Gold Price Forecast: XAU/USD to face a bumpy road to the upside amid stimulus hopes

- Gold cheers higher US inflation expectations on Biden’s stimulus hopes.

- Risk-on mood downs the US dollar ahead of weekly jobless claims.

- The four-hour chart looks constructive but 100-SMA needs to be cleared

With Joe Biden sworn in as the 46th US President on Wednesday, Gold (XAU/USD) surged nearly 2% to reach the highest levels in two weeks above $1870. That came in on the heels of the continued rise in the US inflation expectations, as markets remained hopeful that the Biden administration would boost stimulus to deal with the economic blow from the coronavirus pandemic.

The US stocks registered fresh all-time highs, as the stimulus expectations lifted the risk sentiment and weighed negatively on the US dollar. Meanwhile, the 10-year US Treasury yields traded rangebound around 1.10%.

The risks remain tilted to the upside for gold in Thursday’s trading amid the upbeat market mood while investors rethink Biden’s likely $1.9 trillion stimulus package ahead of the key ECB monetary policy decision and US weekly jobless claims data. The continued surge in the virus cases globally could also underpin the sentiment around the safe-haven gold. According to Reuters, US fatalities rose by 4332 on Wednesday while Germany reported nearly 20,400 new infections on Thursday.

Gold Price Chart - Technical outlook

Gold: Four-hour chart

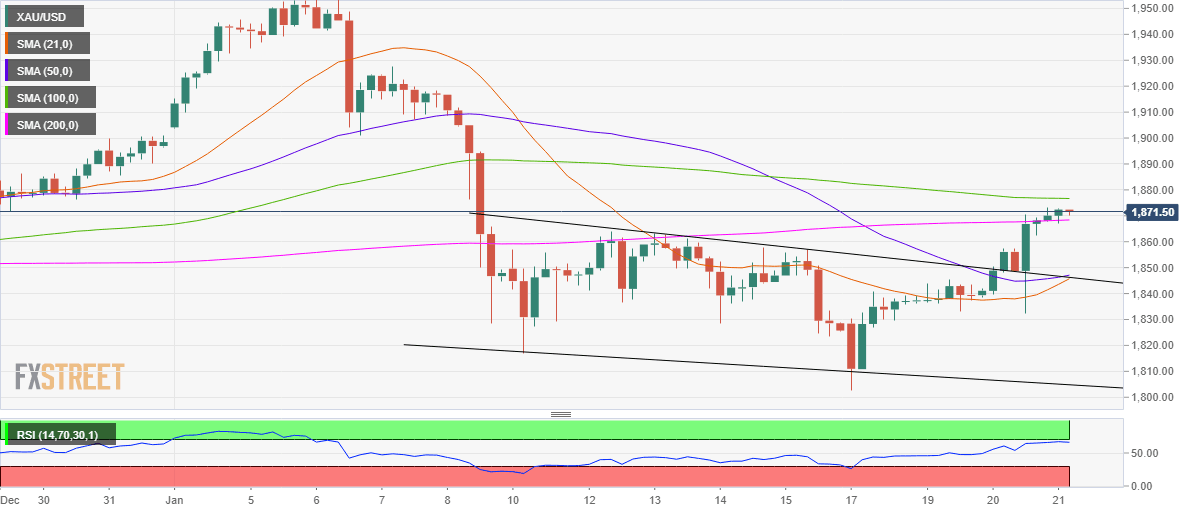

As observed in the four-hour chart, gold extended the break higher, having confirmed a falling channel breakout in Wednesday’s Asian trading.

The price seems to have found acceptance above the 200-simple moving average (SMA) at $1868 on the given timeframe. However, the bulls need to crack the horizontal 100-SMA resistance at $1877 to unleash the further upside.

The 14-day Relative Strength Index (RSI) sits beneath the overbought region, suggesting more scope northwards.

To the downside, a break below the 200-SMA could trigger a sharp drop towards $1846 critical support, which is the confluence of the pattern resistance now support, 21 and 50-SMAs. The next relevant support awaits near $1830 region, below which the January 17 low at $1803 could be back on the radar.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.