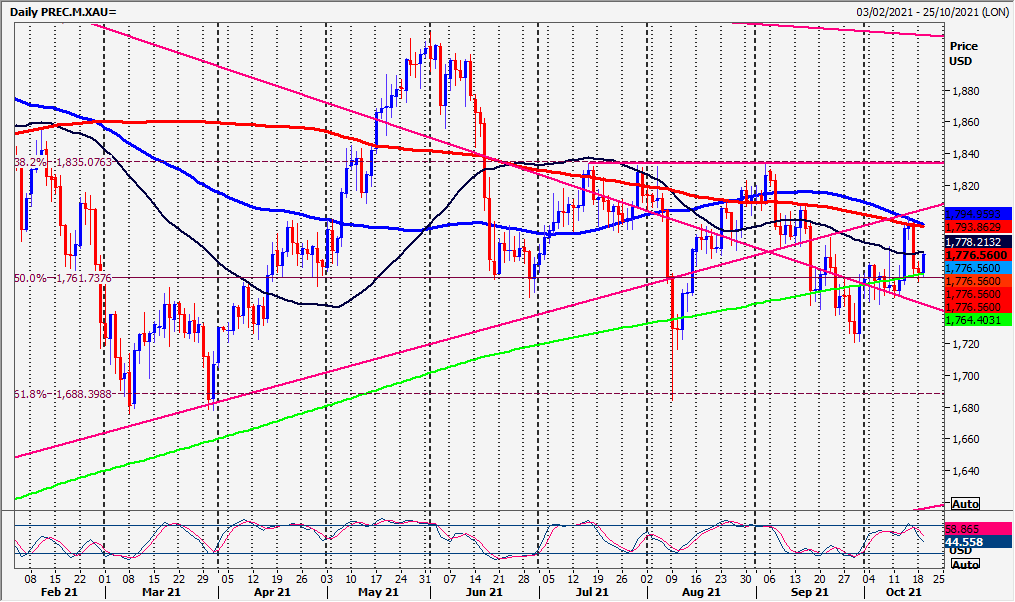

Gold: Very strong resistance again at 1790/95

Gold, silver, WTI crude

Gold Spot we are long at that important 1765/62 level.

Silver Spot longs at our buying opportunity at 2320/10 worked perfectly as we bounce to 2350 this morning.

WTI Crude November we wrote: closed above 8200/20 for another buy signal targeting 8280/90 & 8330/50, perhaps as far as 8400/10.

We reversed just 13 ticks from the upper target of 8400.

Daily analysis

Gold meets support at that old favourite level of 1765/62. Longs need stops below 1757. Longs here target 1773/75 (hit this morning) then 1783/85. Very strong resistance again at 1790/95. Shorts need stops above 1800. A break higher is a medium term buy signal initially targeting 1807/08 but eventually reaching 1830/35 next week.

A break below 1757 is a sell signal targeting 1749/47. Below 1744 risks a slide to 1739/37.

Silver buying opportunity at 2320/10 with stops below 2290. Holding here maintains the medium term buy signal initially targeting 2370 & 2420/30.

A break below 2290 is a sell signal targeting 2275 & 2250/40 for some profit taking on shorts.

WTI Crude made it almost as far as 8400/10 then collapsed to where we started at 8200. In severely overbought conditions this is a minor warning that we are running out of steam with profit taking starting. However there is no sell signal yet. Just be cautious with longs. For now I would still be a buyer on weakness while we wait for a sell signal. Minor support at 8190/70. Best support at 8060/40. Longs need stops below 7990.

Chart

Author

Jason Sen

DayTradeIdeas.co.uk