![]()

The markets are mostly comatose today as we wait for the FOMC minutes this afternoon. Until then we think that tight ranges will prevail. While it is always a tough call to predict anything that comes out of the Fed, we think that, on balance, the message could be less dovish than recent statements.

We think the minutes could trike a more neutral tone compared with Yellen’s dovish press conference last month, which may not represent all views on the FOMC right now. Richmond Fed President Lacker, said in a speech earlier this week that recent inflation data is not entirely “noise” in reference to Yellen’s comment that rising prices would not last. Although a non-voter, his view could be shared by the more centrist members of the FOMC who are starting to signal that they are getting concerned about price pressures.

Even the markets seem to think that Fed governor Yellen is wrong, the 2-year Treasury yield, which is a good representation of market expectations for interest rates, rose close to a 3-year high after the large gain in payrolls for June.

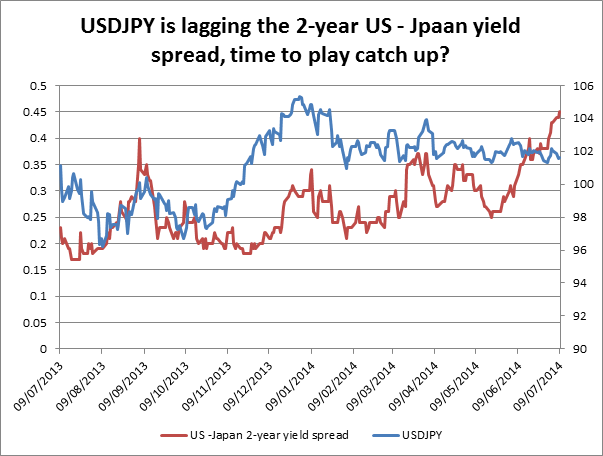

USDJPY is always our one to watch when it comes to the Fed as it tends to move in line with US Treasuries. We think that USDJPY could be a big mover later today because:

1. If the minutes are less hawkish than expected, we could see 2-year Treasury yields surge above the September high, which could put upward pressure on USDJPY.

2. USDJPY also has a strong correlation with the Nikkei, which has been under pressure from the sell-off in global stock markets in recent sessions. However, if US stocks can recover on the back of a good start to earnings season, this could also boost USDJPY’s immediate prospects.

3. One reason for Tuesday’ sell off in USDJPY was down to some JPY repatriation flows ahead of Typhoon Neoguri. The Typhoon has started to lose power, and so far, the damage done was not great. This could limit safe haven flows in the yen, and also add to USDJPY upside.

The technical view:

While the fundamental picture may be starting to get more USDJPY positive, the technical picture remains firmly neutral. A daily close above 101.85 – the 200-day sma, could open the way back to 102.27 – the 3rd July high, ahead of 103.02, the May extreme. In the short-term, these are key obstacles that could thwart USDJPY’s attempts to break out of this range. On the downside, if the minutes are not as neutral as we expect, then the focus could shift to resistance at 101.24 – the June 30th low, and a key resistance level that dates back to March. Below here could open the way to 100.76 – the February low.

Market outlook:

Ahead of the minutes, any move back to 101.45 – Tuesday’s low - could be faded by the market, with short term resistance at 101.75, for the very short-term trader. For those who would prefer a mini-breakout before going long, then a clear break, and daily close, above 101.85 – 200-day sma – is worth watching out for as this could trigger further upside back to the May highs.

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.