![]()

Stocks are surging and peripheral bond yields remain muted after the announcement that Greece had finally managed to strike a deal to temporarily extend its bailout late on Friday. However, the EUR has been conspicuous by its absence, and EURUSD is at fresh lows of the day as we progress through the UK morning.

So why is the EUR holding back?

Firstly, the bailout deal reached by the Eurogroup on Friday is only an agreement in principle. Later on Monday Greece’s creditors will review the latest batch of reforms sent through by the new Syriza government at the weekend. Greece has to pass this review, which will be held by the ECB, IMF and European Commission, otherwise the deal is off. The Eurogroup is not as optimistic as the stock market, it has arranged another meeting for Eurozone finance ministers on Tuesday, just in case the reforms are rejected.

As a reminder, without approval, Greece’s bailout will expire on Saturday and Athens will have no source of external financing. As you can see, the FX market seems wise to be wary of this deal until we hear more from the team reviewing Greece’s reform plans.

The dollar:

Aside from Greece there is also some event risk coming from the US this week. Janet Yellen will testify to Congress on Tuesday and Wednesday. All eyes will be on whether she paves the way for a rate hike in June this year, after the Federal Reserve used the term “patience” when it comes to future rate hikes in its last two post-meeting statements. Yellen’s speeches are likely to be a key medium-term driver for the buck going forward.

Potential EURUSD outcomes this week:

If Yellen surprises on the hawkish side and Greece’s reform package is not agreed then we could see EURUSD test the critical 1.10 area. A break below here would be a bearish development that opens the way to parity in the longer term.

If Greece’s reform package passes its creditor review then we could see an upswing in the EUR, as it plays catch up after a muted response to the initial bailout news on Friday. Key resistance lies at 1.1450 – the high from last week – then 1.1679 – the high from 21st Jan.

If Yellen sounds cautious on the prospect of a rate hike during her testimony then we could see the dollar start to wither, which could also add to any EUR upside.

Takeaway:

Greece managed to secure a 4-month extension to its current bailout during Friday’s Eurogroup negotiations.

However, it is only an agreement in principle and its creditors still need to pass Greece’s reform package before the extension is formally agreed.

If the reform package does not get the green light then Greece’s bailout will expire at the end of this week.

The EUR’s reaction to the bailout deal has been cautious, and EURUSD is testing 1.13 support on Monday.

We may not get a sense of the EUR’s next move until we find out the outcome to the Greek reform review and hear from US Federal Reserve Chair Janet Yellen during her Senate testimony on Tuesday and Wednesday.

If the review of Greek reforms ends badly, it could add to the downside pressure on EURUSD and we could see this pair test critical 1.10 support.

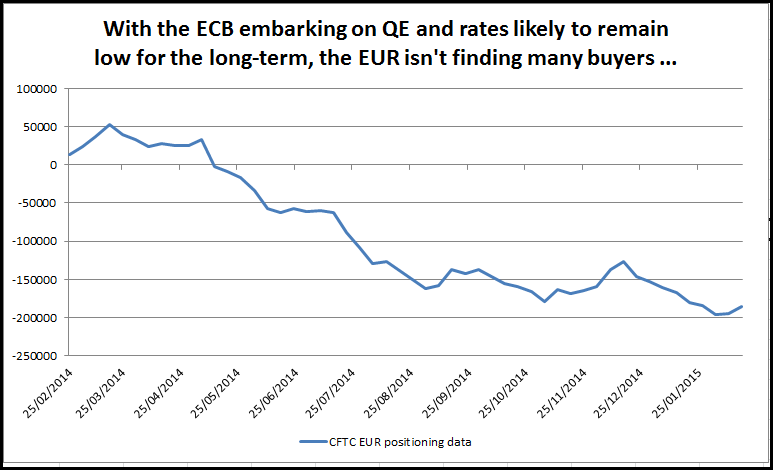

As you can see in the chart below, which shows CFTC positioning data for EURUSD, EUR shorts remain close to their 2.5-year low, suggesting that the market is not interested in buying EUR in this environment of Greek crises, low interest rates and ECB QE. This could limit any upside in EURUSD in the medium-term.

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.