EURUSD plunges through 1.1000 area to confirm last week's break

USD picture mixed as USDJPY refuses to confirm broad USD strength

EURGBP reversed course, GBPUSD bounced a bit

AUD pairs offer two-way risk ahead of much-anticipated RBA rate meeting

Gold remains firm

Key developments in FX today

EURUSD pushed lower, confirming the quality of last week's break of the 1.1050/00 zone, and this opens the way toward 1.0750 or lower. The EURUSD move tried to take USDCHF with it, as the latter traded above parity, but EURCHF downside muddled the USDCHF picture as we discuss in connection with the chart below.

EURGBP reversed course sufficiently to give bears heart as the momentum has come out of the chart amid broad euro weakness. GBPUSD even managed a bit of a bounce today as the sterling weakness looks overplayed if general market confidence returns here.

USDJPY dipped steeply again today after the G20 meeting in Shanghai saw Bank of Japan policy moves garnering considerable negative attention. This kept USDJPY in a lower and shrinking trading range and suddenly saw EURJPY near the lows for the cycle again on the combination of euro weakness and yen strength today.

AUD and NZD have been weak since Friday, especially the latter, ahead of a Reserve Bank of Australia rate meeting tonight that is a bit more highly anticipated than usual, offering two-way risks in AUD pairs. Note the risk of an interesting breakdown in AUDCAD as the 200-day moving average is in play ahead of the RBA meeting.

Gold remains firm within a very organised triangular consolidation, while silver slipped through its first support level at 15.00 and even challenged the last interesting support to keep the upside focus just below 14.75. Silver bulls need a strong bullish reversal and move back above 15.00 to get the upside back in focus (note the gold/silver ratio near generational highs.)

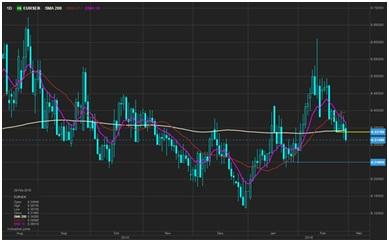

EURUSD

EURUSD followed through lower today after Friday's bearish close, as the chart has now opened up to the 1.0725/50 area support as long as US data this week avoid overly negative surprises. Resistance now looks like 1.0975/1.1000.

EURJPY

EURJPY is back toward the lows for the cycle, perhaps as negative G20 reverberations have some believing that the Bank of Japan will bide its time a bit before acting again and perhaps as well on JPY hedging by exporters before the end of Japan's financial year at the end of March. It's hard to believe that the yen can continue to march from one extreme to the next without risk sentiment weakening again and especially if US data brings a higher rate focus back into play.

USDCHF

USDCHF teased today with a break above parity that was the mirror image of EURUSD's selloff through 1.0900, but the strength in the franc versus the euro at times today made the break look a bit tentaive. Let's take it one session at a time as we watch the 0.9950/1.0000 zone here for the quality of this attempt higher. Note the 61.8% Fibo retracement level in play today.

EURSEK

A very strong Swedish GDP print today combined with the weaker euro saw EURSEK taking out the 9.34/35 support area. This could open up for a move to the bottom of the range toward 9.15 and lower (where, if the market mood is broadly positive, the Riksbank may need to intervene directly as it promised to do recently), if the more recent 9.25 area can't hold.

- The author(s) and Saxo Capital Markets HK Limited are not responsible for and not liable to any loss arising from any investment based on any recommendation, forecast or any other information contained herein. The contents of this publication should not be construed as an express or implied promise, guarantee or implication by Saxo Capital Markets that clients will profit from the strategies herein or that losses in connection therewith can or will be limited. Trades in accordance with the recommendations in an analysis, especially in leveraged investments such as foreign exchange trading and investment in derivatives, can be very speculative and may result in losses as well as profits, in particular if the conditions mentioned in the analysis do not occur as anticipated. Investors should carefully consider their financial situation and consult their professional advisors as to the suitability of their situation prior to making any investments.

- Risk warning: Leveraged investments in foreign exchange or derivatives carry a high degree of risk and may result in significant gains or losses. You should carefully consider your financial situation and consult your independent financial advisors as to the suitability of your situation prior to making any investments.

Saxo Capital Markets HK Limited holds a Type 1 Regulated Activity (Dealing in securities); Type 2 Regulated Activity (Dealing in Futures Contract) and Type 3 Regulated Activity (Leveraged foreign exchange trading) licenses (CE No. AVD061) issued by the Securities and Futures Commission of Hong Kong.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.