![]()

Another day, another decade high in the dollar. It’s business as usual for the world’s reserve currency today, led by dollar strength against the Japanese yen and commodity dollars. Perhaps the most salient catalyst for today’s wave of dollar strength has been concern about the world’s second-largest economy, China. Overnight, government data showed that China grew at an as-expected 7.3% annualized rate in the fourth quarter, but it’s important to note that this is the slowest rate of expansion for China in 24 years! Combined with the IMF’s downgrade to Chinese growth expectations (to 6.8% in 2015 and just 6.3% in 2016), FX traders have punished currencies dependent on continued growth in the Middle Kingdom.

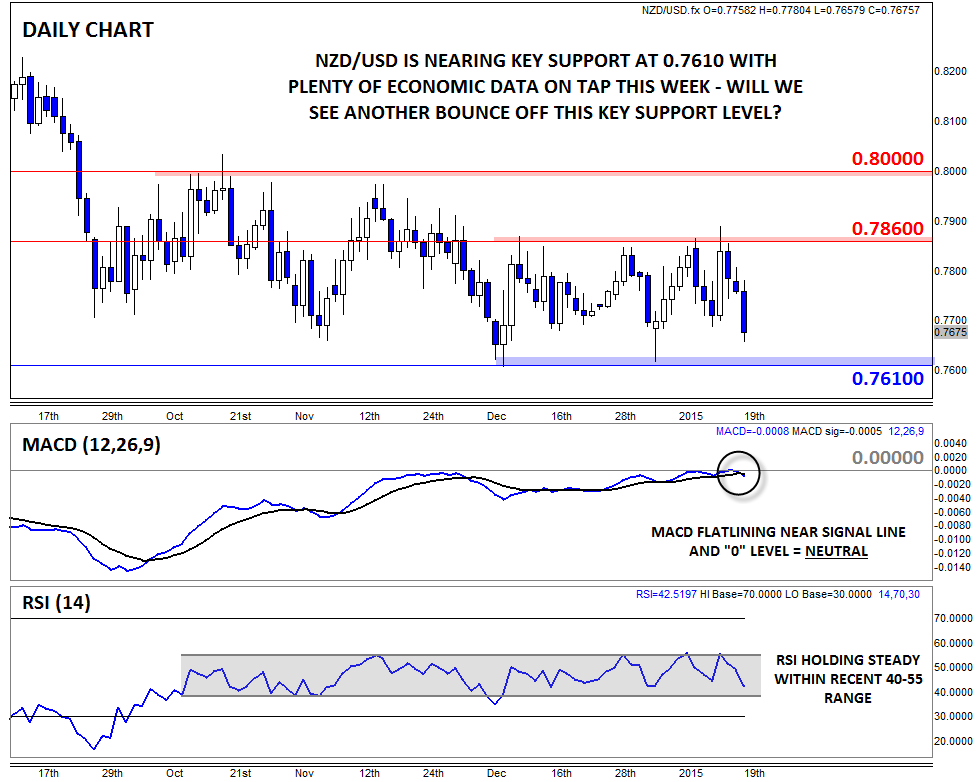

One such currency is NZDUSD, which has been consolidating within a tight 400-pip 0.7610 to 0.8000 range over the last four months; the range has been an even more compact 250 pips (0.7610-0.7860) since the start of December. As of writing, the kiwi is dropping down to test the bottom of that range under 0.7700. Meanwhile, the secondary indicators are generally neutral, with the MACD indicator trading level with its signal line and the “0” level, while the pair’s RSI remains trapped within its own 40-55 range.

Though trade in NZDUSD has been lackluster of late, a breakout is growing increasingly likely. From a fundamental perspective, there surfeit of data on tap over the rest of the week, including NZ CPI (later today), US building permits and housing starts (tomorrow), NZ manufacturing data and US initial unemployment claims (Thursday), and Chinese PMI and US existing home sales (Friday), to say nothing of possible spillover from Thursday’s highly-anticipated ECB meeting. As long NZDUSD holds above 0.7610, a bounce is favored this week, but if that key floor gives way, bears may start to turn their eyes down toward the key psychological level at .7500 or previous support around .7400. Either way, traders should have a lot more clarity on where NZDUSD is heading soon.

Source: FOREX.com

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.