![]()

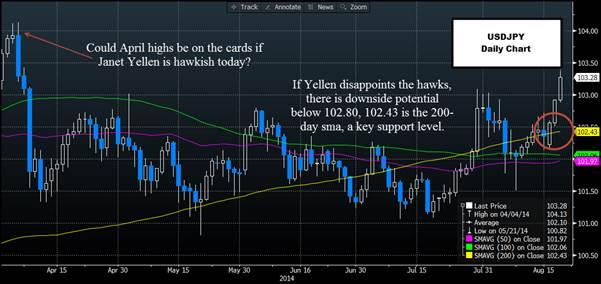

From a market perspective, the dollar is rallying into her speech, so could we be in a situation where we buy the rumour but sell the fact? What Yellen says is out of our control completely, so the best way to plan for the outcome is to flesh out a couple of potential scenarios. We will focus on USD/JPY as this pair can be sensitive to changes in monetary policy.

1, Yellen is hawkish – talks about monetary policy tightening

This would be quite a departure for Yellen, who is considered dovish, and would be the most dollar positive outcome in our view. The dollar index could make fresh annual highs and USDJPY could re-test critical resistance at 104.13 – the high from 4th April, opening the way for a further advance back to 105.00.

2, Yellen is dovish – does not mention tightening or normalisation of monetary policy

Yellen tends to err on the side of caution when she makes speeches, and if she avoids the issue of tightening today this could trigger big disappointment in the markets and a potential sell off in the dollar. The result could be a recovery in the yen, sending USDJPY back down to the 101.50 lows from last month.

Another potential scenario to keep in mind is a vague Yellen. If she suggests that monetary policy needs to be normalised but does not elaborate on the Fed’s plans to do this then we could see some whipsaw action. Once the dust has settled then we could see the dollar trade sideways for a while.

What to do:

You could either try to pre-empt what Yellen is going to say (bad idea) or wait for the dust to settle and then make your move. Waitiing for a technical event is another option, what is sometimes called a break-out strategy. This can work well when there is an event risk that could potential trigger a new trend. There are three steps to this:

1, Assess where the market is now.

2, Decide an upside breakout level that could trigger further gains if Yellen is hawkish.

3, Decide on a downside breakout level to trade a weaker USDJPY, if Yellen is dovish.

The technicals:

Upside breakout level: 103.50, above here opens the way to 104.13 – April 4 high, then 104.92 – the high from January 16, then 105.44, the 2nd Jan high.

Downside breakout level: 102.80 – just below the 61.8% Fib retracement of the April- May sell off at 102.87. Below here opens the way to 102.52 – August 19 low, then 102.14 – low from August 15 and 101.51 – August.

Overall, this methodical way of trading key event risk, and could be critical to your trading success. Good luck.

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.