![]()

Today is D-day for Greece, either the Eurogroup agrees to Greece’s request to a 6-month extension to its bailout that expires next week, or it says no. If the answer is no then Greece will have no access to European funding and will at risk from bankruptcy and leaving the Eurozone.

The prospect of a Grexit has been bandied about this week, but as we progress through the London session on Friday it is becoming more of a possibility. A few interesting developments have happened this morning:

1, The Eurogroup finance ministers meeting has been pushed back. The head of the Eurogroup, Jeroen Dijsselbloem, will release a statement at 2pm London time. The meeting will now start at 3.30pm London time, with a statement to come later, potentially after the NY close at 2200 GMT.

2,The Maltese finance minister said that the “German-led” bloc in the Eurozone is willing to let Greece leave the Eurozone. A German paper also said that the ECB is running contingency scenarios for a Greek exit.

3, Greece has a movable public holiday scheduled for this Monday – 23rd February – which could give the Greek central bank time to print drachma…

This situation remains changeable, but we do expect a binary outcome from this meeting – either Greece gets its money and stays in the Eurozone, or it doesn’t and it leaves. We would want to hear from the main players – Dijsselbloem, German officials or Greece – before we accept that Germany is willing to cut Greece out. However, Germany’s unwillingness to consider Greece’s last minute bailout proposal on Thursday suggested to us that Berlin could be willing to let Greece leave rather than negotiate a new deal that would cost political capital with German taxpayers.

As we have said before, although a Grexit would unleash a wave of uncertainty into the market, now could be as good a time as any to cut Greece loose, because:

1, The ECB has embarked on QE, which could protect the rest of the currency bloc from excess volatility in the event of a Grexit.

2, Contagion has been limited so far: even though Greece’s position within the currency bloc is probably the most vulnerable it has ever been, other peripheral nations have been unaffected. Spanish and Italian bond yields continue to trend near their lowest ever levels.

3, Growth: the latest PMI data, released earlier on Friday, showed the service sector in the Eurozone is picking up strongly, particularly in France and Germany, which helped to push the Eurozone’s composite PMI for January back to its highest level since mid 2014.

As we lead up to the Eurogroup meeting, a couple of potential scenarios to ponder:

No deal for Greece – the can is kicked down the road again: this could trigger a small sell-off in the EUR and in European stocks, but the market would most likely focus on the next deadline.

No deal for Greece – Grexit on the cards: This would be the most risk averse announcement, we could see EURUSD tumble below 1.10 and move back towards parity. Stocks may also sell off sharply.

Greece secures a bailout extension: This is the most risk positive outcome. We would expect to see the EUR and European stocks to rally. Greek assets could also outperform.

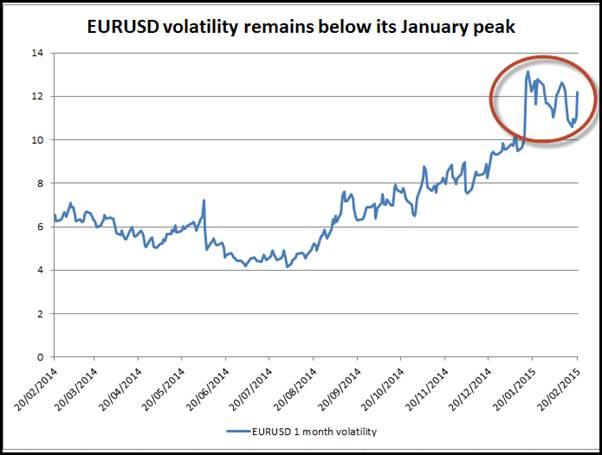

Overall, the Greek situation remains changeable, and the outcome of today’s Eurogroup meeting will be pivotal. Interestingly, EURUSD is still moving in a relatively tight range ahead of the meeting, however, volatility in EURUSD has started to pick-up, although it remains below the January high. We think that the market may be too complacent about the risks of a Grexit in the coming days, and there is a chance that volatility could jump, so make sure that you are prepared.

Takeaway:

Friday’s Eurogroup meeting is make or break for Greece.

There are signs that Germany would be ok with a Grexit, and the ECB is making contingency arrangements.

Is this such a bad time for a Grexit?

The market could be under-pricing the prospect of Grexit, EURUSD volatility remains below its January peak.

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

AUD/USD dips below 0.6600 following RBA’s decision

The Australian Dollar registered losses of around 0.42% against the US Dollar on Tuesday, following the RBA's monetary policy decision to keep rates unchanged. However, it was perceived as a dovish decision. As Wednesday's Asian session began, the AUD/USD trades near 0.6591.

EUR/USD edges lower to near 1.0750 after hawkish remarks from a Fed official

EUR/USD extends its losses for the second successive session, trading around 1.0750 during the Asian session on Wednesday. The US Dollar gains ground due to the expectations of the Federal Reserve’s prolonging higher interest rates.

Gold wanes as US Dollar soars, unfazed by lower US yields

Gold price slipped during the North American session, dropping around 0.4% amid a strong US Dollar and falling US Treasury bond yields. A scarce economic docket in the United States would keep investors focused on Federal Reserve officials during the week after last Friday’s US employment report.

Solana FireDancer validator launches documentation website, SOL price holds 23% weekly gains

Solana network has been sensational since the fourth quarter (Q4) of 2023, making headlines with a series of successful meme coin launches that outperformed their peers.

Living vicariously through rate cut expectations

U.S. stock indexes made gains on Tuesday as concerns about an overheating U.S. economy ease, particularly with incoming economic reports showing data surprises at their most negative levels since February of last year.