Market Overview

An apparent significant de-escalation in the immediate geopolitical risk has reversed the flow out of safe haven assets again. Iran’s foreign minister is suggesting that its response to the Soleimani killing has been “concluded”. US President Trump has also struck very much of a reserved tone too. The hyperbolic threat of World War III has been averted. Both sides can “stand down” with face saving positions. The primary move has been out of Treasuries, gold and the yen; with flow back into the Chinese yuan (at a five month high versus the dollar), US dollar and equities. The intraday swing back lower on oil (more than 10%) reflects how overexcited markets had become by this situation in recent days. The dust is yet to fully settle, however, traders can begin to focus once more on the US/China trade dispute which is still due to see phase one of an agreement being signed next week. Risk appetite has seen a renewed boost this morning and this is reflected through major markets. Equities are stronger, whilst the yen is still underperforming as the slide on gold continues. Chinese inflation underwhelmed slightly overnight , with China CPI remaining at +4.5% (+4.7% exp, +4.5% in November), whilst China PPI improved to -0.5% (-0.4% exp, m-1.4% in November).

Wall Street closed solidly higher with the S&P 500 hitting another all-time as it rallied +0.5% at 3253. US futures are a further +0.3% higher today. This has helped strength through Asian markets with the Nikkei +2.3% and Shanghai Composite +0.9%. European indices show FTSE futures +0.5% and DAX futures +0.9%. In forex, as traders begin to look past geopolitical factors, there is a settling down of the recent USD strength today with JPY underperformance continuing, AUD finding support along with EUR and GBP. In commodities the action still seems to be with gold which is another -$10 lower, whilst oil seems to be settling down after the huge volatility of yesterday’s session.

Eurozone Unemployment for November is the main data announcement for the economic calendar in the European morning, at 1000GMT. Forecasts expect no change to the 7.5% in October. US Weekly Jobless Claims at 1330GMT are expected to remain around recent levels at 220,000 (222,000 last week).

There are several central bank speakers on the agenda today. The Bank of England’s Governor Carney speaks at 0930GMT, which will be interesting being the first communication of the year. Of the Fed speakers, vice-chair Richard Clarida speaks at 1300GMT (permanent voter, mild dove). Neel Kashkari (voter, dovish) is at 1430GMT, whilst John Williams (voter, centrist) is at 1630GMT.

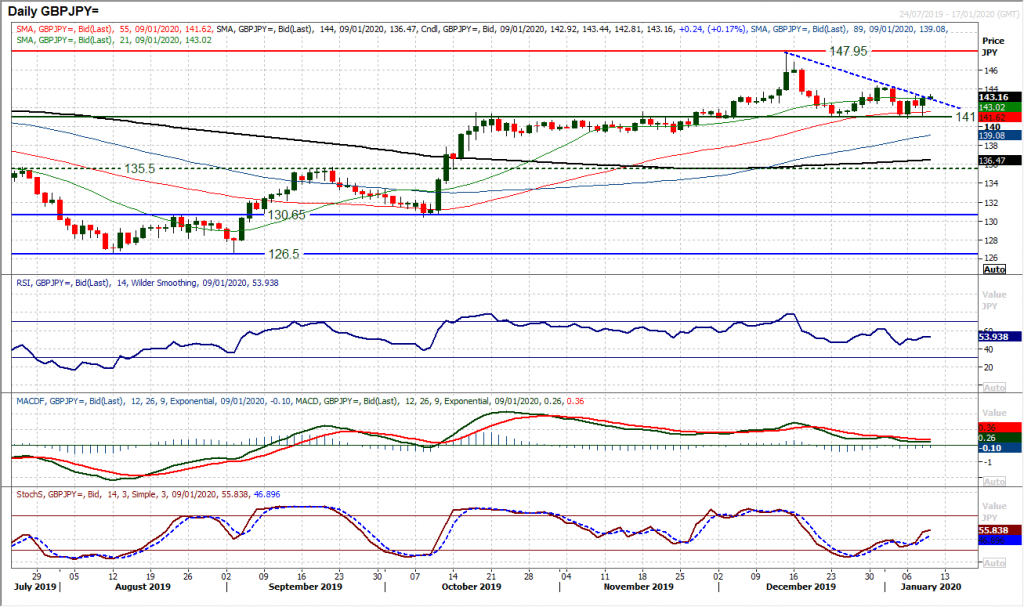

Chart of the Day – GBP/JPY

In recent sessions there has been a growing sense of traders losing faith in the yen. This mood strengthened yesterday afternoon and has driven a rebound on Sterling/Yen and ar arguable bull hammer candlestick. What makes this move interesting is that it once more bolsters the breakout (and now pivot support) at 141.00. The correction back from the mid-December high of 147.95 has built a corrective downtrend, but with yesterday’s bounce continuing into today’s early move higher, this trend is being breached. A closing break above 143.30 resistance wold confirm the downtrend broken (today around 142.90) but also a move above Tuesday’s high. This comes with improving momentum too. A positive recovery formation on Stochastics is gaining impetus, whilst the RSI and MACD lines have both recently unwound to medium term buying opportunity levels. This could be the chance the bulls have been waiting for. A move above 144.35 would be a near term breakout and suggest recovery traction once more on sterling. A close below 141.00 would be a key breakdown of the bullish argument.

