![]()

US stock index futures gapped lower overnight in response to the escalation of the crisis in Ukraine and continued profit-taking ahead of a busy corporate earnings week. However the futures have since risen sharply and at the time of writing they are near the session highs. European markets have also managed to relinquish their earlier losses. It looks like sentiment has turned positive on the back of some better than expected US retail sales figures and Citigroup’s first quarter earnings results. The prospects of further stimulus from the ECB have also soothed the nerves – for now anyway.

Retail sales in the US rebounded a good 1.1% in March after the extreme cold weather had caused sales to stagnate in the first three months of the year. Core sales also rose sharply, by 0.7%, after increasing 0.3% the month before. As both measures easily beat expectations, stock index futures and the dollar both extended their gains. This strong rebound in sales is exactly what most people were hoping for; it suggests economic activity was indeed held back by the cold weather and the dip was probably only temporary. On top of this, consumer confidence has already risen to its highest level since July last year, according to the UoM, as we found out on Friday. As a result, investors may not read too much into individual retailers’ earnings, in particular, now. However these are just a couple of good economic pointers so we do need to see more of the same going forward for sentiment to turn decidedly bullish once again.

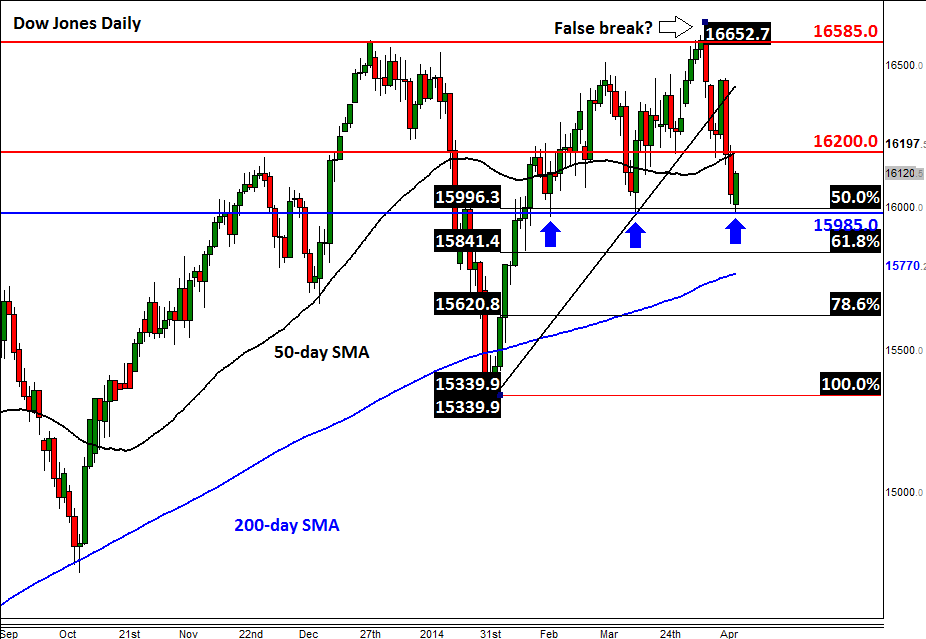

The rebound looks partially technically-driven, too, as evidenced by the daily chart of the Dow, below. As it can be seen, the index has again bounced around the key 15985 support level as it did on previous occasions. This level also corresponds with the 50% retracement level of the last upswing. Thus if this turns out to be just a technical bounce then we could well see further losses – just as we did after the index momentarily found support at 16200 during the middle of last week. Meanwhile this 16200 level could turn into resistance now. It is worth noting that the 50-day moving average also comes in at 16200 so it is definitely worth watching on the upside. However it the index breaks above here then I wouldn’t be surprised if it goes on to revisit the record high of around 16650 it achieved just a couple of weeks ago. On the downside, the next potential support level is at 15840/5 which ties in with the 61.8% Fibonacci retracement level. Beyond that is the 200-day moving average, at 15770.

Trading leveraged products such as FX, CFDs and Spread Bets carry a high level of risk which means you could lose your capital and is therefore not suitable for all investors. All of this website’s contents and information provided by Fawad Razaqzada elsewhere, such as on telegram and other social channels, including news, opinions, market analyses, trade ideas, trade signals or other information are solely provided as general market commentary and do not constitute a recommendation or investment advice. Please ensure you fully understand the risks involved by reading our disclaimer, terms and policies.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of US jobs report

EUR/USD stays in a consolidation phase above 1.0700 after closing the previous two days in positive territory. Investors eagerly await April jobs report from the US, which will include Nonfarm Payrolls and Unemployment Rate readings.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2550 amid the softer US Dollar on Friday. Market participants refrain from taking large positions as focus shifts to April Nonfarm Payrolls and ISM Services PMI data from the US.

Gold remains stuck near $2,300 ahead of US NFP

Gold price struggles to gain any meaningful traction and trades in a tight channel near $2,300. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support to XAU/USD ahead of the key US NFP data.

XRP edges up after week-long decline as Ripple files letter in reply to SEC’s motion

Ripple filed a letter to the court to support its April 22 motion to strike new expert materials. The legal clash concerns whether SEC accountant Andrea Fox's testimony should be treated as a summary or expert witness.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The NFP report is expected to show that the US economy added 243,000 jobs last month, sharply lower than the 303,000 job creation seen in March. The Unemployment Rate is set to stay unchanged at 3.8% in the same period.