The S&P 500 looks set to open lower today. Given that this morning’s earnings results have been mostly better than expected and the fact that there was some mixed-bag data from Asia and Europe overnight, the weakness can at least be partly blamed on profit-taking. Indeed with shares on Wall Street rallying in each of the last six trading days, the odds for a pullback of some sort is correspondingly increasing each day. Also weighing on investor sentiment is renewed concerns over Ukraine where tensions have not de-escalated despite last week’s Geneva accord. Ukraine has accused pro-Russian activists of torturing Ukraine citizens and shooting at a jet. If the situation there were to deteriorate further then that may cause investors to retreat from riskier assets once again.

Overnight, although the latest reading on HSBC’s PMI survey on Chinese manufacturers climbed to 48.3 from 48.0 in March, this was still below the expected increase of 48.5. But the results of the April eurozone PMIs were better than expected: the headline services sector PMI rose to 53.1 from 52.2 last month while the manufacturing PMI edged up to 53.3 from 53.0 previously. Significantly it was Germany, the euro area’s economic powerhouse, where private sector activity accelerated most notably, with both of its sector PMIs hitting two-month highs. The French PMI readings, which had come out earlier in the day, were below expectations however. Meanwhile ahead of the US data, we saw earnings from Boeing, Dow Chemical and P&G all come out better than expected. But the major US index futures hardly reacted and remained near their lows. The Flash US manufacturing PMI, due at 14:45 BST (10:45 EDT) is expected to have edged up at the start of April to 56.2 from 55.5 in March. Sales of new homes, due at 15:00 BST (11:00 EDT), is likewise expected to have increased last month to 455,000 annualised units from 440,000 in February.

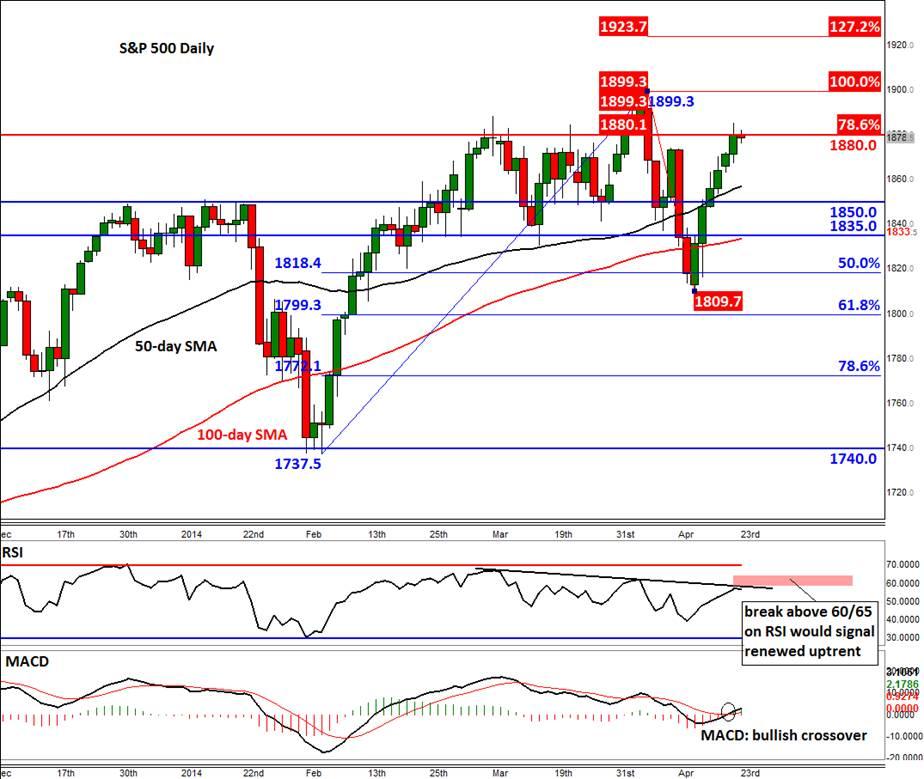

Technical outlook

On the technical front, the S&P 500 yesterday closed at just shy of the key 1880 mark despite trading above it earlier in the session. This was previously a key resistance level and was finally taken out at the start of this month. However the index failed to hold above there and this caused the bulls to flee the market en masse, leading to a sharp sell-off that eventually ended at 1810. Now that we are back at this level, the bulls are once again being hesitant. What’s more, the 78.6% Fibonacci retracement level of this month’s sell-off also comes in at 1880. But a crossover on the daily MACD is a bullish development. Meanwhile the Relative Strength Index (RSI) is approaching a bearish trend line. If the RSI is able to break above it and also the 60/5 area then it would signal renewed upward trend. This could occur in advance of the S&P breaking its previous record high of around 1900. If so, it would signal that we may see further fresh record highs soon with the next logical target being 1923/5 which is the 127.2% Fibonacci extension level of the aforementioned swing.

Trading leveraged products such as FX, CFDs and Spread Bets carry a high level of risk which means you could lose your capital and is therefore not suitable for all investors. All of this website’s contents and information provided by Fawad Razaqzada elsewhere, such as on telegram and other social channels, including news, opinions, market analyses, trade ideas, trade signals or other information are solely provided as general market commentary and do not constitute a recommendation or investment advice. Please ensure you fully understand the risks involved by reading our disclaimer, terms and policies.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.