![]()

Are you following the FOREX.com Research Team on Twitter? If not, you are missing up to the minute updates about market moves, insight in to what, when, why, and where of market moves, as well as links to easily accessible published material as soon as it is finished. Just in case you missed some of our most popular tweets of the week, here’s a Top 5 countdown to catch you up to speed.

5. 11 RETWEETS AND 6 FAVORITES = 17 ACTIONS

https://twitter.com/FOREXcom/status/588446209808859136

Source: www.twitter.com/FOREXcom

Our countdown starts out with Neal Gilbert’s suggestion that there was a dollar to believe in hours before the Australian employment figures were released. The Gartley pattern shown in the article turned out to be a false signal as employment jumped strongly Down Under and the AUD was the dominant dollar of the day.

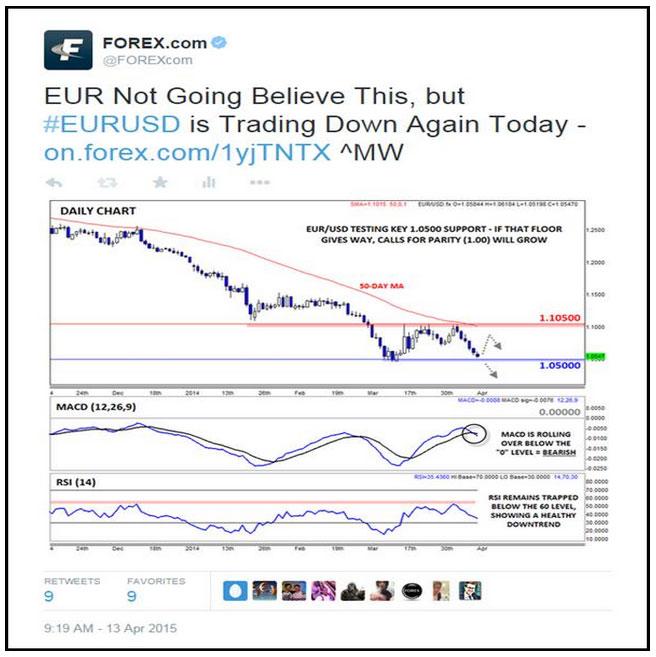

4. (tie) 9 RETWEETS AND 9 FAVORITES = 18 ACTIONS

https://twitter.com/FOREXcom/status/587606071516209152

Source: www.twitter.com/FOREXcom

Matt Weller takes this spot with his creatively titled article about the EUR/USD and its struggles to start the week. Just as his image indicates, the 1.05 level ended up being a key reversal point as the currency pair rallied back up to 1.0850 at the end of the week. If Matt’s analysis continues to be on fleek, the euro may start next week on the wrong foot as investors begin to worry about Greek issues at the end of the week.

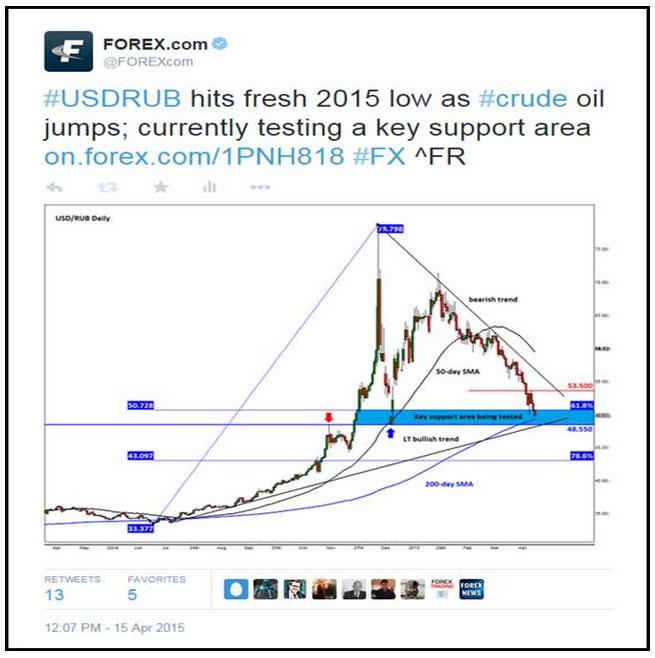

4. (tie) 13 RETWEETS AND 5 FAVORITES = 18 ACTIONS

https://twitter.com/FOREXcom/status/588373024996470784

Source: www.twitter.com/FOREXcom

Fawad Razaqzada joins our list with his tweeted article about the Russian Ruble and its utter domination of the USD over the last few weeks. There was a time when the RUB was one of the most toxic currencies to hold, but the tables have turned lately with the ruble being one of the best performers against the dollar in 2015. Fawad’s analysis was spot on as well as the “key support area” in his image provided the necessary support for this pair to rally at the end of the week.

