Gold Price Forecast: XAU/USD eyes acceptance above $1817 for further upside, US ADP, ISM in focus

- Gold price holds firmer amid cautious mood, China PMI sparks growth concerns.

- US dollar holds the rebound ahead of the US ADP jobs, ISM PMI.

- Gold is on the verge of a symmetrical triangle breakout on the 4H chart.

Gold price enjoyed good two-way businesses on Tuesday, initially rising as high as $1819 after the US dollar index reached a fresh four-week low amid the extension of Fed Chair Jerome Powell’s led bearish momentum. However, the dollar bulls jumped back on the bids and attempted a rebound after the US CB Consumer Confidence slumped to 113.8 in August vs. 124 expected.

The weak US data reignited economic growth concerns, tempering the market mood while lifting the greenback’s safe-haven appeal. In light of the dollar’s rebound, gold price saw a sharp downtick to $1802, although managed to swiftly recovery ground at the close, where it settled around $1813. The renewed upswing in the US Treasury yields also backed the dollar’s pullback while tepid risk sentiment dragged the Wall Street indices into the red zone, off their record highs. Concerns over the rapid spread of the Delta covid variant continued to haunt the markets.

Gold price is trying to extend Tuesday’s rebound, holding the higher ground above $1800 ahead of the critical US ADP jobs data and ISM Manufacturing PMI. The US economic releases will be closely eyed for fresh hints on the strength of the recovery while Friday’s Nonfarm Payrolls will be the main event risk. The Fed’s guidance on tapering hinges on Friday’s employment report.

Meanwhile, investors remain worried over the global economic recovery, especially amid looming covid risks and after the Chinese manufacturing activity slipped back into contraction last month, which is boding well for gold price. Although traders will watch out for the movements in the US rates and impact on the dollar for fresh trading impetus heading into the data flow.

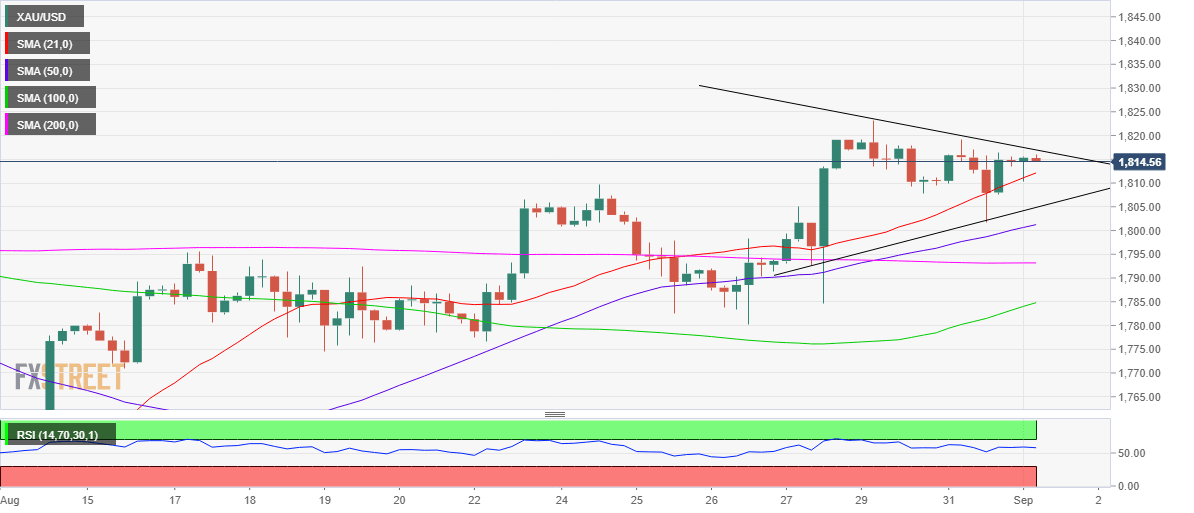

Gold Price Chart - Technical outlook

Gold: Four-hour chart

Gold’s bullish potential remains intact, as it teases a symmetrical triangle breakout on the four-hour chart.

A four-hour candlestick closing above the falling trendline resistance at $1817 will confirm the upside breakout, recalling the buyers for a test of the four-week highs of $1823.

Gold bulls will then target the $1830 round number, above which the pattern target measured at $1839 will come into play.

The Relative Strength Index (RSI) remains flatlined but well above the midline, suggesting that a move higher remains in the offing.

Alternatively, the upward-sloping 21-Simple Moving Average (SMA) at $1812 is likely to offer immediate support to gold price.

If the selling pressure accelerates, then the rising trendline support at $1805 will be put at risk.

A sustained move below the latter could validate a triangle breakdown, exposing the bullish 50-SMA at $1801.

The horizontal 200-SMA at $1793 will be the level to beat for gold bears.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.