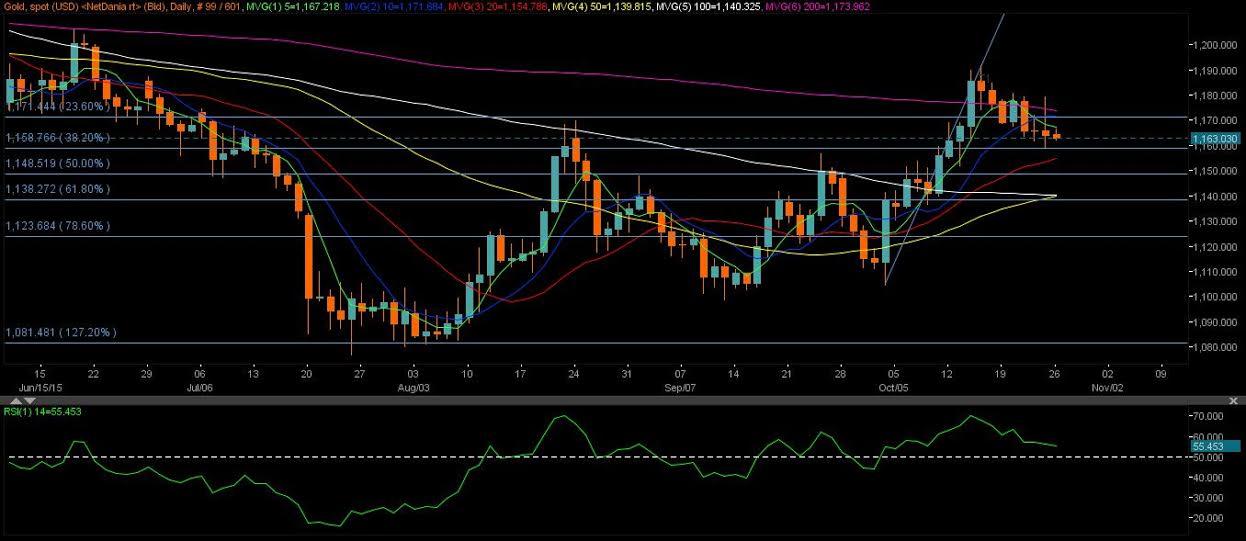

The XAU/USD pair (gold prices in terms of the US dollar) ended in the red on Friday at 1164.10, booking first weekly losses after two consecutive weeks of gains. The prices extended its 3-day decline and witnessed steep losses as the US dollar rallied to fresh two-month tops versus its major peers. The bullion failed to benefit from the ECB stimulus hints and China interest rate cut as the solid gains in the USD overshadowed the easing news. The yellow metal spiked to 1179.47 in a knee-jerk reaction to China rate cut news, piercing through the 200-DMA then located at 1174.52. Although gold immediately faded the spike and plunged to fresh weekly-lows of 1159.04 as markets flocked to the US currency. The pair found good support ahead of the Fib 38.20% retracement of Oct 2-15 rally which lies at 1158.76 and managed to recover above Thursday’s low at 1161.69 at close.

As for today’s trade so far, XAU bears took a breather from the recent run of losses and edged slightly higher, as the US dollar corrects lower after the recent upsurge to two-month highs. However, the risk-on rally in the global equities after China's rate cut announcement keeps the gains in check. Markets remain cautious and refrain from placing big bets on the bullion ahead of the most influential event this week – the FOMC statement, which may create huge volatility around the US dollar and eventually impact the gold prices. Later today, the prices are expected to trade in the recent familiar ranges as the US new home sales due to be reported in the New York session might have limited influence on markets.

Technicals – Capped by 5-DMA, doji seen on daily sticks

On daily charts, the prices are currently hovering below the bearish 5-DMA located at 1167.33 and oscillates in a $ 4 slim range. The prices await fresh triggers for further momentum as indicated by a small doji formed while the daily RSI at 56 has turned slightly flatter, which also supports range-trade to extend with a slightly negative bias. Hence, to the downside, the prices could drop to the above-mentioned Fib 38.20% levels below a break of daily lows struck at 1162.20. The next immediate support stands at the rising 20-DMA located at 1154.82 levels, should the prices crack through the Fib levels.

On the other hand, the prices could rebound higher from the Fib 38.20% retracement and head higher for a retest of 5-DMA, beyond which the next upside barrier in sight is the Fib 23.60% of the same rally placed at 1171.44 levels. A break above the last, the 200-DMA located at 1174 could come back into the picture.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD loses ground due to the absence of a hawkish RBA

The Australian Dollar has plunged following the Reserve Bank of Australia's decision to maintain its interest rate at 4.35% on Tuesday. Investors sentiment leaned toward a potentially more hawkish stance from the RBA, particularly after last week's inflation data surpassed expectations.

EUR/USD edges lower to near 1.0750 after hawkish remarks from a Fed official

EUR/USD extends its losses for the second successive session, trading around 1.0750 during the Asian session on Wednesday. The US Dollar gains ground due to the expectations of the Federal Reserve’s prolonging higher interest rates.

Gold price remains on the defensive on a firmer US Dollar

Gold price attracts some sellers on the firmer US Dollar during the Asian trading hours on Wednesday. The hawkish remarks from Federal Reserve officials dampen hopes for potential interest rate cuts in 2024 despite weaker-than-expected US employment reports in April.

FTX files consensus-based plan of reorganization, awaits bankruptcy court approval

FTX has filed a consensus-based plan for its reorganization, coming almost two years after the now defunct FTX filed for Chapter 11 Bankruptcy Protection in the District of Delaware.

Living vicariously through rate cut expectations

U.S. stock indexes made gains on Tuesday as concerns about an overheating U.S. economy ease, particularly with incoming economic reports showing data surprises at their most negative levels since February of last year.