![]()

The North American trading session has been underwhelming for stocks and the USD so far as Canadian data has earned a majority of the attention in early trade. The lack of US data points has given way to Canadian GDP which improved 0.3% in the month of December when only a 0.2% rise was anticipated. In addition, the Annualized release that measured Q4 rose 2.4%, beating the 2.0% expected with the previous revised from 2.8% to 3.2%. It turns out the Canadian economy isn’t in as dire straits as many had assumed heading in to 2015 which may cause the Bank of Canada to raise an eyebrow toward the strong performance. Considering the BoC will be making a monetary policy decision tomorrow, this good news couldn’t have come at a more convenient time.

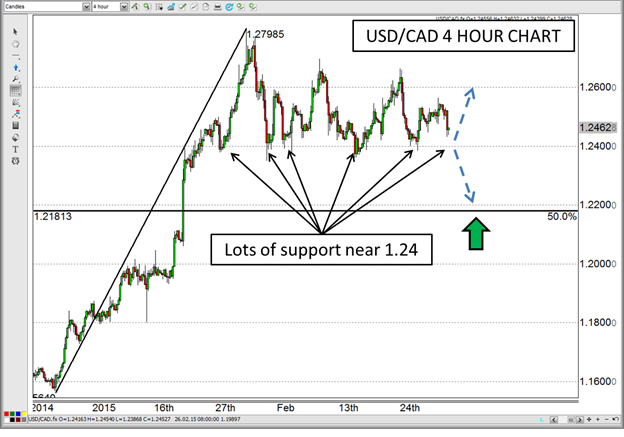

In response to the strong Canadian data, the CAD has improved against virtually all other major currencies, and threatens to challenge a well-supported level in the USD/CAD. However, simply looking at GDP to help determine the path of BoC policy would be a fool’s errand. Besides, that data was from 2014, and we’re already two-thirds of the way though Q1 of 2015, so it’s admittedly a bit crusty. On the other hand, BoC Governor Steven Poloz mentioned in a speech last week that “the downside risk insurance from the interest rate cut buys us some time to see how the economy actually responds.” If we were to read that as a direct statement insinuating what they will do this time around, it appears Poloz is telling us that they want to wait and see what happens; meaning no rate cut this time around.

The problem with expecting no rate cut from the BoC is that the majority of economists expected them to cut rates by another 25 basis points; at least at the end of last week. As we get closer to the decision, the majority has flipped to expect no cut from the institution. This indecision from those who should know best also creates a lot of indecision by investors who rely upon those opinions, which could lead to a lot of action in the CAD over the next 24 hours. The major level of support I mentioned earlier is around the 1.24 handle in the USD/CAD, and could be the major level that indicates what to expect from there. If broken, it could open the floodgates to a further decline as we approach Non-Farm Payroll at the end of the week, but if it holds, the market may just wait until after NFP before picking a side.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.