Gold Price Forecast: XAU/USD rebounds on US stimulus progress but not out of the woods yet

- Gold rebounds on Wednesday amid US stimulus progress.

- A potential golden cross on the daily chart could revive the XAU bears.

- Gold could track silver prices as the retail-trade frenzy cools-off.

Gold (XAU/USD) is attempting a minor bounce after falling over 1% to eleven-day lows at $1830 on Tuesday. The yellow metal slumped as the US dollar rallied hard on the macroeconomic divergence between the US and Euro area economies. The relative strength of the US economic recovery amid the coronavirus crisis drove the greenback broadly. The social media-driven retail-trade frenzy fizzled and weighed heavily on silver prices alongside gold. Markets also favored the US currency amid ongoing talks on fiscal stimulus.

Wednesday’s pullback in gold can be mainly attributed to the progress on a likely US fiscal stimulus deal. The Senate voted 50 to 49 in a straight party-line decision in order to push through a $1.9 trillion aid package proposed by President Joe Biden. However, the covid vaccine-driven optimism could cap the recovery attempts in gold. Also, if the US dollar resumes the recent advance, gold could once again feel the pull of gravity, as the technical picture also suggests limited upside.

Gold Price Chart - Technical outlook

Gold: Daily chart

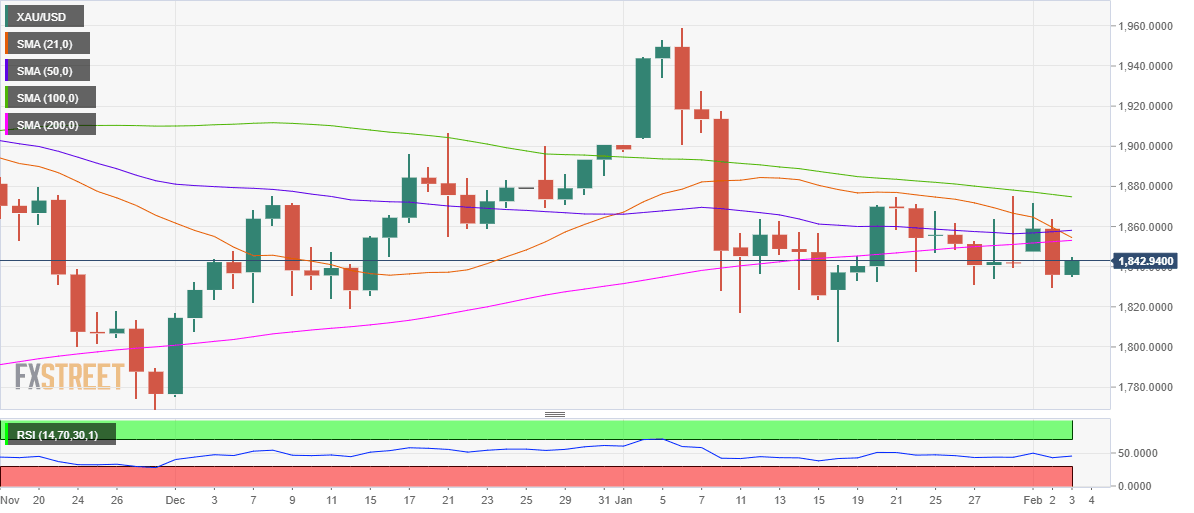

The daily chart shows that a bear cross is in the making for gold, suggesting that the sellers could remain hopeful despite the latest bounce.

The bearish crossover will get confirmed once the 21-daily moving average (DMA) pierces the 200-DMA from above. Also, adding credence to the downside bias, the Relative Strength Index (RSI) continues to hold below the midline.

Therefore, a retest of Tuesday’s low at $1830 cannot be ruled, below which the January 13 low of $1803 would come into play. Further south, the November 30 high at $1790 could offer some support to the XAU bulls.

Wednesday’s fall prompted gold to breach the critical 200-daily moving average (DMA) at $1850, with the path of least resistance seemingly downside after closing the day below the 200-DMA support.

On the flip side, the buyers need to find acceptance above the critical $1854, where the 21 and 200-DMA look to coincide. The next upside target awaits at the 50-DMA of $1858. The path of least resistance, therefore, appears to the downside.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.