It was a case of sell the rumour buy the fact for financial markets after the referendum in Crimea at the weekend, which saw Crimeans overwhelmingly vote to re-join Russia. Anticipation of the vote hurt market sentiment last week and the Eurostoxx index dropped 5% after the US and Europe said the vote would be illegal; however, the markets have been fairly sanguine now that it has taken place.

Toothless Russia sanctions helps boost sentiment

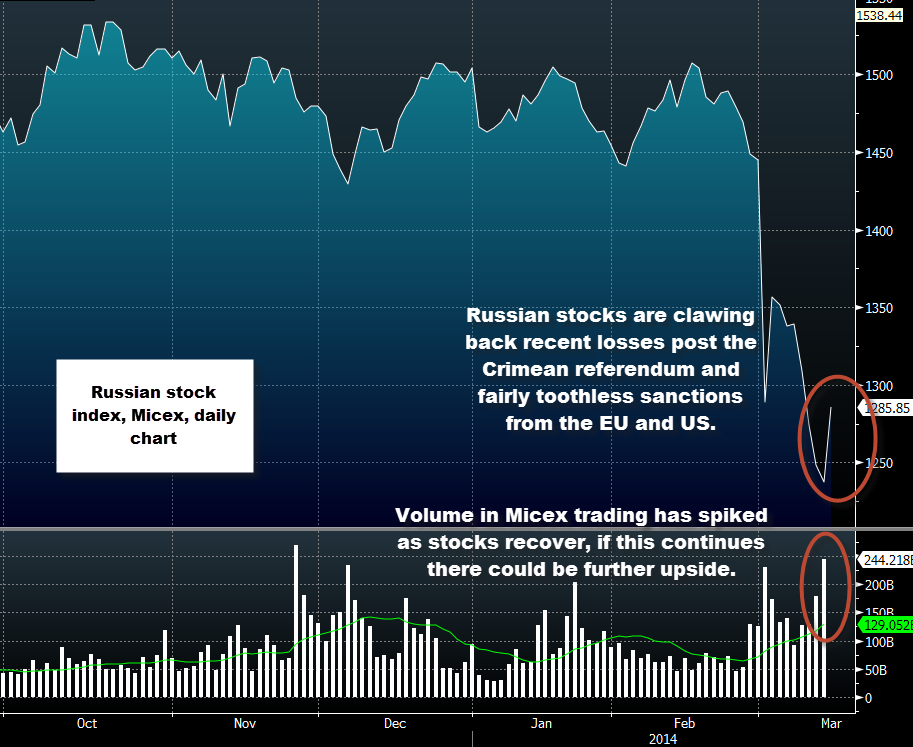

Perhaps sentiment has been boosted by the fairly toothless EU and US sanctions imposed on Russia as a result of the referendum taking place. EU officials met earlier to discuss ways to punish the government, without hurting Russian business, which seems to have calmed the markets; hence the RUB and Russian stock market have managed to bounce off of last week’s lows. EU and US officials agreed travel bans and asset freezes on 2`1 individuals linked the Russian takeover of Crimea. So far the sanctions seem fairly toothless and much less severe than shad been expected last week, this is one factor behind the relief rally in Russian assets on Monday.

Markets should not get complacent

However, while the markets may feel that the immediate political risks emanating from the Russia/ Ukraine tension are receding, there are still plenty of dangers. The Crimean parliament announced on Monday that it would declare itself an “independent sovereign state” and asked to be incorporated back into Russia, which looks deliberately provocative from my perspective. But for now, this is not denting sentiment on St Patrick’s Day trading.

From the market’s perspective, the biggest risk was that the referendum would trigger tough sanctions against Russia that could lead to another Cold War; this is what weighed on sentiment last week. However, now it looks like sanctions may be harder to impose after all since Spain, Greece, Cyprus, Portugal and Italy all expressed caution at threatening Russia. This highlights how difficult it can be for the EU to get 28 nations to agree to one set of sanctions. Thus, as things stand now, the risks from the region have been reduced as EU sanctions seem fairly toothless and unlikely to provoke a response from the Kremlin, hence stocks are rallying in the US and Europe and gold is giving back some recent gains.

