XAU/USD pair – Daily Chart

Gold prices in terms of US dollar (XAU/USD) breached the 10-DMA located at 1184 levels on Monday before witnessing a mild rebound on close at 1185.92 levels. XAU/USD dropped on broad based US dollar weakness posing a solid recovery from three week lows reached at 96.17 levels last week. The US dollar gained 0.60% on the day in the previous session as impressive US economic releases, viz, pending home sales and core PCE price index topped estimates, supporting the USD bulls.

The pair, currently trades around 1183 levels, extending its downtrend for the third day in running. However, the losses in the pair seem restricted by 20-DMA support located at 1177.36 levels. While the upside remains capped by 10-DMA barrier at 1187.26. The pair seems to consolidate losses and awaits fresh incentives from the session ahead amid persistent USD strength. The pair may drop from current levels and retest daily lows at 1179.78 levels. The daily RSI at 45.65 aims lower, building case for further downside. A break below daily lows the pair may test 20-DMA at 117.36 and below that floors are likely to open for a test of 1169 levels (March 19 Low). Overall, the pair is expected to remain pressured as the US dollar is likely to remain supported on recent series of upbeat macro data in the US.

XAU/EUR pair – Daily Chart

Gold prices in terms of Euro (XAU/EUR) settled lower on Monday at 1095.15 levels, bouncing-off daily highs at 1102.40 and unable to sustain above 1100-psychlogical barrier. XAU/EUR remained capped despite the weakness seen in the shared currency across the board as stronger US dollar amid a generalized risk-on sentiments kept a lid on the pair. However, the pair fought its way back and managed to close above the 50-DMA support located at 1094.05 levels.

Currently, the pair trades near highs at 1197.20 levels, having bounced-off a brief dip below 50-DMA located at 1093.62 levels. The pair continues to trade in a bearish flag channel and bounces-off every dip on the trend line support. XAU/EUR seems supported on a weaker euro versus the greenback at the moment and may break above 5-DMA barrier at 1097.50 on German retail sales release as the data is expected to show a fall in the retail volumes in Eurozone’s economic power house dragging the euro further down. The pair may climb higher to once again test 1100 levels. A daily closing above 1100 levels may confirm further potential for an uptrend. If the pair breaches the 50-DMA, the pair may drop to the trend line support located at 1092 which may pose a key reversal point. Overall, the pair may edge higher attempting to retest 1100 mark and beyond given the underlying weakness in the Euro.

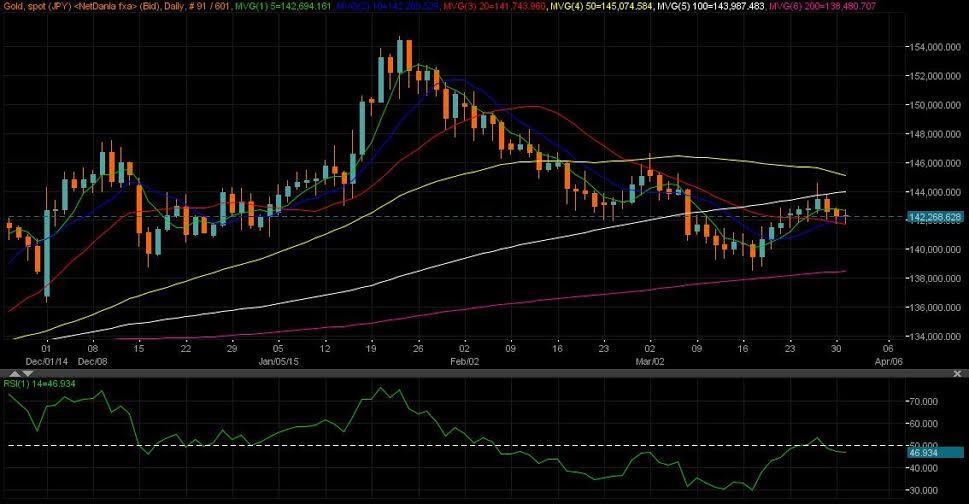

XAU/JPY pair – Daily Chart

Gold prices in terms of Japanese yen (XAU/JPY) failed to break above 5-DMA resistance at 142,800 levels and ended lower on Monday at 142,338 levels. The pair remained stuck between 5-DMA and 20-DMA range unable to find a clear direction despite a strengthening US dollar versus the yen. Although XAU/JPY managed to close above 142k levels on daily basis.

The pair now trades near lows at 142,169 levels, bouncing off day’s high around 142,714 levels, and remains squeezed in a slim range with the upside capped by 5-DMA located at 142,700 levels and 20-DMA located at 141,737 acting as a crucial support. The daily RSI at 46.29 aims lower suggesting more room for declines. To the upside, the pair faces stiff barrier at 5-DMA levels and may test next resistance at 143k levels beyond that level. However, with the technical indicator favouring downside on the daily chart, the pair is expected to test 141,500 levels below a break of a major support at 10-DMA. Selling pressure may intensify below that mentioned level drowning the pair to 141k levels. Overall, a generalized intraday downside bias persists so long as 143k levels is breached.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.