How to trade five explosive rate decisions this week, Fed and BoJ stand out

- Investors fear the Fed may signal fewer cuts this year as inflation remains sticky.

- The Bank of Japan may finally move away from negative interest rates.

- Australia's central bank could provide hints of its first rate cut.

- The Swiss National Bank may surprise with a rate cut.

- A three-way vote is in play for the Bank of England, which is torn between inflation and a recession.

Central banks are all over the place – in dominating the agenda and in wildly different policies. When they take different paths, so do currencies, creating big market waves.

Here is a preview for this week's five rate decisions, in chronological order.

1) Bank of Japan to end historic negative rates

Tuesday, early in the day. Japanese workers will receive a significant pay raise – that has been the latest nail in the coffin of negative interest rates. The Bank of Japan (BoJ) is set to raise its borrowing costs from -0.10% to 0%, joining the hiking train after others had gotten off long ago. Inflation is set to remain above the bank's target, driving the change.

Will the Japanese Yen (JPY) jump? Not so fast. The hike has been telegraphed for a long time, and it is in the price. Moreover, BoJ Governor Kazuo Ueda and his colleagues will likely abandon their Yield Curve Control (YCC) policy, by which they keep 10-year yields capped. That too, is priced in.

To see further Yen strength, the BoJ would need to fully drop any bond-buying – highly unlikely – and to signal further hikes are coming. Without these two steps, there is room for a "buy the rumor, sell the fact" response, in which the Yen weakens, at least until the Fed decision. It would be a "dovish hike."

Japanese interest rates stood at 0.50% before the 2008 financial crisis, and a signal they could go there would be needed to trigger instant appreciation of the currency.

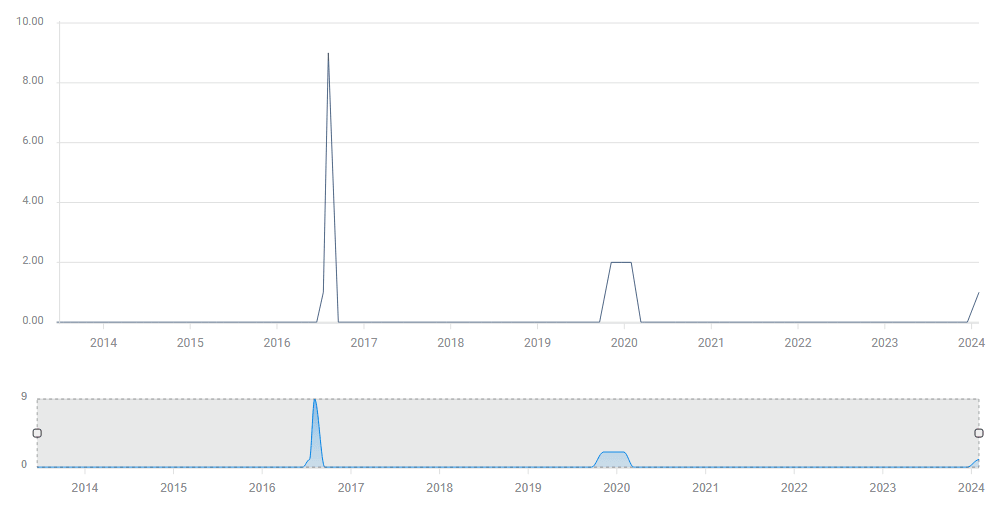

Interest rates in Japan have only gone down in the past 17 years:

BoJ interest rates. Source: FXStreet

2) Reserve Bank of Australia may highlight weakness in the economy

Tuesday, 3:30 GMT. The Reserve Bank of Australia (RBA) is set to leave its Cash Rate unchanged at 4.35%. Inflation is under control, but officials in the land down under are unlikely to act before the Fed does.

Nevertheless, the RBA has surprised in the past, and may lead the world in highlighting concerns about higher unemployment. Australia's unemployment rate topped 4% in January for the first time since 2022, and its two latest jobs report missed estimates.

Australian unemployment rate. Source: FXStreet

The next set of labor figures is due on Thursday, and perhaps officials in Canberra have a sneak peek. I see a risk that RBA Governor Michele Bullock and her colleagues express worries about the labor market, indirectly setting the stage for upcoming rate cuts.

In case the RBA takes that path, the Australian Dollar (AUD) would weaken, as economists expect the RBA not to rock the boat.

