Gold Price Forecast: XAU/USD bulls insist but not out of the woods yet

- Gold holds onto Friday’s recovery gains, well above $1850.

- US dollar dips as stocks rise on covid vaccine progress.

- All eyes remain on US Markit PMIs, covid and vaccine updates.

Despite a green day last Friday, Gold (XAU/USD) fell for the second straight week and held onto the critical $1850 support. Fresh calls for US fiscal stimulus kept the gold buyers alive, although the further upside remained elusive amid vaccine progress. US Treasury Secretary Steven Mnuchin on Friday hinted that the stimulus talks would continue just a day after halting Fed’s emergency lending program. The US dollar suffered alongside stocks, in the face of the Fed-Treasury clash, spiking COVID-19 cases and fresh lockdowns in the US cities, which lifted the sentiment around gold.

Gold clings onto the recent recovery gains so far this Monday, benefiting from the persistent weak tone seen around the US dollar amid the vaccine optimism. Increased expectations over the rapid rollout of the covid vaccines on both sides of the Atlantic weigh on the safe-haven greenback. The UK is likely to give a green signal to Pfizer’s vaccine by the end of this week while a top US health official said that the vaccinations could start in three weeks. However, gold’s upside could be capped by the risk-on rally in the global stocks. On the macro front, the US Preliminary Markit Manufacturing and Services PMIs will be featured later in the NA session. Also, the global covid statistics and vaccine updates will be closely followed.

Gold: Short-term technical outlook

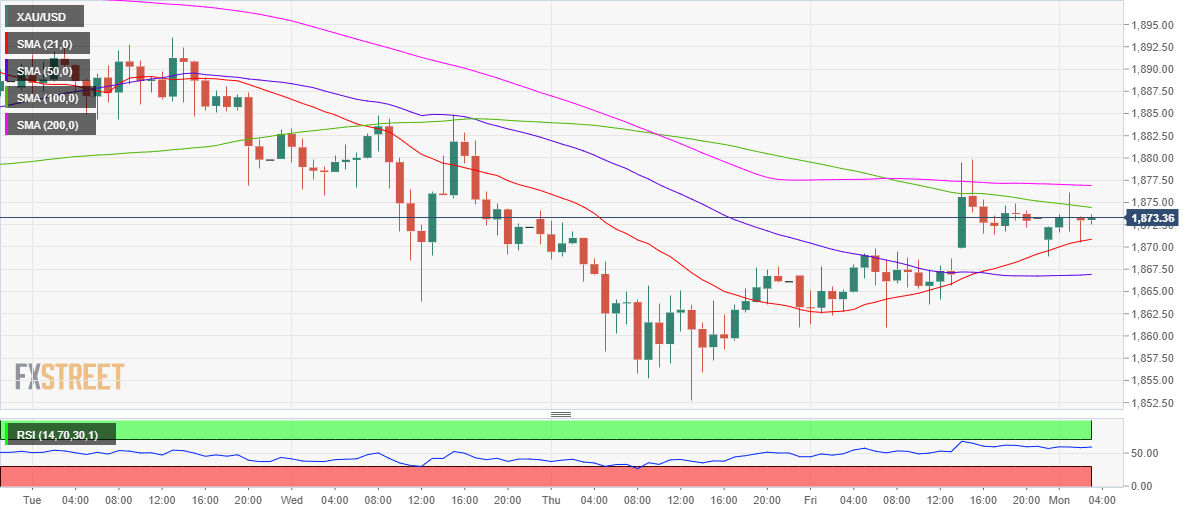

Hourly chart

The hourly chart shows that gold remains capped below the horizontal 200-hourly moving averages (HMA) at $1877, which is tough not crack for the XAU bulls.

Meanwhile, the upward-sloping 21-HMA at $1871 offers immediate support, with the hourly Relative Strength Index (RSI) having turned flat while hovering above the midline.

Acceptance above the 200-HMA barrier is critical to reviving the recovery momentum from the powerful $1850 support area. The next upside target is aligned at $1900.

On the flip side, 50-HMA at $1867 is the relevant support, below which the October low of $1860 could be tested. Only a daily close below $1850 could call for a resumption of the correction from record highs of $2075.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.