![]()

It’s been a bad first half of the day for European indices, with a sea of red across all European markets. The FTSE 100 has managed to fare the best, it is currently down 0.8%, which compares with a 1.75% fall for the FTSE MIB in Italy and a 1.14% decline for the Eurostoxx index.

Interestingly, the drop has been across the board, with traditionally defensive sectors, which should do well during times of market panic, such as the healthcare and consumer staples sectors, also coming under pressure. The energy sector is also lower today; however it is the second best performing sector after utilities as some investors try to pick up bargains after sharp falls for the oil majors.

Why the oil price decline is not having a positive effect

The airline sector has also come under pressure today with IAG and Easyjet both falling more than 2%. But falling fuel costs should surely be good news for airlines, right? Well yes, and no. In the current environment of very weak inflation in the UK, corporations’ pricing power could be eroded, which may hit profits down the line. So, even though falling oil prices can save on the costs front, it doesn’t necessarily mean that profits will surge.

Tuesday’s inflation report from the UK suggested that it’s not only oil price declines that are weighing on the CPI rate. Price declines for November, when the CPI fell to its lowest level for 12 years, were also noted across the transport sector, including air transport, and in the prices of recreational and cultural goods. Food and energy prices were the largest downward contributors to the CPI rate; however, lower prices are becoming more broad-based, which is starting to spook investors.

Surely the consumer can save the FTSE 100?

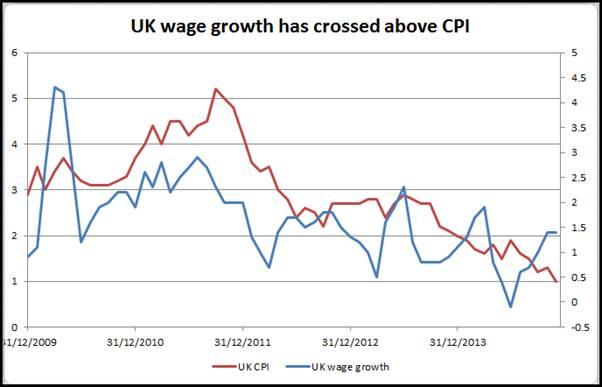

Falling prices and rising wages are surely a boon to a consumer-focused economy like the UK? Well, yes and no. Rising wages, for November wages rose to 1.4%, the second straight month when wage growth was above inflation (see fig 1), could actually cause the BOE to hike interest rates sooner than the market expects. With a potential rate hike looming on the horizon we could see shoppers embark on some belt-tightening for the first few months of 2015.

In conclusion, the oil price decline may not be such a good thing for stocks in the long-term if it starts to erode companies’ pricing powers. This could weigh on the FTSE 100 as we move into 2015. In the short term, however, the FTSE 100 is likely to be driven by external factors like the outcome of today’s FOMC decision, and whether panic in emerging markets starts to spook developed market investors as we move towards the Christmas holidays.

Takeaway:

UK stocks are under pressure on Wednesday.

The sell-off has been broad-based, and even traditionally defensive sectors like healthcare and consumer staples are coming under pressure.

This could be down to the fall in UK inflation.

CPI for November saw broad-based declines, suggesting that the decline in UK CPI is not only down to the oil price.

This could erode corporate pricing power going forward, which could hit profits.

If inflation stays low for the long-term then we could see stocks remain under pressure.

In the short term, the FOMC decision and overall market sentiment could drive the FTSE 100.

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.