3) Fed dot-plot in focus, two or three cuts matter

Wednesday, 18:00 GMT. It would only take two out of 17 to make a difference – if a couple of policymakers at the Federal Reserve (Fed) downgrade their expectations for rate cuts this year, the median would be upgraded. A forecast of two rate cuts this year instead of the three projected in December 2023 makes a difference to markets. It would also imply the first easing would wait.

The world's most powerful central bank is set to leave rates unchanged. The dot plot is a collective outlook of members for inflation, employment, growth, and, most importantly for traders, interest rates.

Concerns of a hawkish shift stem from last week's hotter inflation reports. Both consumer and producer prices beat estimates, showing that inflation is more stubborn than expected. That implies higher rates for longer, which is bullish for the US Dollar (USD) and bearish for everything else.

The first reaction will be to the dot plot, but what then? In many cases, the initial move proves to be the wrong one. In addition to the fresh forecasts, the Fed releases a statement, and Fed Chair Jerome Powell speaks to the press.

Contrary to most central banks, the Fed has two mandates – full employment in addition to price stability, aka inflation.

On employment: A hawkish tone would be reiterating that the labor market is tight and that unemployment has been under 4% for the longest streak since the 1960s. A dovish tone would be to say that there are signs of weakening.

On inflation: A hawkish tone would be to express concern about stubborn price rises, and to say the bank still lacks enough confidence on the path of inflation. A dovish tone on the topic would be to downplay the latest data as related to lagging house price data

I want to stress that the reaction to the Fed decisions is multi-layered. Investors usually react to the dot plot before reversing the initial move. Then, they tend to respond to Powell's words but may have a rethink once the dust settles and analysis of the bank's message surfaces.

The long-term reflection of the decision would be seen in the odds for a rate cut in June, which currently stand at roughly 50-50.

Odds of a rate cut in June. Source: CME Group.

What do I expect? If the dot plot shows only cuts in 2024, it would serve as an opportunity to counter the initial reaction. I suspect Powell will express some concerns about the cooling labor market. If my scenario is correct, the US dollar would rise and then fall, while Gold and stocks would first fall and then rise.

As detailed above, there are many scenarios, and the impact of the Fed will last several days.

4) Swiss National Bank could surprise with a cut

Thursday, 8:30 GMT. The first central bank to announce its decision after the Fed is the Swiss National Bank (SNB), which holds rate meetings only once a quarter. The economic calendar points to an unchanged decision – a rate of 1.75% for the next three months. However, there is room for surprise.

Inflation in Switzerland fell quickly, with Core CPI hitting 1.1% – less than a third of that in the US. Similar to the Germans, the inflation-averse Swiss prefer preventing any risks of higher prices. But up to a point.

Swiss inflation's silhouette is less dramatic than its mountains:

Swiss CPI. Source: FXStreet

There is a chance that outgoing SNB Chair Thomas Jordan and his colleagues will begin unwinding rate hikes, which totaled 250 bps. The SNB held rates at -0.75% for many years.

A surprise rate cut would send the Swiss Franc (CHF) plunging, while an unchanged decision would keep its bid.

5) Bank of England is torn between three options

Thursday, 12:00 GMT. Was Dr. Swati Dhingra the "canary in the coal mine?" She was the sole Monetary Policy Committee (MPC) member to vote for a rate cut in February. Six, including Governor Andrew Bailey, voted to hold, while two wanted higher borrowing costs than the current 5.25%.

The last times the majority of MPC members voted to cut was around the pandemic and Brexit.

BoE MPC votes to cut. Source: FXStreet.

Like the Fed's dot plot, the MPC's voting pattern will trigger the initial reaction. I suspect another member will join dovish Dhingra by supporting lower borrowing costs, pressuring the Pound Sterling (GBP).

The UK is officially in a recession, and unemployment is edging higher. Even with relatively high inflation—expected to drop from 4% to 3.6% in a publication on Wednesday—there is room for a cut. Slashing rates is unlikely now, but having a second member support such a stance would hurt the Pound.

A mere change in the voting pattern of the two hawks supporting a hike would weigh on Sterling. A hot inflation report and a hawkish twist in the voting pattern would propel the Pound higher.

Final thoughts

Having five central banks announcing decisions in less than 60 hours means volatile trading – opportunities as well as risks. Trade with care, especially around the Fed and the BoJ

(This story was corrected on March 18 at 13:46 GMT to say that the Fed's dot plot could show two interest-rate cuts for 2024, not hikes.)

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.