The FX market has failed to grab the headlines of late as stocks and earnings season hog the limelight. However, some interesting developments are taking place that are worth noting. In EURUSD two key things are worth pointing out:

Spain managed to sell 10-year debt at a record low of 3.05% on Thursday .

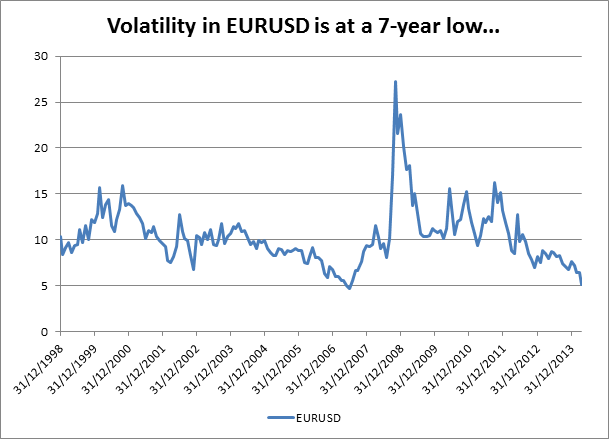

EURUSD volatility (measured using 1-month options) has fallen to its lowest level since 2007.

Why the drop in volatility?

There could be two reasons for this:

1, the sovereign debt crisis is considered over by the markets, which has reduced expectations of a dramatic sell off in the single currency. Hence the ease with which peripheral nations can sell debt.

2, the market is expecting the ECB to embark on QE, which can dampen FX volatility. This happened to the dollar in 2009 when the Fed started its asset-purchase programme. Volatility in USDJPY dropped over 60% from the credit-crunch peak in 2008 to 2009. As the Fed has embarked on further rounds of QE, USDJPY volatility has continued to moderate.

All eyes on the ECB

If QE tends to dampen FX volatility then the future direction of the EUR could be dependent on the ECB actually cranking up the printing presses. Although the ECB has hinted at the prospect of QE for the currency bloc, the head of Europe’s central bank has one of the best poker faces around. He managed to quell the sovereign crisis in 2012 by simply saying he would do “whatever it takes” without actually spending one euro in the process. However, with inflation falling to a 5-year low, there is more pressure on the ECB to take action. Next week’s April inflation reading could be crucial.

At this stage, QE from the ECB is not a given, and we still think it could be some way off due to the complexity of managing QE for a currency union. However, if the fall in volatility is a sign that the market is pricing in QE, then if Draghi and co. choose to sit on their hands at the May meeting we could see fireworks in the FX market.

How does volatility affect a currency?

Volatility does not impact the direction of a currency; instead it impacts the size of price movements. When volatility is high it means there can be large price swings on a frequent basis. When price swings are large this can trigger changes in trends and potential opportunities in the FX market. Conversely, when volatility is low, price tends to move in a narrow band, and you may not see as many changes in trend. Instead prices can meander along in frustrating ranges, which we have seen in EURUSD for most of this year.

If Draghi does not deliver the QE goods at the ECB’s next meeting on 8 th May, then we could see volatility pick up, which could help EURUSD break out of its range. If Draghi fails to announce QE this could trigger a rally in the EUR, and EURUSD may see back to 1.40. In contrast, if he does announce QE then the markets may sell EUR aggressively, causing volatility to jump.

Technical picture:

EURUSD has been trading in a fairly tight range in the past month as volatility has moderated, between 1.3673 on the downside and 1.3906 on the upside.

A break of 1.3664, the 61.8% Fib retracement of the March advance, would be a bearish development.

In the short term, an incremental support is 1.3817; the top of the daily cloud, below here suggests the end of a technical uptrend.

On the upside, above 1.3906, the April 11 th high, may open the way to 1.3967 – the March 13 th high.

Takeaway:

Volatility in EURUSD has fallen to its lowest level since 2007.

This is one reason why EURUSD has traded in such a tight range so far this year.

When volatility falls to multi-year lows watch out, periods of low volatility don’t last forever.

The ECB could trigger higher volatility in this pair at its next meeting. If it fails to deliver QE then we could see EURUSD break to the upside, while an announcement of QE could trigger a wave of EUR selling.

Figure 1:

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.