![]()

The EUR/USD has dropped sharply in the past hour or so and is in danger of resuming its long-term downward trend. Not only has it come under pressure from technical selling, but there’s also some fundamental news behind this latest move. According to a Reuters report, which cites “several sources familiar with the situation”, the European Central Bank is considering buying corporate bonds on the secondary market. The report suggests the ECB may decide on the matter as soon as December and begin purchasing early next year. Of course, the ECB has already started buying covered bonds as of yesterday, but expanding its asset purchases programme to include corporate bonds, which are much riskier, would mark a significant expansion in its already ultra-loose monetary policy stance. If the report is confirmed, the euro could come under increased pressure.

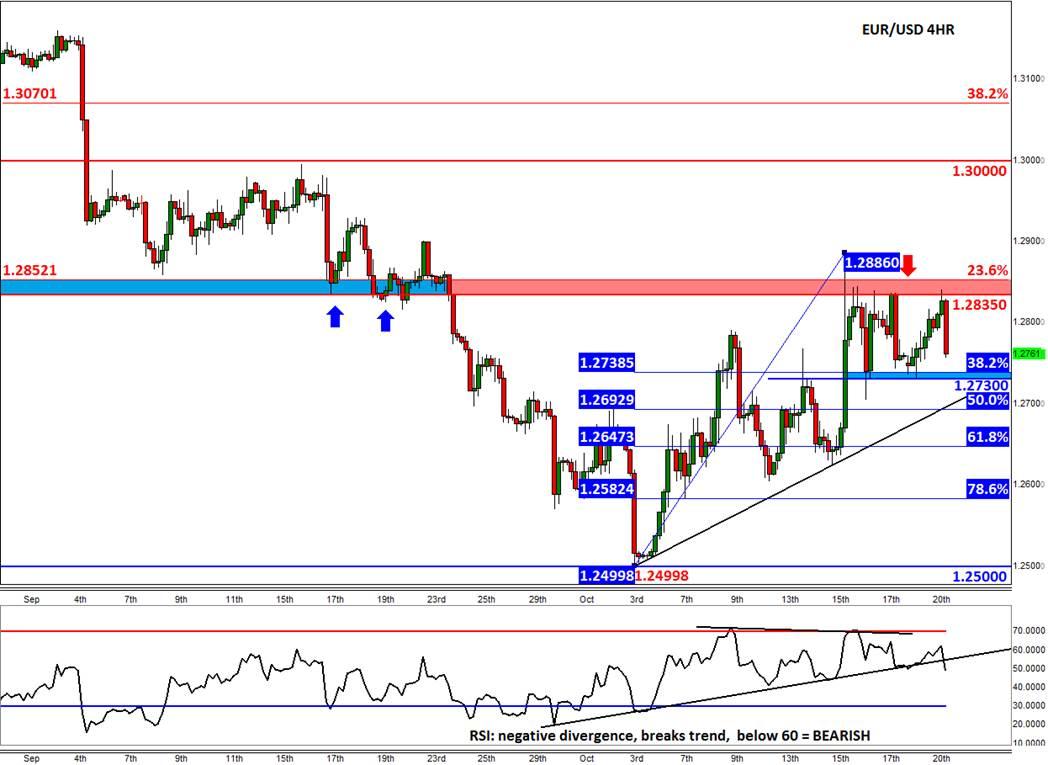

Now that the euro had had a decent bounce back, it may be a good time for its downward trend to resume – especially against the dollar, with the US central bank on course to end its own QE programme at the end of this month and raise interest rates next year. If the EUR/USD’s kick back rally that started from the psychological 1.2500 support does end here, it would be a significantly bearish outcome. That’s because it would have not even had a 38.2% retracement from its May peak (~1.4000). So far, it has only retraced to the 23.6% Fibonacci level at 1.2850 where it has come under additional pressure from the past price reference point, namely at 1.2835.

The downward move could accelerate if and when the EUR/USD breaks below a short-term upward trend around 1.2700. There are obviously a few important intra-day support areas to watch now, with the first one coming in around 1.2730/40, which, as can be seen on the chart, is also a Fibonacci-based level. So, there is still a good chance the EUR/USD may bounce back and push through the 1.2835 resistance level and head sharply higher. However the odds are stacked against the bulls, with the ECB’s on-going interventions, weaker Eurozone data and better fundamental developments in the US all likely to weigh on this pair. Meanwhile the Relative Strength Index (RSI) is bolstering the bearish argument. Not only has it recently created a negative divergence with the underlying EUR/USD prices (i.e. the EUR/USD created a higher high while the RSI made a lower low), it has also broken its own uptrend and is now below the key 60 level.

But in the absence of any major European data today or tomorrow, the potential downward move could be limited. That said, we do have some key data out of the US to look forward to. Existing home sales for September will be published at 14:00 GMT today, which are expected to have climbed to 5.11 million annualised units from 5.05m the month before. The more important inflation data will come out tomorrow at 12:30 GMT, with the CPI seen flat and core CPI up 0.2% month-over-month.

Trading leveraged products such as FX, CFDs and Spread Bets carry a high level of risk which means you could lose your capital and is therefore not suitable for all investors. All of this website’s contents and information provided by Fawad Razaqzada elsewhere, such as on telegram and other social channels, including news, opinions, market analyses, trade ideas, trade signals or other information are solely provided as general market commentary and do not constitute a recommendation or investment advice. Please ensure you fully understand the risks involved by reading our disclaimer, terms and policies.

Recommended Content

Editors’ Picks

How will US Dollar react to April jobs report? – LIVE

Following the Fed's policy announcements, market focus shifts to the April jobs report from the US. Nonfarm Payrolls are forecast to rise 238K. Investors will also pay close attention to revisions and wage inflation figures.

EUR/USD clings to gains near 1.0750 ahead of US jobs report

EUR/USD clings to modest gains at around 1.0750 after closing the previous two days in positive territory. Investors eagerly await April jobs report from the US, which will include Nonfarm Payrolls and Unemployment Rate readings.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2550 amid the softer US Dollar on Friday. Market participants refrain from taking large positions as focus shifts to April Nonfarm Payrolls and ISM Services PMI data from the US.

Gold remains stuck near $2,300 ahead of US NFP

Gold price struggles to gain any meaningful traction and trades in a tight channel near $2,300. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support to XAU/USD ahead of the key US NFP data.

XRP edges up after week-long decline as Ripple files letter in reply to SEC’s motion

Ripple filed a letter to the court to support its April 22 motion to strike new expert materials. The legal clash concerns whether SEC accountant Andrea Fox's testimony should be treated as a summary or expert witness.