Gold Price Forecast: XAU/USD returns to familiar range after Powell-led wild ride

- Gold’s upside looks elusive amid rallying Treasury yields.

- Dollar could find support from Powell-led stronger T-yields.

- Focus shifts to the US macro news for fresh impetus.

Gold (XAU/USD) witnessed wild swings of around $65 in a matter of an hour on Thursday after the Federal Reserve (Fed) Chair Jerome Powell unleashed a new framework to tolerate inflation rising above 2% for short periods of time to ensure economic recovery and job creation. In a knee-jerk reaction, the US dollar was dumped across the board that drove gold to the highest in six-days at $1976.

However, the greenback quickly reversed the drop and jumped in tandem with the longer-term US Treasury yields, downing Gold as low as $1910. The US benchmark 10-year Treasury yields rallied 10 basis points on the Fed event, now trading at the highest level since mid-July at 0.780%. Meanwhile, the US long-term inflation expectations hit a 7-month high. Markets ignored the mixed US Jobless Claims and Q2 GDP data. The bright metal, however, managed to recover some ground to close the day near the $1930 region.

The Asian stocks trade with mild optimism on Friday, tracking the positive close on Wallstreet, as investors cheer Fed’s new strategy that implies lower interest rates for a longer period. From a broader perspective, the yieldless gold is likely to remain underpinned by lower rates. However, Powell induced rebound in the Treasury yields could keep gold’s upside limited in the near-term. The relentless rally in the US rates could fuel a recovery in the US dollar in the day ahead, as attention now turns towards the US Core PCE Price Index and Michigan Consumer Sentiment Index.

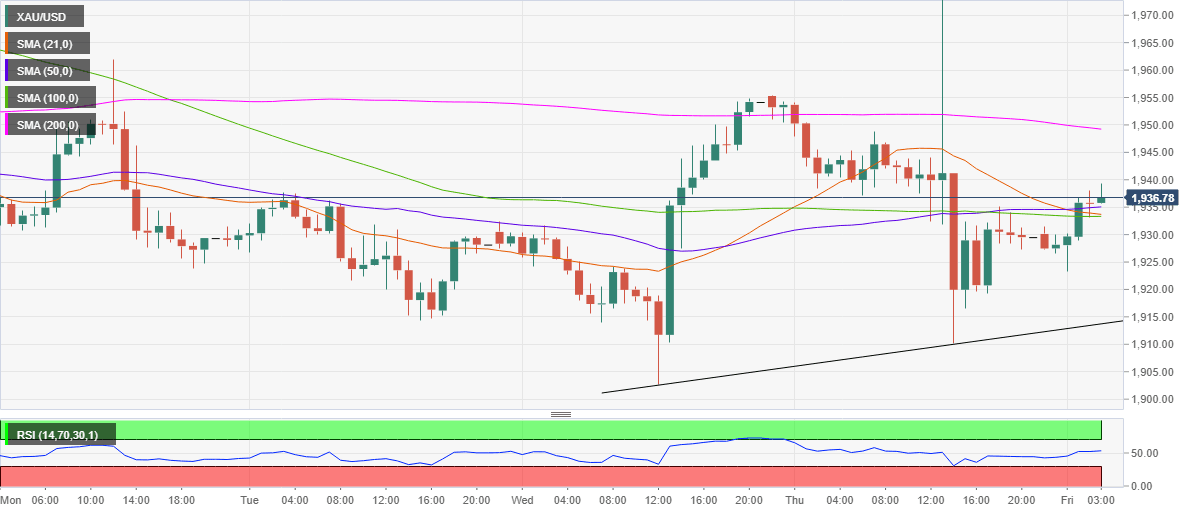

Gold: Hourly chart

Short-term technical perspective

Looking at the hourly chart, Gold has pierced above the critical resistance at $1934/35 zone, which is the confluence of the horizontal 50 and 100-hourly Simple Moving Averages (HMA) and bearish 21-HMA.

The hourly Relative Strength Index (RSI) is trading flat just above the midline, still supportive of the further upside.

Therefore, the bulls now look to retest the psychological $1950 barrier, where the horizontal 200-HMA coincides.

A breakthrough the latter could call for a retest of Thursday’s high at $1976.

To the downside, should the $1934 level give way, a sharp decline towards the rising trendline support at $1914 cannot be ruled. Below which, Wednesday low of $1903 could be tested.

Gold: Additional levels to consider

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.