![]()

The week has started out with a lot of USD strength as a complicated set of influences are converging simultaneously in global markets. Not only do we have the month end flows to contend with, but this is also jobs week in the US, and there is a holiday on Friday (Good Friday) that is being observed by virtually the entire developed world outside of the Bureau of Labor Statistics who has decided to release Non-Farm Payrolls anyway. This strange set of circumstances could lead to irrational flows of currencies that could baffle many investors AND do so in increasingly illiquid environments. That being the case, it may be justifiable to consider some moves that go against your overall feel of markets, and the thought that USD strength could stop prematurely today may be just that type of situation.

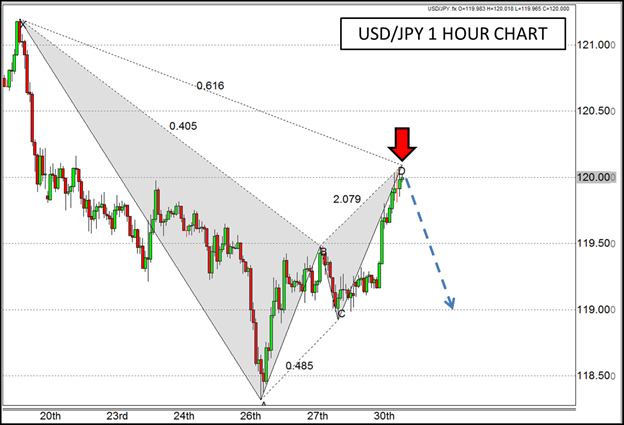

Overall, I’ve been in the USD/JPY Pamplona streets for a long time. The Bank of Japan’s Quantitative and Qualitative Easing program is utterly massive in relation to their economy, so I typically look for any excuse to find patterns that suggest it will go higher. However, as I was looking for said bullish patterns this morning, another pattern caught my eye that could provide impetus for it to stop.

Not only is the USD/JPY near a psychological level of resistance near the 120 level, but there is also a convergence of Fibonacci retracements and extensions there that form a Bearish Gartley pattern. The early USD strength that has proliferated thus far this week has already started to wane in currencies like the GBP/USD, and perhaps that is a sign that it may be time for a little profit taking for the USD bulls. While I’m not convinced that it will be long lasting, perhaps the USD/JPY could take a rest at this level and regroup for another run higher later in the week.

The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase of sale of any currency. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. While the information contained herein was obtained from sources believed to be reliable, author does not guarantee its accuracy or completeness, nor does author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.