XAU/USD (gold prices in terms of the US dollar) halted a 2-day slide and rebounded sharply on Tuesday, finally reaching highs beyond 1080 barrier. The price regained 10-DMA at 1078.49 and extended to the upside as a renewed buying interest for the yellow metal spurred following the news of a Russian fighter jet shot down by Turkey near the Syrian border. The investors fretted over conflicts escalating in the Middle-East on the plane crash news and flocked to the traditional safe-haven in gold. Moreover, the US dollar failed to benefit from the upwardly revised US GDP second estimate (2.1% versus 2.0% expected) and continued its corrective slide, thereby boosting the bullion. A weaker greenback makes gold cheaper for holders in other currencies. At close, the pair failed to sustain above 10-DMA and settled at 1075.41.

In today’s trade so far, the yellow metal is seen clinching yesterday’s gains and hovers above 10-DMA now located at 1077.71. The price remains buoyed on the back of extending USD weakness and risk-off moods amid persisting geo-political risks and global security issues. While the negative performance on the Asian equities also lifted the sentiment around the yellow metal. Looking ahead, we have a flurry of key US economic data on the cards later today, wrapping a holiday-shortened week for the US traders. Hence, thin trading is expected later in the NY session with the US durable goods, Core PCE index and consumer sentiment data closely eyed ahead of next week’s NFP report. Although the upcoming US data may have limited impact on the USD, as the Dec Fed rate hike is already priced-in by markets. However, a horribly weak durable goods orders print could raise doubt over the Fed’s intentions next month and add to further bearish USD moves, benefiting the bullion.

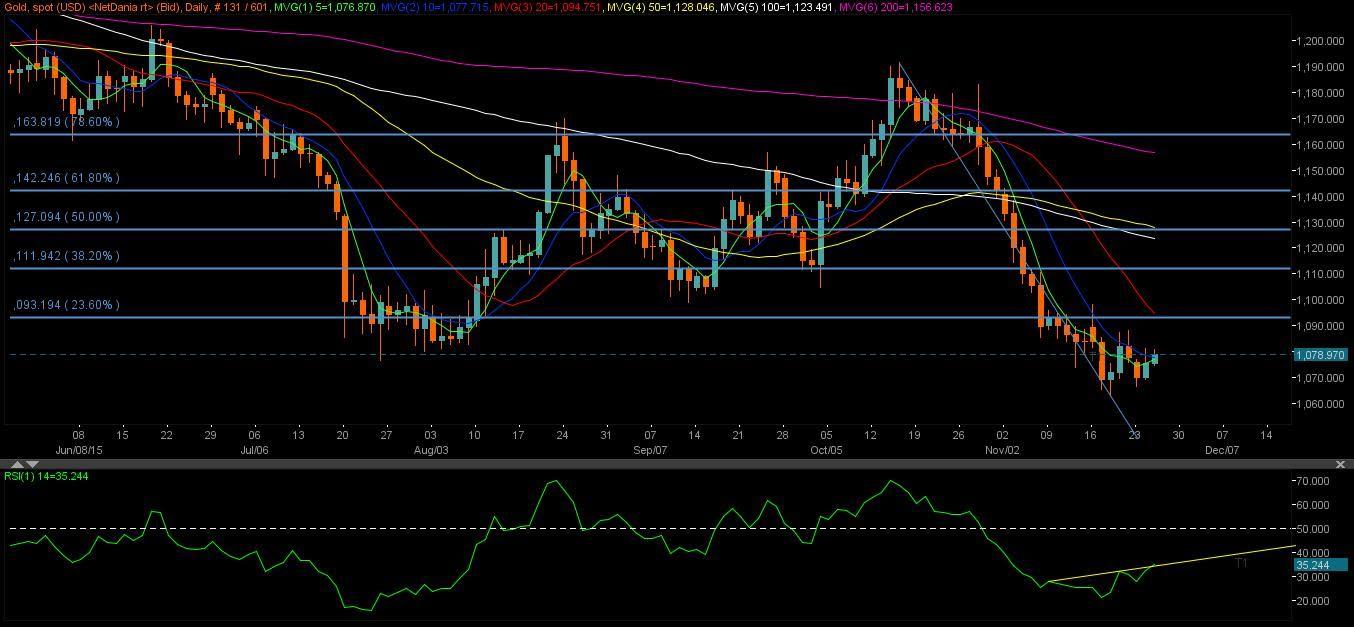

Technicals – Positive price-RSI divergence on daily sticks

On daily charts, the pair trades well above 10-DMA and tries hard to take out yesterday’s high reached at 1081.27, which may open doors for further advances. The pair looks poised for further upside, as clearly seen by the positive price-RSI divergence. The prices are seen making lower tops while the RSI forms higher highs. Moreover, the USD is expected to continue its corrective mode, and remain little affected by the US dataflow to be released later in the day.

Hence, to the topside, a convincing break above $ 1080-81 levels backed by higher volume, could take the prices towards the immediate resistance located at 1088.41, 100-SMA on 4h chart. a break above the last, a renewed rally could be witnessed towards the strong upside barrier place near 1094-1095, the confluence of heavily bearish 20-DMA, fib 23.60% retracement (of Oct 15-Nov 18 fall) and 5-WMA. While to the downside, the prices could retest daily lows at 1074.53 should the US durable goods order outperform or the USD halt its correction. A failure to resist the last, the immediate support at 1070 and from there to 1066.49 (Nov 23 low) could be tested.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD drops toward 0.6500 after dismal Aussie Retail Sales, mixed China's PMIs

AUD/USD is extending losses toward 0.6500, hit by an unexpected drop in the Australian Retail Sales for March while China's NBS April PMI data came in mixed. Upbeat China's Caixin Manufacturing PMI data failed to lift the Aussie Dollar amid a softer risk tone and the US Dollar rebound.

USD/JPY holds rebound to 157.00 after Monday's suspected intervention-led crash

USD/JPY is trading close to 157.00, staging a solid rebound in the Asian session on Tuesday. The pair reverses a part of heavy losses incurred on Monday after the Japanese Yen rallied hard on probable FX market intervention by Japan's authorities. Poor Japan's jobs and Retail Sales data weigh on the Yen.

Gold prices soften as traders gear up for Fed monetary policy decision

Gold price snaps two days of gains, yet it remains within familiar levels, with traders bracing for the US Fed's monetary policy decision on May 1. The XAU/USD retreats below the daily open and trades at $2,334, down 0.11%, courtesy of an improvement in risk appetite.

BNB price risks a 10% drop as Binance founder and ex-CEO Changpeng Zhao eyes Tuesday sentencing

Binance Coin price is dumping, with the one-day chart showing a defined downtrend. While the broader market continues to bleed, things could get worse for BNB price ahead of Binance executive Changpeng Zhao sentencing on Tuesday, April 30.

FX market still on intervention watch

Asian foreign exchange traders will be particularly attentive to any signs of Japanese intervention on Tuesday, following reports of Tokyo's involvement in the market on Monday. This intervention action propelled the yen upward from its 34-year low of 160 per dollar, setting off shockwaves of volatility.