Gold Price Forecast: XAU/USD’s bearish bias intact ahead of a big week

- Gold steadies near two-month lows, as the US dollar slips early Monday.

- Technical set up points to the additional downside in the near-term.

- US election debate and Non-Farm Payrolls data – key event risks this week.

Gold (XAU/USD) has started out a critical week on a cautious note, ranging within a striking distance of the two-month lows of $1849. Although the downside appears cushioned, at the moment, as the safe-haven US dollar loses further ground across its higher-yielding rivals. The Asian market mood remains buoyed by the renewed optimism on the Chinese economic recovery after industrial profits in the world’s second-largest economy rose for the fourth straight month. Further, uncertainty over the US political scenario, with the election debate in focus this week, and the pre-Non-Farm Payrolls release anxiety keep the dollar bulls unnerved.

Meanwhile, markets also pay close attention to the US CFTC data released late Friday, which showed that speculators held a big net short position in the greenback, near its highest levels in almost a decade. Amid a light data docket in the day ahead, the risk sentiment and US dollar dynamics will continue to play out, in the face of the looming coronavirus risks and US fiscal stimulus uncertainty.

Note that the yellow metal finished last week 4.5% lower amid unabated demand for the US currency as an ultimate safe-haven. The dollar’s ascent, however, stalled towards the weekly closing, as the US stocks recovered ground and lifted the market mood.

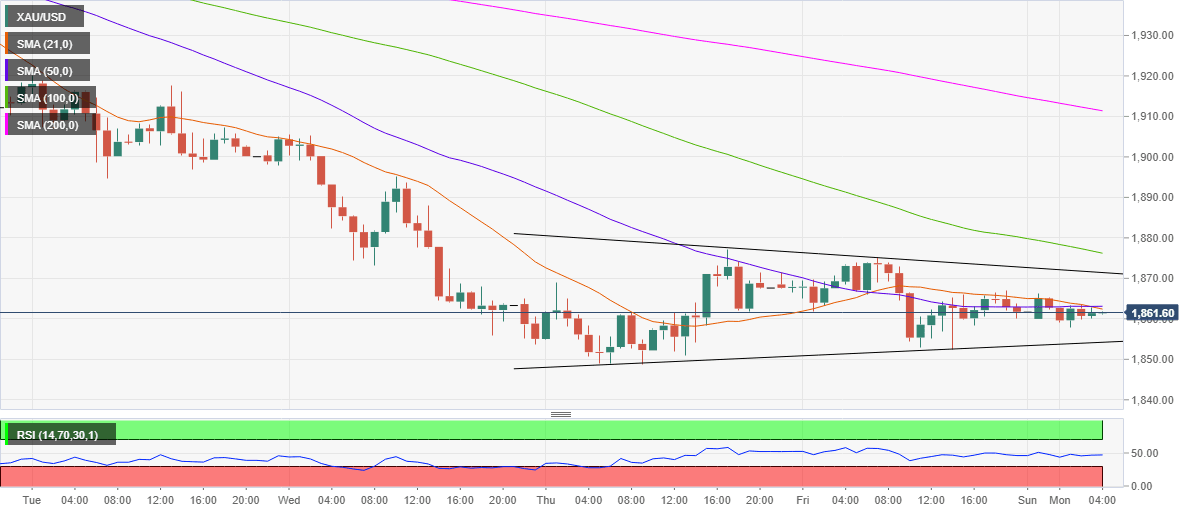

Gold: Short-tern technical outlook

Hourly chart

Although the bulls are likely to have little luck in their attempt, as the short-term averages have charted a bearish crossover. The 21-HMA is cutting the 50-HMA from above, suggesting the recovery attempts are likely to fade out, opening doors for fresh declines.

The hourly Relative Strength Index (RSI) remains sidelined just below the midline in the bearish region, further backing the case for limited upside potential.

To the downside, the two-month lows of $1949 will be threatened, below which the powerful 100-day Simple Moving Average (DMA) at $1847 will be on the sellers’ radar. All in all, the path of least resistance is to the downside.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.