Tail risks getting thinner

We doubt the markets will forget about the crisis entirely, and they are likely to continue to price in the tail risk of a Cold War event from happening, although that tail has become thinner since last week. Instead, some new risks are on the horizon – 1, what will the ECB do if EURUSD continues to strengthen and 2, what can we expect from Janet Yellen’s first press conference as Fed Governor on Wednesday.

EUR: is 1.40 the ECB’s line in the sand?

The EUR has rallied today and reached a high of 1.3944 even though the February CPI figure was revised down to 0.7% from 0.8%, still too close to deflationary territory for comfort. The EUR has secured its position as the Teflon currency of the G10, managing to hold onto recent strength even though inflation remains weak and the ECB President Draghi decided to unexpectedly talk down the currency last week. It is worth noting that Draghi’s comments that the strengthening EUR was concerning coincided with EURUSD hitting 1.3967 – the highest level since September 2011. This suggests that 1.40 could be a line in the sand for some members of the ECB, and if we break above this level in the short-term then we could see ECB verbal intervention to limit EUR upside start to become more frequent, potentially something the EUR bulls can’t just ignore.

Dollar approaches key support

But EURUSD has also received a boost from a weak dollar, which has been tumbling in recent sessions on the back of some weak US economic data. There was some more data disappointment today when the Empire manufacturing survey and NAHB housing market index both missed expectations for March, and although industrial production beat expectations the data suggests that Q1 was weak for production overall. This has weighed on the Dollar index; it is worth watching the dollar vs. its major trading partners, as it approached the 12-month low at 78.99, a key support level. If the buck falls through this level, there could be further weakness to come, which could trigger further EUR upside.

The second point is Yellen, who hosts her first press conference as Fed Governor this Wednesday at 1830 GMT/ 1430 ET. Will she show her dovish credentials, or will she reflect the more hawkish members who joined the Fed at the start of this year? The market is expecting a fairly neutral conference from Yellen and expects her to confirm the Fed’s commitment to tapering $10bn per month. If the recent weakness in the data causes the Fed to slow the pace of tapering that could cause another steep fall in the dollar as it would take the market by surprise. Likewise, a hawkish tone from Yellen would also be a surprise and could trigger a push higher in Treasury yields, which could drag protect dollar downside.

So while political risk is on the backburner, central bank risk is coming to the fore as we start a new week.

Figure 1:

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

AUD/USD dips below 0.6600 following RBA’s decision

The Australian Dollar registered losses of around 0.42% against the US Dollar on Tuesday, following the RBA's monetary policy decision to keep rates unchanged. However, it was perceived as a dovish decision. As Wednesday's Asian session began, the AUD/USD trades near 0.6591.

EUR/USD edges lower to near 1.0750 after hawkish remarks from a Fed official

EUR/USD extends its losses for the second successive session, trading around 1.0750 during the Asian session on Wednesday. The US Dollar gains ground due to the expectations of the Federal Reserve’s prolonging higher interest rates.

Gold wanes as US Dollar soars, unfazed by lower US yields

Gold price slipped during the North American session, dropping around 0.4% amid a strong US Dollar and falling US Treasury bond yields. A scarce economic docket in the United States would keep investors focused on Federal Reserve officials during the week after last Friday’s US employment report.

FTX files consensus-based plan of reorganization, awaits bankruptcy court approval

FTX has filed a consensus-based plan for its reorganization, coming almost two years after the now defunct FTX filed for Chapter 11 Bankruptcy Protection in the District of Delaware.

Living vicariously through rate cut expectations

U.S. stock indexes made gains on Tuesday as concerns about an overheating U.S. economy ease, particularly with incoming economic reports showing data surprises at their most negative levels since February of last year.