![]()

Ahead of this evening’s FOMC meeting, the pound is the strongest performer in the G10 FX space. Sterling is still benefitting from the decent GDP figure released on Tuesday, which has triggered a 150 pip rally in two days, not bad for end of July markets.

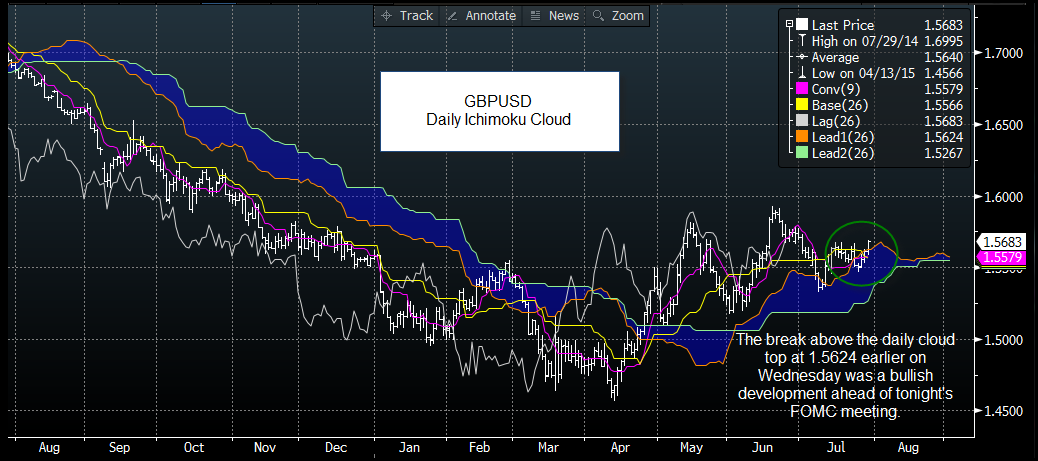

As we lead up to the FOMC meeting, GBPUSD is currently above the most recent peaks on 17th and 23rd July, and is at its highest level of the month so far. The recent advance in cable is also important from a technical perspective, as this pair is now above the top of the daily Ichimoku cloud at 1.5624, which was a key resistance level, is now key support, and signals a technical resumption of the former uptrend in this pair.

Can GBP strength last?

This depends on a few factors including:- A dovish Fed statement post this evening’s FOMC meeting.

- Weaker than expected US Q2 GDP report on Thursday.

- A hawkish tone to the BOE Inflation Report next week.

If the Fed statement is neutral and the US GDP report is roughly in line with expectations of 2.5%, then the focus may shift to next week’s BOE interest rate decision and Inflation Report, which have been lumped together for the first time. We will give you our preview on these key events later this week, but if the BOE can get the hawkish upper hand over the Fed then the future could look bright for sterling.

However, if the US data beats expectations, particularly GDP on Thursday, then it could weigh on GBP, as the headline UK Q2 GDP figure bellied some weakness in the detail of the report including flat construction growth.

The technical view:

As we mentioned, the break above the Ichimoku cloud top at 1.5624 is a bullish signal, which is now key support. Important resistance ahead of this level includes: 1.5810 – the high from end of June, then 1.5879 – the 50% retracement of the entire July 2014 – April 2015 sell off.In the event that US data trumps the UK, then key support for GBPUSD lies at 1.5475 – the low from 23rd July, then 1.5401 – the 200-day sma.

However, if US events and economic data go in sterling’s favour over the next few days then we may see further upside in the medium-term.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.