![]()

While many US traders are anxiously watching the status of their flights on the biggest travel day of the year, European traders have seen a bit of turbulence in today’s European session. First, traders got a glimpse of the revision to Q3 UK GDP, which came out at 0.7% q/q as expected, marking the 6th consecutive quarter this specific reading has been 0.7% or 0.8%. While some of the report’s details were less-than-stellar, traders have taken this reading as a green light to push the pound higher, and the widely-watched GBPUSD has now broken above the top of its 2-week range at 1.5735 to trade up to a high of 1.5770 so far.

The news on the other side of the English Channel was more ambiguous. Sending the strongest signal yet, ECB Vice President Vitor Constancio explicitly stated that the central bank is prepared to start buying sovereign bonds in Q1 of next year if inflation fails to rise meaningfully. This is the first time that a high-ranking ECB official has highlighted a specific time period for enacting a full-blown QE program, and European sovereign bond yields have reached all-time record lows as a result, though the reaction in the forex market has been more limited.

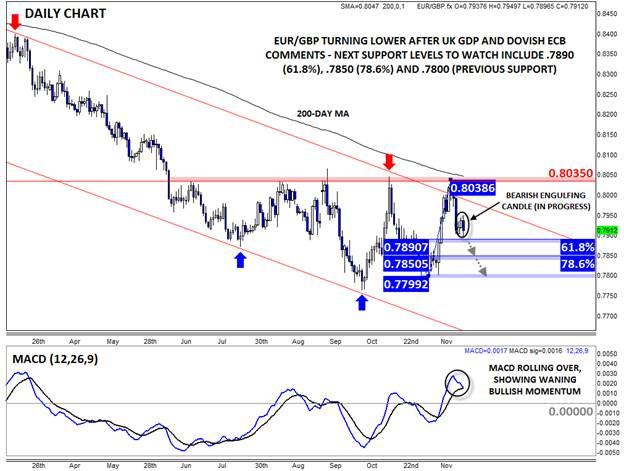

Technical View: EURGBP

The clearest way to see how these two economic developments are interacting is through EURGBP. After turning lower horizontal resistance and the top of its bearish channel near .8000 last week (see my colleague Fawad Razaqzada’s EURGBP note from last week for more), rates stabilized off the .7900 level early this week. However, today’s data has pushed the pair back lower, undoing the bounce from the first two days of the week and forming a (unfinished) Bearish Engulfing Candle*. For the uninitiated, this candlestick pattern shows a shift from buying to selling pressure and raises the probability of a continuation lower later this week. At the same time, the pair’s MACD is rolling over and on the verge of crossing below its signal line, suggesting that bearish momentum may soon return.

Assuming EURGBP finishes today below .7917, the bias will remain lower in EURGBP. From here, bears may start to target the Fibonacci retracements of November’s bounce, including .7890 (61.8%, .7850 (78.6%) and .7800 (previous support). Meanwhile, even if rates do recover today, the medium-term bias will remain to the downside as long as the pair stays within its bearish channel (below ~.8000).

This research is for informational purposes and should not be construed as personal advice. Trading any financial market involves risk. Trading on leverage involves risk of losses greater than deposits.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.