Global developments

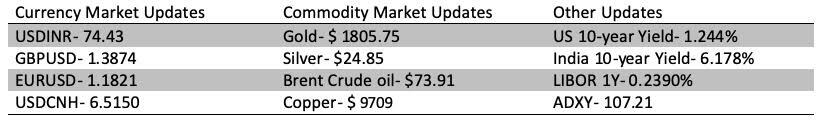

Chinese government's crackdown on big tech i.e. large consumer internet companies and Edutech companies has sent ripples of risk aversion across the globe. There are several reasons behind the crackdown; suppressing monopolistic behavior, ensuring alignment with Chinese government policies, ensuring data security, redirecting focus towards more meaningful and productive R&D and innovation are some of them. News of the first conviction under the newly enacted national security law in Hong Kong which makes it virtually impossible to freely express dissent against the government also added fuel to fire. There is speculation that the US could retaliate by restricting US funds from investing in shares of Chinese companies. The Hang Seng Index fell 4.2% yesterday. The Yuan fell to the lowest level since April. The US Dollar has weakened against majors as US real rates continue to remain under pressure. US equities were under pressure, tracking weakness in Asian equities. Technology stocks particularly are getting sold off. US treasuries are seeing safe-haven demand. The key event today would be the Fed monetary policy. We do not expect any major change in the wording or tone of the policy statement. The Fed is likely to continue to overlook inflation (terming it transitory) while focusing on recovery in the labor market.

Domestic developments

The IMF has revised India's growth forecast lower to 9.5% from 12.5%. The revision aligns IMF's forecast with that of RBI and major Rating agencies as well.

Equities

Equities came off during the session to end on a weak note, tracking weakness in Asian equities led by Hang Seng. Asian equities are trading flat. US equities did recover towards the end of the session yesterday.

Bonds

Bond yields were steady yesterday. The yield on the benchmark 10y ended at 6.17%. Rates ended slightly higher with 3y OIS ending at 4.67% and 5y at 5.20%.

USD/INR

Today is the July exchange-traded currency derivative expiry. We could see some selling at RBI fix. Month-end exporter selling is likely to cap upside in USD/INR. Forwards came off yesterday across the curve. 1y forward yield dropped 7bps to 4.43%

Strategy: Exporters are advised to cover a part of their near-term exposure on upticks toward 74.90. Importers are advised to cover through options. The 3M range for USDINR is 73.20 – 75.50 and the 6M range is 73.50 – 76.50.

This report has been prepared by IFA Global. IFA Global shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. IFA Global nor any of directors, employees, agents or representatives shall be held liable for any damages whether direct, indirect, special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information. No liability whatsoever is accepted for any loss arising (whether direct or consequential) from any use of the information contained in this report. This statement, prepared specifically at the addressee(s) request is for information contained in this statement. All market prices, service taxes and other levies are subject to change without notice. Also the value, income, appreciation, returns, yield of any of the securities or any other financial instruments mentioned in this statement are based on current market conditions and as per the last details available with us and subject to change. The levels and bases of, and reliefs from, taxation can change. The securities / units / other instruments mentioned in this report may or may not be live at the time of statement generation. Please note, however, that some data has been derived from sources that we believe to be reliable but is not guaranteed. Please review this information for accuracy as IFA Global cannot be responsible for omitted or misstated data. IFA Global is not liable for any delay in the receipt of this statement. This information is strictly confidential and is being furnished to you solely for your information. This information should not be reproduced or redistributed or passed on directly or indirectly in any form to any other person or published, copied, in whole or in part, for any purpose. This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation or which would subject IFA Global to any registration or licensing requirements within such jurisdiction. The information given in this report is as of the date of this report and there can be no assurance that future results or events will be consistent with this information. IFA Global reserves the right to make modifications and alterations to this statement as may be required from time to time. However, IFA Global is under no obligation to update or keep the information current. Nevertheless, IFA Global is committed to providing independent and transparent information to its client and would be happy to provide any information in response to specific client queries. Neither IFA Global nor any of its directors, employees, agents or representatives shall be liable for any damages whether direct, indirect, special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information. The information provided in these report remains, unless otherwise stated, the copyright of IFA Global. All layout, design, original artwork, concepts and other Intellectual Properties, remains the property and copyright IFA Global and may not be used in any form or for any purpose whatsoever by any party without the express written permission of the copyright holders.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.