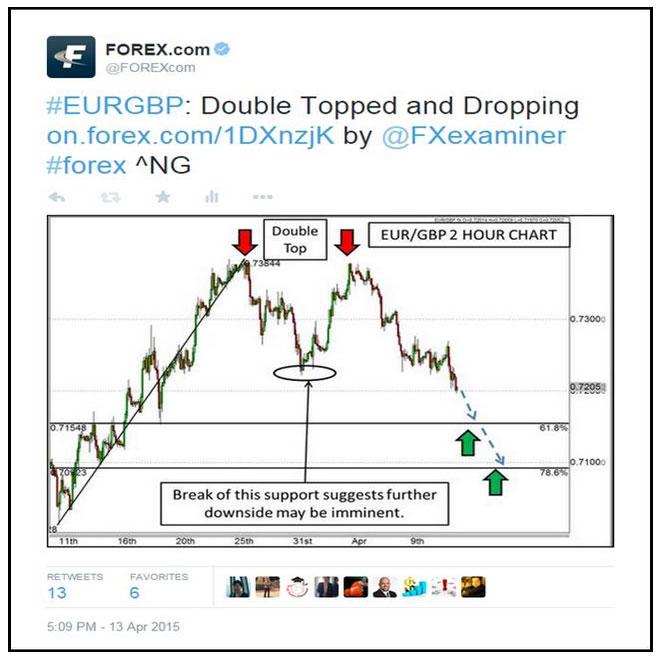

3. 13 RETWEETS AND 6 FAVORITES = 19 ACTIONS

s://twitter.com/FOREXcom/status/587724243472883715

Source: www.twitter.com/FOREXcom

Neal’s analysis of the EUR/GBP was relatively popular this week, but his analysis only turned out to be kinda right. While the pair did drop down to the 61.8% Fibonacci retracement, it actually bounced off that level and ranged for the rest of the week, trading advances and declines in about a 70 pip range.

2. 14 RETWEETS AND 7 FAVORITES = 21 ACTIONS

https://twitter.com/FOREXcom/status/588305976345899008

Source: www.twitter.com/FOREXcom

Who would have thought that Fawad’s insinuation that the stock rally was losing momentum would be so prophetic as stocks got hammered to end the week. In fact, on the DAX, the market fell all the way down to the 50 SMA pictured in Fawad’s tweet. Being that the oft used moving average is representative of support in this case, perhaps there will be a recovery to start next week.

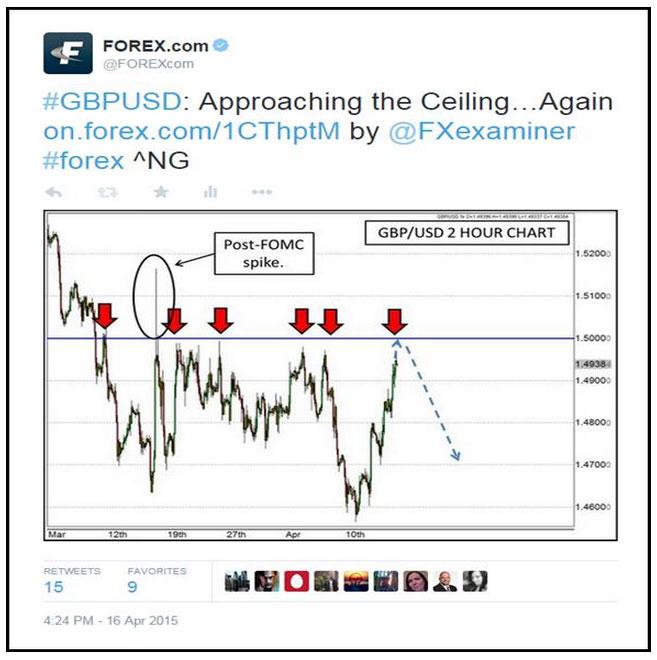

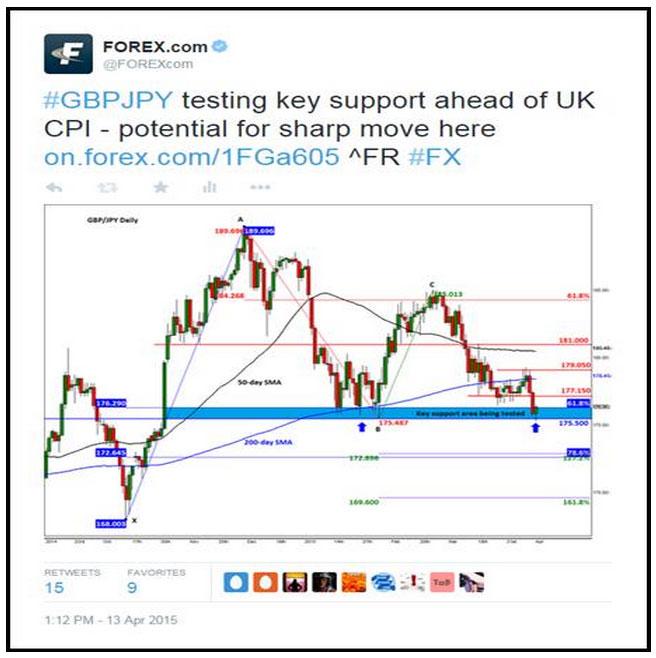

1. (tie) 15 RETWEETS AND 9 FAVORITES = 24 ACTIONS

https://twitter.com/FOREXcom/status/588800228209336321

Source: www.twitter.com/FOREXcom

For a fourth straight week Neal has taken the top spot on our countdown with his analysis of the GBP/USD’s tendency to stop short of 1.50 lately. As it turned out, this pair did make a brief appearance above the 1.50 level before retreating back toward 1.49. Strangely enough, the employment data out of the UK missed consensus, but that didn’t stop the GBP bulls from driving the currency up before it fell.

1. (tie) 15 RETWEETS AND 9 FAVORITES = 24 ACTIONS

https://twitter.com/FOREXcom/status/587664722507497472

Source: www.twitter.com/FOREXcom

Sharing the title as top tweeter of the week with Neal is Fawad who provided detailed analysis on the GBP/JPY as it was falling in to some long term support. Once again Fawad looked pretty prophetic as the pair touched 175.00 and then rallied up to nearly 179 before the week was through.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.