Gold Price Forecast: XAU/USD struggle with $2,330 extends, as focus shifts to Fed decision

- Gold price drops but downside appears limited ahead of US jobs data, Fed decision.

- US Dollar rebounds in sync with USD/JPY amid sluggish US Treasury bond yields.

- Gold price teases downside break of the key daily trendline support at $2,330.

Gold price is looking to build on to the previous downside early Tuesday, as traders continue to take profits off the table in the lead-up to the US Federal Reserve (Fed) interest rate decision due on Wednesday.

Gold price stays weak, awaiting key US events

Besides, a cautiously optimistic market mood and a broad US Dollar (USD) rebound exert downward pressure on Gold price, as markets digest reports of a probable truce talks. Citing an Israeli source familiar with the negotiations and a foreign diplomatic source, CNN News reported on Tuesday that Hamas is considering a new framework proposed by Egypt that calls for the group to release as many as 33 hostages kidnapped from Israel in exchange for a pause in hostilities in Gaza. Receding geopolitical tensions dent the appeal of Gold, as a safe-haven asset.

Meanwhile, the US Dollar stages a comeback after two back-to-back days of losses, tracking the recovery in the USD/JPY pair after it was thrashed nearly 500 pips on Monday, in the face of a suspected intervention by the Japanese authorities to rescue the Yen from its lowest level in 38 years against the Greenback.

Gold price also bears the brunt of increased expectations that the Fed will stick to its recent hawkish rhetoric when it announces its policy decision on Wednesday, especially after hotter-than-expected US Core Personal Consumption Expenditures (PCE) Price Index inflation data.

On Friday, the annual Core PCE Price Index, the Fed’s preferred inflation gauge, rose 2.8%, at the same pace as seen in February but came in hotter than the expected 2.6% increase. Markets are pricing in the first Fed rate cut in September, with just over 30 basis points worth of easing expected this year, down from 40 bps projected a week ago.

However, the downside in Gold price appears cushioned following encouraging China’s Manufacturing PMI data for April. China is the world’s top Gold consumer and improving economic activity in the country, helps underpin the demand for the bright metal.

Next of note for Gold traders remain the US ADP Employment Change, JOLTs Job Openings data and the Fed policy announcements due on Wednesday. Meanwhile, Gold price will stay at the mercy of the broader risk sentiment and the US Dollar price action.

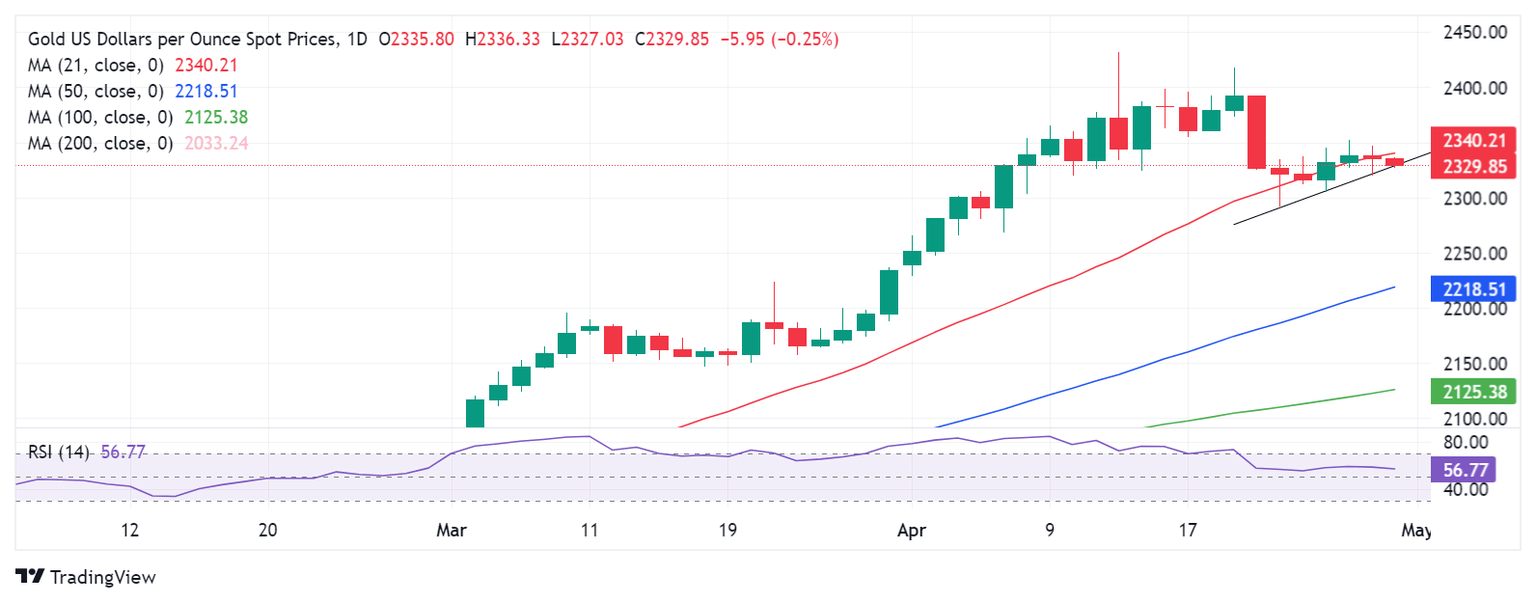

Gold price technical analysis: Daily chart

As observed on the daily chart, Gold price closed Monday below the key 21-day Simple Moving Average (SMA), then at $2,336.

The bright metal is once again challenging the rising trendline support at $2,330 on the extended weakness early Tuesday.

If Gold sellers manage to find a strong foothold below the latter on a daily closing basis, a fresh downtrend could be initiated toward the 50-day SMA at $2,212.

Ahead of that, the previous week’s low of $2,291 and the psychological $2,250 level could lend support to buyers.

The 14-day Relative Strength Index (RSI) looks down but holds above the midline, suggesting that the bearish potential in Gold price could be limited.

On the upside, the previous week’s high will be the initial contention point on recapturing the 21-day SMA support-turned-resistance. Further up, the $2,370 round level will be challenged en route to the April 22 high of $2,392.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.