-off in stock markets and the Chinese currency devaluation has made the market less sure of a rate rise in 2015, and more likely to put their money on a rate rise in Q1, where there is an 83% chance of a rise according to Fed Fund futures.

This is significantly lower than expectations earlier in August, as you can see in the chart below, when the Fed Funds futures was pricing in a 55% chance of a rate rise on the 17th September FOMC meeting.

From a market perspective, this caution on the prospect of a rate hike next month may trigger some interesting market developments in the next couple of weeks:

It could weaken the dollar index, which is testing a cluster of moving averages at 96.40. Below here opens the way to 94.60 – the 200-day sma – and also the lowest level since June.

A weaker dollar could fuel a short term recovery in commodity prices, Bloomberg’s commodity index is at its lowest level since 2002, and oil looks desperately oversold.

If commodity prices rally then it could be an Indian summer for commodity FX bulls.

It could keep the EUR above water. EURUSD has been stubbornly range-bound around 1.10 and has not fallen as much as expected. A weaker buck could support EURUSD downside in the next few weeks, with 1.0850 a medium-term support level. A break above 1.1220 – the high from 12th August – is a bullish development that opens the way for more late summer upside from the euro.

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of US jobs report

EUR/USD stays in a consolidation phase above 1.0700 after closing the previous two days in positive territory. Investors eagerly await April jobs report from the US, which will include Nonfarm Payrolls and Unemployment Rate readings.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2550 amid the softer US Dollar on Friday. Market participants refrain from taking large positions as focus shifts to April Nonfarm Payrolls and ISM Services PMI data from the US.

Gold remains stuck near $2,300 ahead of US NFP

Gold price struggles to gain any meaningful traction and trades in a tight channel near $2,300. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support to XAU/USD ahead of the key US NFP data.

XRP edges up after week-long decline as Ripple files letter in reply to SEC’s motion

Ripple filed a letter to the court to support its April 22 motion to strike new expert materials. The legal clash concerns whether SEC accountant Andrea Fox's testimony should be treated as a summary or expert witness.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The NFP report is expected to show that the US economy added 243,000 jobs last month, sharply lower than the 303,000 job creation seen in March. The Unemployment Rate is set to stay unchanged at 3.8% in the same period.