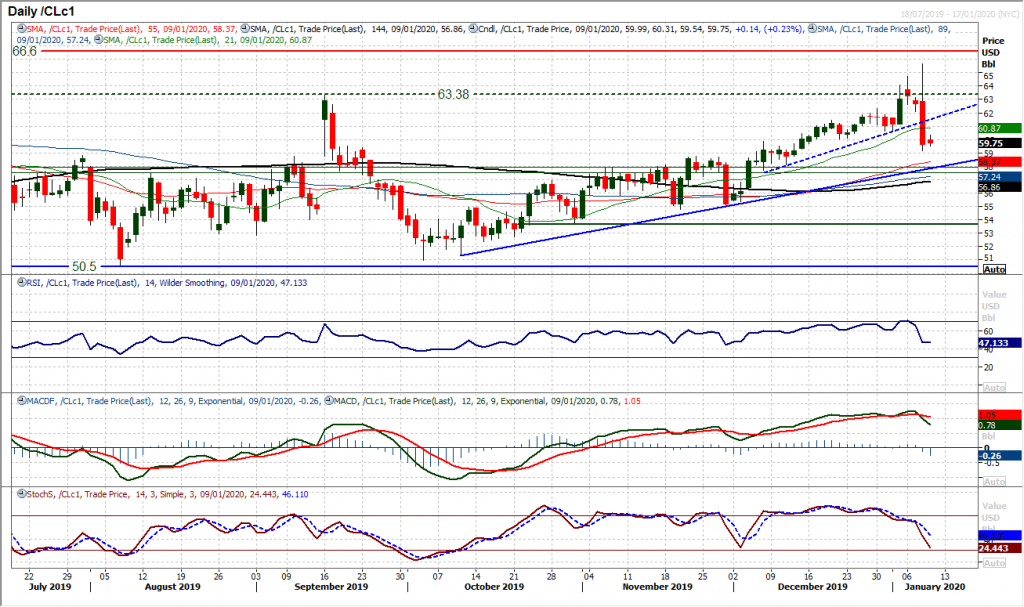

WTI Oil

An enormous intraday turnaround with a $6.50 daily range (c. 10% where the Average True Range is c. $1.55) shows what huge volatility is playing out on oil right now. This massive bearish engulfing candle drives the potential for a continued move lower now. A close under $60 now leaves overhead supply $60.00/$60.65 into today’s session, which is already having an impact. Momentum signals are increasingly corrective now too and unless the bulls quickly regather themselves, the market could continue to retrace into the old pivot band $57.50/$57.85. This is also where the support of a three month uptrend comes in. We remain medium term positive outlook on oil, but the legacy of yesterday’s slide may still have some legs in it near term.

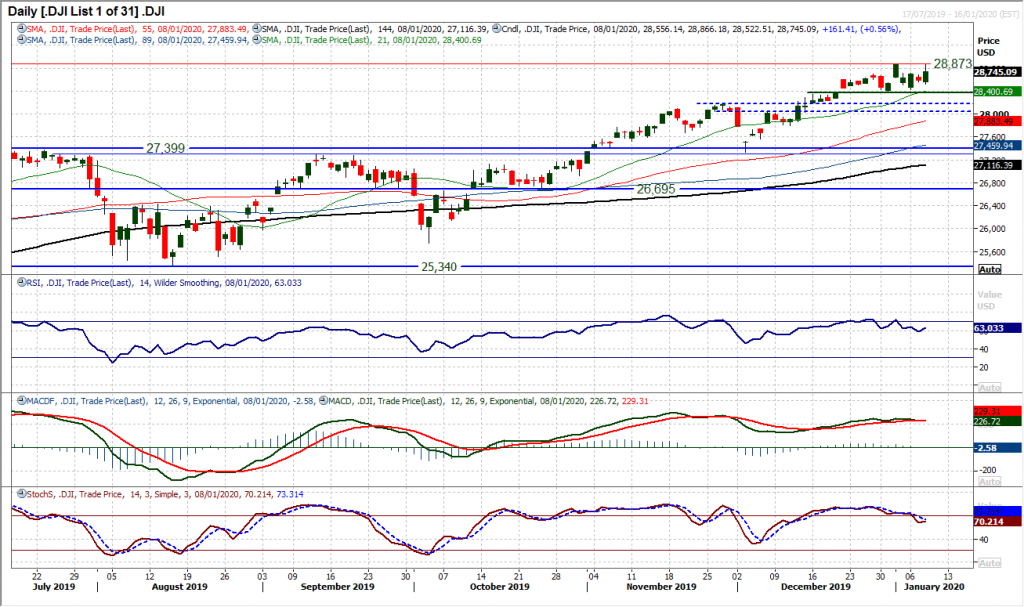

Dow Jones Industrial Average

The bulls have held up well during the geopolitical tensions which have impacted markets through the past week. Another opening gap lower was quickly closed intraday to leave a strong positive candle. It shows that whilst the risk of a near term head and shoulders top is still present, there still seems to be an outlook to buy into weakness. There has been a mild moderating of momentum in recent sessions as the market has toyed with the idea of topping out, however, there is still a reasonably positive configuration. The RSI remains above 60, whilst MACD lines have only flattened. Stochastics are sliding but even this move is fairly well contained. In four of the five sessions in 2020, there has been a strong intraday reaction by the bulls, so with the geopolitical risks receding, we look for this to continue. A test of the all-time high at 28,873 did not quite succeed yesterday, but this is unlikely to be the last. Initial support at 28,522 above the key potential neckline at 28,376.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.