Gold Weekly Forecast: XAU/USD shakes off bearish pressure, eyes $1,745

- Gold made a sharp U-turn following a steep drop earlier in the week.

- The next target on the upside is located at $1,745.

- US T-bond yields are likely to continue to drive XAU/USD movements next week.

Gold started the week on the back foot and suffered heavy losses after it broke below the lower limit of its two-week-old range at $1,720. Following a two-day slump that saw XAU/USD lose more than 2% on its way to a three-week low of $1,678, the pair managed to stage a decisive rebound in the second half of the week. With US Treasury bond yields falling sharply and the USD struggling to find demand, gold erased all of its weekly losses and settled near $1,730.

What happened last week

The benchmark 10-year US T-bond yield edged higher on Monday and preserved its bullish momentum to touch its highest level in more than a year at 1.774%. The upsurge in yields helped the greenback gather strength and forced XAU/USD to slump below $1,700.

On Wednesday, the upbeat market mood, as reflected by rising global equity indexes, made it difficult for the USD to continue to outperform its rivals and triggered a recovery in XAU/USD. Additionally, quarter-end flows and profit-taking on the last trading day of March helped gold correct its oversold conditions.

On Thursday, the data published by the Institue for Supply Management (ISM) showed that the business activity in the US manufacturing sector expanded at its most robust pace since 1983 with the PMI jumping to 64.7 from 60.8. This reading came in better than the market expectation of 61.3 as well and allowed risk flows to remain in control of financial markets. The S&P 500 Index registered impressive gains and closed at an all-time high of 4,019 before the Easter holiday while the US Dollar Index lost 0.3% on a daily basis.

Meanwhile, US President Joe Biden unveiled the highly-anticipated economic plan that aims to ramp up spending by $2.25 trillion with substantial investments in infrastructure and green initiatives. However, investors remain sceptical about the support the plan will receive from lawmakers as the Biden administration is planning to fund the spending package via tax hikes.

Finally, the US Bureau of Labor Statistics’ monthly report revealed on Friday that Nonfarm Payrolls (NFP) in March surged by 916,000, compared to analysts' estimate for an increase of 647,000. Furthermore, the Unemployment Rate edged lower to 6% as expected and the Labor Force Participation Rate ticked up to 61.5%. Although it was difficult to assess the market reaction due to the Easter holiday, the modest increase seen in the 10-year US T-bond yield suggests that the greenback could start the new week on a firm footing.

Next week

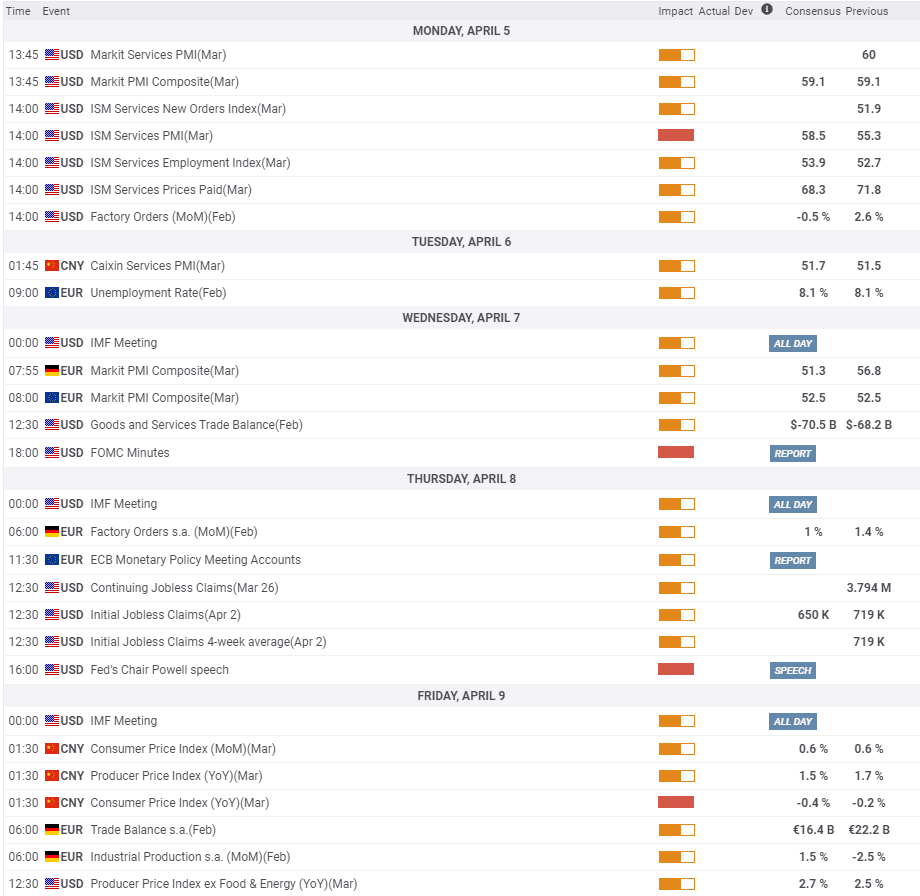

Next week will be relatively quiet with regards to significant macroeconomic events, hinting that the performance of US Treasury bond yields could continue to impact the USD's market valuation and XAU/USD's movements.

