![]()

It’s been a rollercoaster ride of a week for US dollar traders, who were still trying to catch their breath after yesterday’s GDP- and Fed-driven collapse when they were hit by another whirlwind of economic data today. At the top level, there were four major economic releases this morning, and they were evenly split between encouraging and downbeat.

Whenever I’m asked if I “want the good news or the bad news first,†I always opt to get the negativity out of the way immediately. On that note, today’s Personal Income and Spending figures from the world’s largest economy certainly would be classified as “bad news.†Personal Spending rose just 0.4% m/m, while Personal Income was flat at 0.0%, missing expectations of 0.6% and 0.2% respectively. While spending did manage to tick higher, traders were hoping for a stronger rebound after the abysmal readings throughout Q1. Even more discouragingly, the Core PCE Price Index came out at just 0.1% m/m (vs. 0.2% eyed); as many traders know, this is the Federal Reserve’s preferred measure of inflation and unless it starts to rise more durably, the central bank is unlikely to raise interest rates in the next few months (see our full review of yesterday’s FOMC statement here). Based on these economic figures, the storm clouds are still looming over the US economy.

Of course, every storm eventually runs out of rain, and bulls are hoping that some of today’s more timely data releases signal a coming break in the clouds. The (notoriously volatile) initial jobless claims report showed just 262k new unemployed Americans in the most recent week, marking a 15-year low in this employment indicator. While the Fed has been satisfied with the quantity of jobs created, it’s the quality that has been lacking, and for that reason, today’s Employment Cost Index reading was particularly encouraging. This alternative measure of wages rose by 0.7% m/m, besting the 0.6% reading expected, and suggests potential inflation may be coming down the pipeline as consumers eventually spend their rising wages. Therefore, today’s more timely and forward-looking economic indicators hint at a spring thaw in the US economy, though traders and the Fed will need to see the improvement in the US economy sustained before acting too strongly on it.

Technical View: EURUSD

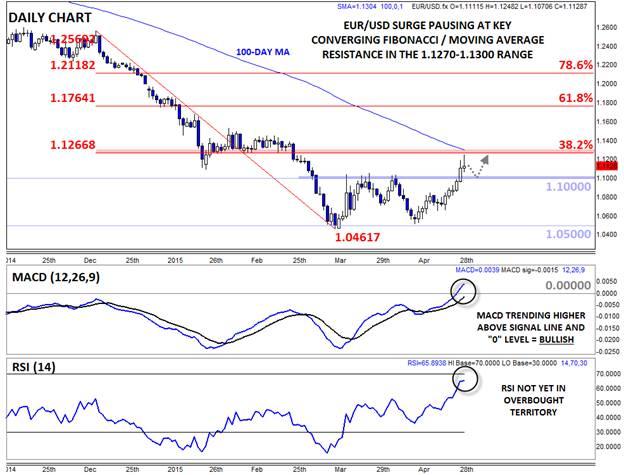

The world’s most widely traded currency pair has had a particularly wild ride over the last 48 hours, but today’s US data releases have taken some of the wind out of EURUSD bulls’ sails. The pair tested its 38.2% Fibonacci retracement near 1.1270 early in today’s European session before retreating on the economic data dump and the convergence of that level with the 100-day MA near 1.1300 may provide a near-term ceiling for the pair after the big rally this week.

That said, yesterday’s move above the key 1.1000-50 zone represents a major breakout and points toward further gains as long as rates remain above 1.10. The MACD indicator is trending higher above both its signal line and the “0†level and the RSI is not yet in overbought territory, supporting the bullish case over the medium term.

This research is for informational purposes and should not be construed as personal advice. Trading any financial market involves risk. Trading on leverage involves risk of losses greater than deposits.

Recommended Content

Editors’ Picks

AUD/USD awaits RBA Meeting Minutes for direction

The AUD/USD pair retreated from above 0.6700 and trades around 0.6670 early in Asia, following clues from Gold price in the absence of other news. Australia will publish Westpac Consumer Confidence and RBA Minutes early on Tuesday.

EUR/USD consolidates ahead of 1.0900

The EUR/USD pair failed to grab speculative interest’s attention on Monday and consolidated at around 1.0860. Federal Reserve officials keep flooding the news, but so far, failed to spur some action.

Gold retreated from record highs, maintains the upward bias

Gold rose sharply at the beginning of the week on escalating geopolitical tensions and touched a new all-time high of $2,450. With market mood improving modestly, XAU/USD erases a majority of its daily gains but manages to hold above $2,400.

Ethereum poised for high volatility as SEC may ‘slow play S-1s’ filings

Ethereum's (ETH) price movement on Monday reveals traders' uncertainty following Grayscale CEO's departure and expectations that the Securities & Exchange Commission (SEC) would deny applications for spot ETH ETFs this week.

Signed into law: Alabama abolishes income taxes on Gold and Silver

On May 14, 2024, Alabama Governor Kay Ivey signed a bill that removes all income taxes on capital gains from the sale of gold and silver, enabling the state to take an important step forward in reinforcing sound money principles.