On Monday, the ISM Services PMI from the US will be looked upon for fresh impetus. A stronger-than-expected reading could provide a boost to Wall Street's main indexes and limit the USD's potential gains.

On Wednesday, the FOMC will publish the minutes of its March meeting and FOMC Chairman Jerome Powell will be delivering a speech on Thursday. The Federal Reserve's latest Summary of Projections showed that four policymakers were expecting a rate hike in 2022. Market participants will look for fresh clues regarding the possible timing of policy tightening.

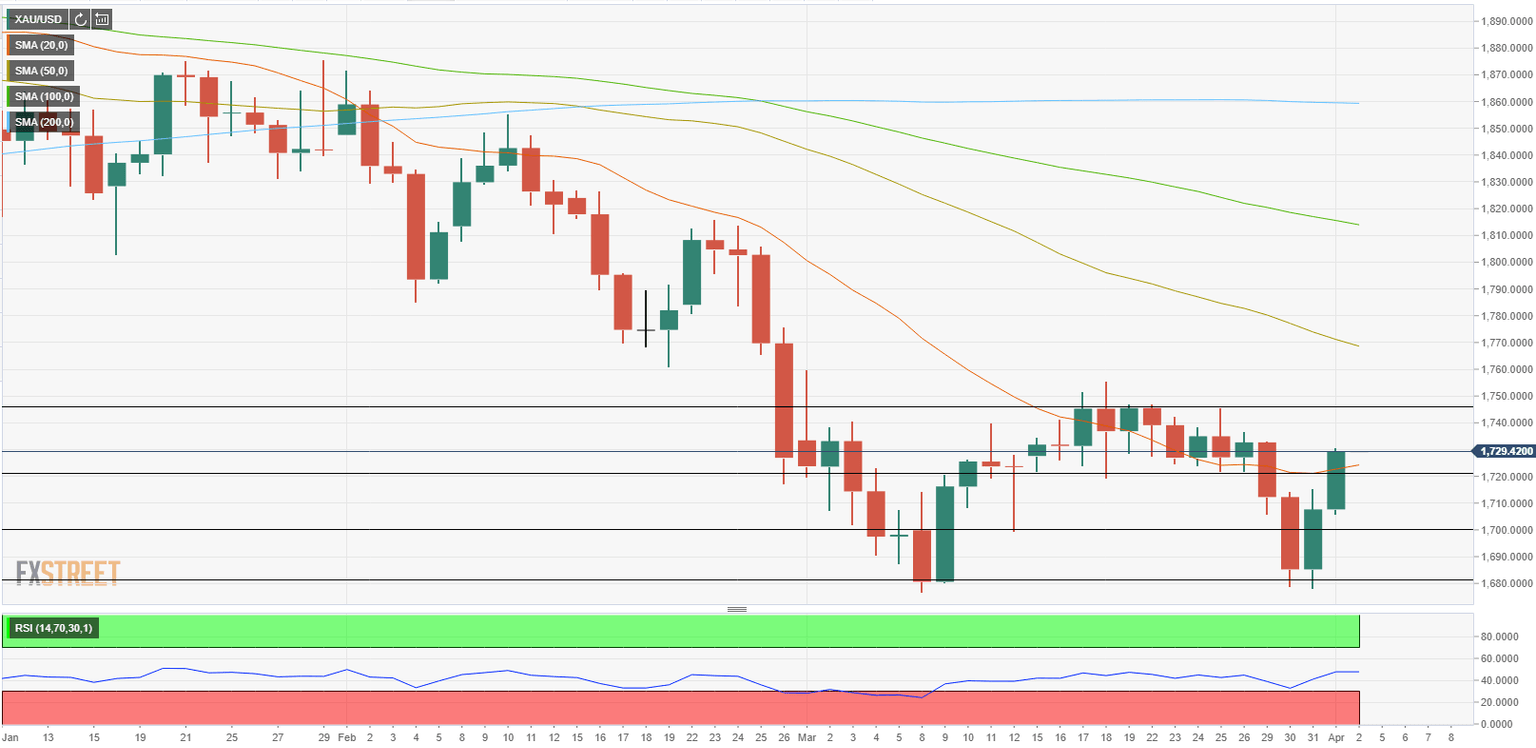

Gold technical outlook

Following the sharp decline witnessed earlier in the week, the Relative Strength Index (RSI) indicator on the daily chart dropped to 30 to show oversold conditions. With the strong rebound, the RSI recovered to 50, suggesting that the bearish pressure has softened. Furthermore, XAU/USD managed to close above the 20-day SMA, reaffirming the view that sellers have lost interest.

However, gold still needs to make a daily close above the strong hurdle that formed at $1,745 to attract more buyers and complete a bullish shift in the near-term outlook. Above that level, the next resistance is located at $1,770 (50-day SMA).

On the flip side, sellers could look to retake control of the price if the $1,745 resistance remains intact. The initial support is located at $1,725 (20-day SMA) ahead of $1,720 (static level) and $1,700 (psychological level).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.